Can I use a savings account for my business

More than just a place to store money, a business savings account can help your business succeed. While it may be tempting to transfer money from your personal savings to fund a business venture or live off business deal proceeds, separating your accounts will serve you and your business well.

Can you use a normal bank account for business

Legally, you can use your personal bank account for both business and non-business transactions, or you can set up a second personal bank account to use for your business. As a limited company is a separate legal entity, it needs to have its own business bank account.

What is the difference between personal and business savings account

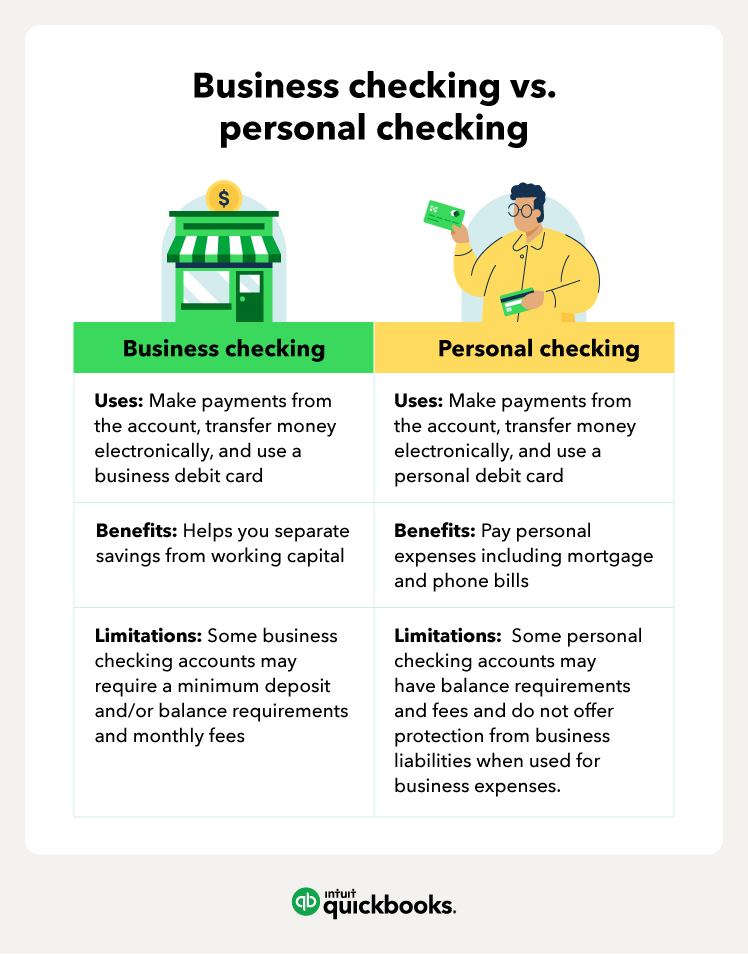

What's the difference between a business bank account and a personal bank account The main difference between business and personal bank accounts, as the name suggests, is that business bank accounts are used to manage business transactions while personal bank accounts are for personal expenses.

What is a disadvantage of using your personal savings to start your business

Disadvantages of self-financing your business:

You may not have enough money left over to cover your living costs. You should try to leave a contingency fund, in case you need extra money to see you through a difficult period. If your business were to fail, you could lose your home and other personal possessions.

Does a business need a business bank account

Not all businesses are legally required to have a business bank account but there are several advantages to opening one. This guide outlines why you might need a business bank account, how to find the right one for your business and how to successfully apply.

Do I need a new bank account for my business

Why do you need a separate bank account for your company Opening a business bank account is an important first step to establishing your small business. If your company is incorporated, then you should handle all of its financial transactions through your business, especially those related to taxes.

Do I need a different bank account for my business

1. Tax Simplification. The IRS recommends that all small business owners have separate bank accounts.

Should a small business have a savings account

A small business savings account gets you into the habit of collecting money that can be used to invest in your business's expansion. You can take advantage of growth opportunities and scale your business without having to take out loans or pay hefty interest rate fees, thus maximizing your profits.

Is it better to use your own money to start a business

ADVANTAGES OF SELF-FINANCING

With no interest to pay and no restrictive repayment terms (not applicable to personal bank loans and credit card borrowing), self-financing is a less risky and less expensive form of investing money in your own business.

What bank accounts do I need for my business

Common business accounts include a checking account, savings account, credit card account, and a merchant services account. Merchant services accounts allow you to accept credit and debit card transactions from your customers. You can open a business bank account once you've gotten your federal EIN.

Can you use a personal account for limited company

No, it is not legal for a limited company to use a personal bank account for business transactions. The company's financial transactions must be conducted through the company's bank account and not through the personal bank account of the directors or shareholders.

Do I need a business bank account or can I use my personal account

Since you're not legally required to open a separate business account unless you operate as a corporation, sole proprietors don't always see the point of having separate business and personal bank accounts for several reasons: Setting up a business bank account takes time.

Should I have my personal and business accounts at the same bank

If you have a sole proprietorship, to ensure FDIC coverage of all of your deposits, you should keep your personal and business checking accounts at different banks if the total sum of both accounts will exceed $250,000.

Can you transfer money from personal to business account

Move Personal Funds into Your Business

Once you've decided to put personal money into your business, you can choose to label it as either equity or a loan and write the check for deposit into your business account. Many business owners list it as equity.

Should I put all my money in my business account

How much you should set aside in your business savings account depends on your business. Aim to save at least 10% of the profits you make every month, with up to 6 months' worth of operating expenses in reserve. This is especially true if your business is seasonal and receives most of its profits over a few months.

What are the disadvantages of personal savings for a business

Disadvantages of self-financing your business:

You may not have enough money left over to cover your living costs. You should try to leave a contingency fund, in case you need extra money to see you through a difficult period. If your business were to fail, you could lose your home and other personal possessions.

Do entrepreneurs use their own money

Entrepreneurs obtain funding for their ventures from different places. They often use their own money when first starting out. Family and friends may help with some financing in the early years of a business. Then, they may take on partners who are well capitalized and can help support the business financially.

Why can’t you use a personal account for business

Although having two bank accounts appears inconvenient, you shouldn't use a personal account for your business finances primarily because it can affect your legal liability. In fact, one of the first steps to owning a business should be opening a business bank account, in addition to a personal bank account.

Can I use my personal bank account if I’m self employed

Can a sole trader use a personal bank account As a sole trader, you're not legally required to have a business bank account opens in new window. You can use your personal bank account for all business transactions.

What is the difference between a normal bank account and a business account

A business checking account helps business owners hold and manage money made within a company. Personal checking accounts help individuals hold and manage their personal funds.

What happens if you mix business and personal accounts

Managing your personal and business taxes becomes much more difficult when you have to separate each and every transaction. It can also lead to missing out on business deductions that lower your tax bill, according to The Balance. It also means more work for your accountant, as well as more money spent on that process.

How do you separate business and personal expenses

How to Separate Business and Personal FinancesObtain an EIN.Incorporate your business.Open a business bank account.Apply for a business credit card.Pay yourself a salary.Separate receipts.Understand the difference between personal and business expenses.Educate other members of your business.

How many bank accounts should I have

It's best to have at least one bank account that's a dedicated emergency fund, another savings account for large purchases you plan to make in the future, and a checking account for everyday spending.

Should I use my own money to start a business

The easiest and most cost-effective way to provide your own financing for a new business is to use your personal savings. However, this can be risky, and you may not have enough to cover all the funding you need. You could also consider: getting a mortgage – or a second mortgage – see commercial mortgages and lenders.

What are 2 disadvantages of a savings account

Compared to other interest-yielding options like CDs, savings accounts will often have lower APYs. Account restrictions: Savings accounts often have restrictions, such as minimum balance or deposit requirements, withdrawal limits, and limited deposit or withdrawal methods.