Can I use Google Pay for large amounts

Purchases with Google Pay balance

Maximum single transaction amount: $2,000 USD. Daily maximum total transaction amount: $2,500 USD. Up to 15 transactions per day. Additional limits on the dollar amount or frequency of transactions may be imposed in accordance with the Google Pay Terms of Service.

What is the limit on Google Pay

no limit

Google Pay is accepted instore, online and in app for unlimited payments wherever you see the contactless symbol or Google Pay logo. Google Pay has no limit on the number or value of in-store transactions.

Is Google Pay transaction free

Customer benefits. Google Pay gives customers many benefits, including the following: Pay with Google Pay for free: Google Pay is free for customers to use to pay for goods and services in stores and online.

Does Google Pay require KYC

Make payments of up to ₹200 INR without the use of a UPI PIN on the Google Pay app. No fees. No KYC required.

Can I send 100000 through Google Pay

GPay Per Day Limit

The transfer limit per day for GPay users in India is Rs. 1,00,000.

Can I transfer 100000 through Google Pay

Going by the limit set by NPCI, you cannot transfer more than Rs 1 lakh through Google Pay. The number of transactions per day which one can make is not more than 10 times in a single day across all UPI apps.

Why Google Pay limit is 5,000

If you have changed your phone, mobile number or UPI PIN, you only send a maximum of Rs 5,000. However, the limit is only valid for the first 24 hours. Google Pay allows you to send up to Rs 1 lakh in one day. Moreover, one can send money only 10 times in one day across all UPI applications.

What is the limit of cash transaction per day

₹2 Lakh

Act on Income Taxes, Section 269ST

No person is permitted to receive in cash an amount equal to ₹2 Lakh or more, according to Section 269ST of said Tax Act of India. In regards to a single transaction, in total from a person in a day, in regards to transactions from a person pertaining to a single event or occasion.

How much does Google Pay charge for money transfer

It will result in an interchange at 1.1% of the transaction value. However, the NPCI has clairified that there will be zero charges for the bank account to bank account-based UPI payments or normal UPI payments.

Can I send money internationally with Google Pay

Yes. Apart from local payments, cash-back rewards, and other benefits, you can undertake Google Pay international money transfers as well. However, there are certain restrictions and limits on international transfers via the Google Pay app.

Can I transfer money without KYC

No, KYC is not required for money transfer on Paytm. Users can perform bank transfers or UPI transactions on the Paytm app without getting their KYC done.

Can I transfer 40000 through Google Pay

The GPay limit per day for money transfers is ₹1,00,000.

Can I transfer 30000 from Google Pay

Google Pay allows you to send up to Rs 1 lakh in one day.

Can I transfer 300000 from Google Pay

You cannot send more than Rs 1,00,000 in one day: This simply means that the app allows you to transfer money up to Rs 1 lakh using the application. You cannot transfer money more than 10 times in one day: The Google Pay application, like all other apps, has a limit on sending money in a single day.

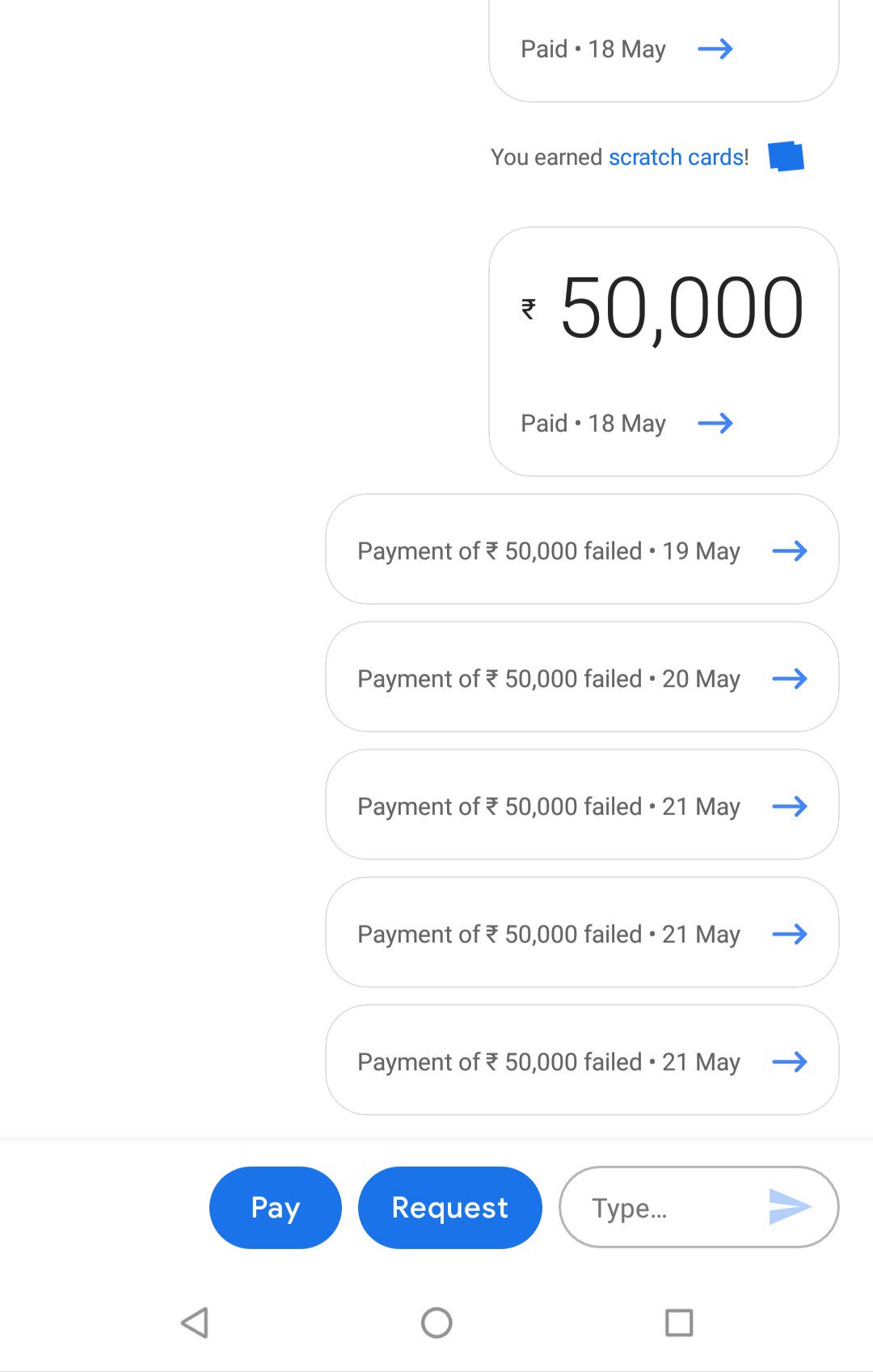

Why i can t send more than 50000 in Google Pay

Daily limits

You may reach a daily limit if: You try to send more than ₹1,00,000 in one day across all UPI apps. You try to send money more than 10 times in one day across all UPI apps. You request more than ₹2,000 from someone.

Can I deposit 50000 cash in bank

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

Is there a 10k transaction limit

The Bank Secrecy Act is officially called the Currency and Foreign Transactions Reporting Act, started in 1970. It states that banks must report any deposits (and withdrawals, for that matter) that they receive over $10,000 to the Internal Revenue Service. For this, they'll fill out IRS Form 8300.

Is PayPal better than Google Pay

Google Pay is free for businesses and can be set up in only a few days with a developer-friendly API. PayPal, on the other hand, charges a range of fees for accepting different forms of payment. It's also important to consider each platform's global support.

Is PayPal and Google Pay the same

In the end, both Google Pay and PayPal are valuable cashless transaction platforms that facilitate an excellent buying experience for customers. Their differences lie in their fees, number of global users, different integration strategies, and customer loyalty features.

How to send BTC without KYC

CoinSwitch is one of the top cryptocurrency exchanges that require no KYC verification since it allows you to trade crypto at the best rates. They allow you to trade 400+ cryptos, cryptocurrencies, and tokens without having to create an account on any exchange. Additionally, there is no withdrawal limit on CoinSwitch.

Does Google Pay require bank account

Note: You'll need a Google account, an active Indian (+91) phone number and an active Indian bank account to set up Google Pay.

How can I transfer more than 50 000

The required details are account number, account name, IFSC Code, branch name, bank name, and account type of both persons. If the transaction exceeds Rs. 50,000, the remitter will have to provide his/her PAN card at the time of commencing the transaction.

Can I send 35000 in Google Pay

You cannot send more than Rs 1,00,000 in one day: This simply means that the app allows you to transfer money up to Rs 1 lakh using the application.

Can I transfer 500000 through Google Pay

You cannot send more than Rs 1,00,000 in one day: This simply means that the app allows you to transfer money up to Rs 1 lakh using the application.

Can I transfer 40000 from Google Pay in one transaction

Going by the limit set by NPCI, you cannot transfer more than Rs 1 lakh through Google Pay. The number of transactions per day which one can make is not more than 10 times in a single day across all UPI apps.