How many times are dividends paid per year

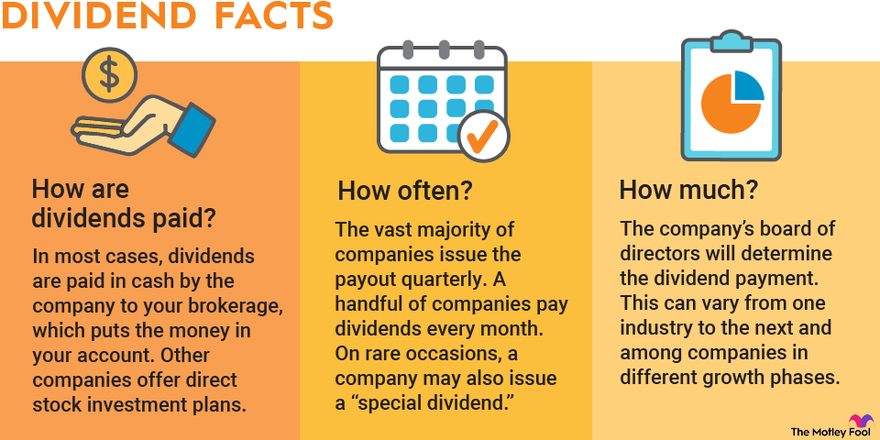

The vast majority of dividends are paid four times a year on a quarterly basis, but some companies pay their dividends semi-annually (twice a year), annually (once a year), monthly, or more rarely, on no set schedule whatsoever (called “irregular” dividends).

Are dividends only paid once a year

Most stocks that pay dividends pay them every three months, after the company releases its quarterly earnings report. However, others pay their dividends every six months (semi-annually) or once a year (annually). Some stocks also pay monthly, or on no set schedule — these are termed "irregular" dividends.

Are dividends monthly or yearly

While most dividends are paid on a quarterly basis, some companies make their payouts on a monthly basis, and many investors like the greater frequency, in part because it can help them structure their own budgets more effectively.

Are dividends paid quarterly or annually

quarterly

Most dividends are paid on a quarterly or annual basis, though some are paid monthly or bi-annually. Companies may also announce special dividends that are declared at a certain time, like when a company has excess income.

Are dividends paid once or twice a year

A dividend is a portion of a company's profit that it may decide to pay out to shareholders, usually once or twice per year after announcing its full-year or half-year results.

Do all dividends pay monthly

A dividend is paid per share of stock. U.S. companies usually pay dividends quarterly, monthly or semiannually. The company announces when the dividend will be paid, the amount and the ex-dividend date.

How frequently are dividends paid

quarterly

A dividend is usually a cash payment from earnings that companies pay to their investors. Dividends are typically paid on a quarterly basis, though some pay annually, and a small few pay monthly.

What does a 5% dividend mean

For example, if a stock trades for $100 per share today and the company's annualized dividend is $5 per share, the dividend yield is 5%. The formula is: annualized dividend divided by share price equals yield. In this case, $5 divided by $100 equals 5%.

How often can you pay dividends

There are no rules about how frequently dividends can be paid, but most businesses distribute them quarterly or every six months after working out how much the company can afford to pay.

How often are dividends paid S&P 500

S&P 500 investments

The SPDR S&P 500 ETF, which trades under the ticker SPY, is the oldest and biggest ETF to track the S&P 500, with about $425 billion in assets under management. It's administered by State Street Global Advisors. It pays a dividend quarterly and had a yield of about 1.3% as of November 2021.

How do yearly dividends work

They're paid on a regular basis, and they are one of the ways investors earn a return from investing in stocks. Dividends can be paid out in cash, which can be reinvested or withdrawn and used as income, or they can come in the form of additional shares. This type of dividend is known as a stock dividend.

How to make $500 a month in dividends

Dividend-paying Stocks

Shares of public companies that split profits with shareholders by paying cash dividends yield between 2% and 6% a year. With that in mind, putting $250,000 into low-yielding dividend stocks or $83,333 into high-yielding shares will get your $500 a month.

Does Coca Cola pay dividends monthly

Coca-Cola dividends are paid in April, then July, October, and December.

Is a 3% dividend good

What Is a Good Dividend Yield Yields from 2% to 6% are generally considered to be a good dividend yield, but there are plenty of factors to consider when deciding if a stock's yield makes it a good investment. Your own investment goals should also play a big role in deciding what a good dividend yield is for you.

What is the 4 dividend rule

The 4% rule is easy to follow. In the first year of retirement, you can withdraw up to 4% of your portfolio's value. If you have $1 million saved for retirement, for example, you could spend $40,000 in the first year of retirement following the 4% rule.

Does the S&P 500 ever split

Last year, less than 10 S&P 500 companies split their shares, says Bespoke. That's down from the more than 60 S&P 500 firms to pull off splits in 2005. But don't worry about the dearth of splits.

Does S&P 500 return include dividends

S&P 500 Annual Total Return (I:SP500ATR)

The S&P 500 Annual Total Return is the investment return received each year, including dividends, when holding the S&P 500 index. The S&P 500 index is a basket of 500 large US stocks, weighted by market cap, and is the most widely followed index representing the US stock market.

Do dividends get paid monthly

While most companies pay dividends quarterly, there are 58 stocks that pay dividends monthly. And many of them have high dividend yields above 7%. The table below contains a complete list of monthly dividend stocks with up-to-date dividend yields and Dividend Safety Scores™.

How much for $1,000 a month in dividends

Making $1,000 per month in dividends requires you to invest hundreds of thousands of dollars in dividend stocks. Though there is not technically an exact amount, many experts mark the range as being between $300,000 and $400,000.

How to get $5,000 in dividends per month

How To Make $5,000 A Month In DividendsDevelop a long term perspective.Determine how much you can allocate for investment.Select dividend stocks that are consistent with your strategy.Invest in your selected dividend stocks regularly.Keep investment costs and trading to a minimum.Reinvest all dividends received.

Does Tesla pay dividends

Growth stocks can generate strong returns but also carry the burden of high expectations due to their sky-high valuations, and Tesla is certainly no different. Plus, Tesla does not pay a dividend to shareholders, which is also an important factor for income investors to consider.

Does Pepsi pay monthly dividends

PepsiCo has paid consecutive quarterly cash dividends since 1965, and 2023 marks the company's 51st consecutive annual dividend increase.

Is 5% a good dividend

A good dividend yield is high enough to meet your current dividend income needs. But low enough to suggest a company's dividend is not at risk. Dividend yields that meet these requirements will typically fall between 2% and 5%.

Is 6% dividend good

Yields from 2% to 6% are generally considered to be a good dividend yield, but there are plenty of factors to consider when deciding if a stock's yield makes it a good investment.

How many times a company can give dividend

Dividend payments might be made monthly, quarterly, semi-annually, or annually. There is no established timeline for payouts in some cases, and if the company is making exceptional profits, it may also pay out special one-time dividends. The distribution could be in cash or more stock.