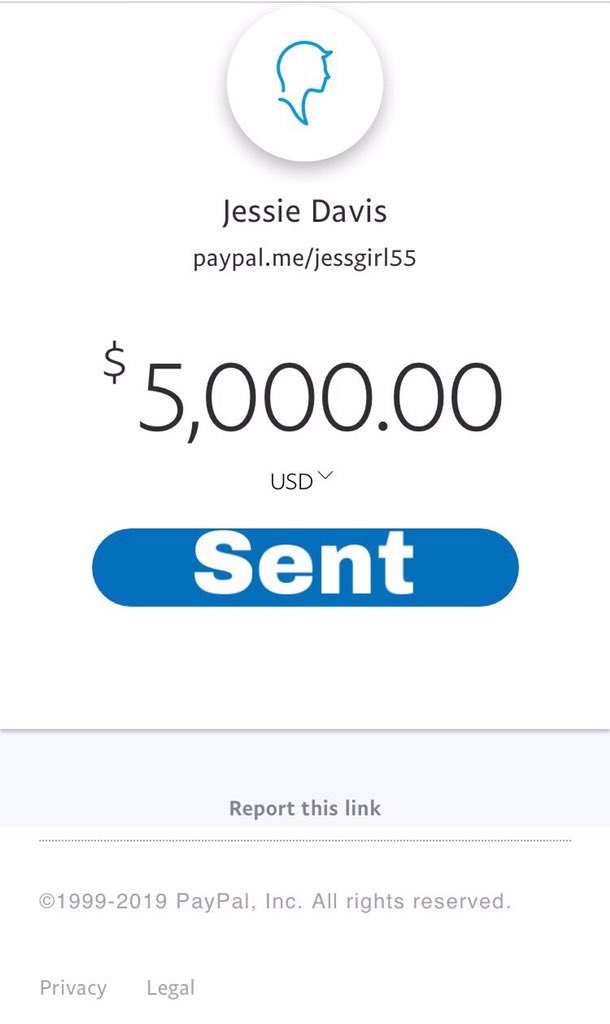

Can you send 5000 over PayPal

$5,000 maximum transfer amount in a single transaction. $5,000 maximum transfer amount per day. $5,000 maximum transfer amount per week.

What is the max you can receive on PayPal

This blog will guide you about PayPal transfer limit, including minimums and maximums, and how to increase them. The maximum amount you can send or receive in a single transaction is $10,000 USD for personal accounts. The maximum amount you can send or receive weekly is $60,000 USD.

Can I send $25000 through PayPal

Bank Account Transfer Limits

PayPal's instant transfer limit for banks is a daily maximum of $25,000 and is $10,000 per transaction.

How much does PayPal charge to receive money

We've stated that the standard PayPal fees for receiving money are 2.9% + $0.30 if both accounts are from the U.S., or 4.4% + $0.30 if the client's account is from another country.

Can you send $100,000 through PayPal

PayPal Instant Transfer Limits for Linked Bank Accounts

For verified accounts: up to $25,000 per transaction and $100,000 per week. For unverified accounts: up to $2,000 per transaction and $2,000 per week.

How can I send more than 5000 dollars

Sending a wire transfer through your bank might be the best way to send a large amount quickly. As convenient as P2P apps are, they limit how much you can send, generally $1,000 to $10,000 per transfer, and delivery can take multiple days.

What is the limit on PayPal receiving money with unverified accounts

The maximum amount that can be received by an unverified PayPal account is typically limited to a certain amount, usually around $500.00 to $2,000.00, depending on the country and account usage. Verifying the account with a linked bank account or credit card usually removes these limits.

Can I receive money on PayPal if not verified

Receiving money to your PayPal account doesn't require verification, so long as you don't mind keeping the money in your PayPal wallet. But, if you want to withdraw money from PayPal to your credit (or debit) card or bank account, then you'll have to verify your card or account first.

Why did PayPal limit my account

We may limit your account to protect you from potential losses and review any fraudulent activity. This can happen if your: Account was accessed without your authorization. Bank informs us there have been unauthorized transfers between your PayPal account and your bank account.

What are the PayPal fees on $3000

If the amount you're sending is up to $3000, you will be charged with 4.4% of the amount plus a fixed fee. The percentage level decreases as the transaction amount goes above $3000.

How much does it cost to receive $100 on PayPal

How much is the PayPal fee for $100 For the most common PayPal fee of 3.49% + $0.49, the fee for a $100 transaction will be $3.98, making the total money received after fees $96.02.

Is PayPal safe for large amounts of money

PayPal has a strong reputation as a safe and secure online payment system. The platform uses the highest security measures possible, including end-to-end encryption, to protect all transactions.

What app can I use to send $5000

If someone is having a verified account on the cash app, they can send $5000.

Can I receive money on PayPal without verifying bank account

You can send and receive money on PayPal without linking your bank account or credit card. However, you will have limited access to features and be limited in the amounts you can send.

How do I lift a PayPal receiving limit

And increase your spending limit. So basically just logging into my account i've clicked on the more menu. And then on business setup. That's taken me to this page here you choose my PayPal.

Is it safe to receive money from strangers on PayPal

PayPal is considered one of the safest ways to receive money online. All PayPal transactions are protected by advanced data encryption. PayPal also offers seller protection protocols to prevent fraudulent activities and make the platform safe for sellers.

Can you receive money on PayPal without a bank account

It securely connects to a bank account or credit card. You then use your PayPal account to shop. You don't need a bank account or credit card to receive money in your PayPal account. But to send money to family and friends or withdraw funds, PayPal will ask you to link a bank account.

How do I avoid PayPal limits

How to Avoid a PayPal Limitation1 Use unique information.2 Use a payment method that matches your identity.3 Connect to PayPal directly.4 Keep your buyers happy.5 Wait before transferring funds to other users.6 Don't change your account information too much.7 Don't use E-trade as your bank.

How much is PayPal fee for $10,000

For a $10,000 revenue, you would pay $440.30 in fees. But with merchant rate, PayPal grants you a discounted rate. For that same $10,000 revenue, you pay $390.30 in fees.

Can you send $3000 on PayPal

What's the maximum amount I can send with my PayPal account If you don't have a PayPal account, you can send a one-time payment of up to 4,000.00 USD. If you have a verified PayPal account, there's no limit on the total amount of money you can send.

Can PayPal receive $2000

The current limits for PayPal Instant Transfer with a linked bank account are: For verified accounts: up to $25,000 per transaction and $100,000 per week. For unverified accounts: up to $2,000 per transaction and $2,000 per week.

How much is the PayPal fee for $3000

If the amount you're sending is up to $3000, you will be charged with 4.4% of the amount plus a fixed fee. The percentage level decreases as the transaction amount goes above $3000.

Can I send 1000 on PayPal

If you have a verified PayPal account, there's no limit on the total amount of money you can send.

What is the best way to send $5000 to someone

Our Top Picks for the Best Ways to Send MoneyVenmo – Best for Paying Friends.Google Pay – Most Secure.Cash App – Best for Bitcoin Users.Zelle – Best for Banking.PayPal – Best for Businesses.Xoom – Best for International Payments.Wise – Best for Exchanging Currency.

How to send $5,000 to someone

Sending a wire transfer through your bank might be the best way to send a large amount quickly. As convenient as P2P apps are, they limit how much you can send, generally $1,000 to $10,000 per transfer, and delivery can take multiple days.