Can you cash out on life insurance while alive

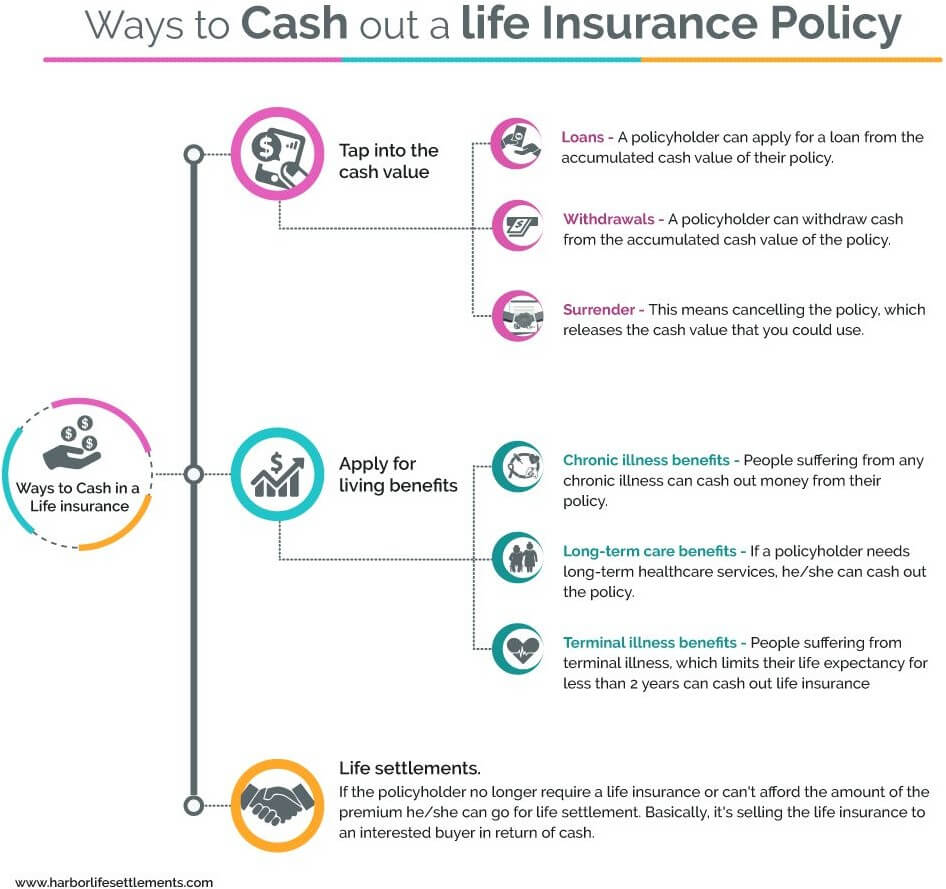

Permanent life insurance policies will allow you to access the cash portion of your account while you're alive. Term life insurance, meanwhile, does not have a cash element for policyholders to access. So, if you're planning on using your life insurance as a backup cash resource you'll want to avoid term policies.

What happens to life insurance if you don’t use it

Your coverage ends if you outlive your term life policy. Before it expires, you can choose to convert your policy to permanent insurance, buy a new policy, or go without coverage.

When can you borrow from a whole life policy

No, you cannot immediately borrow against life insurance. You must wait until your policy's cash value exceeds a certain threshold, and it can take several years to reach that point. The minimum cash value required for a policy loan varies by insurer.

Can I invest my life insurance

With variable life insurance, the policy's cash value operates like a brokerage account, regulated by the Securities and Exchange Commission. You can then use this cash value to invest in securities, bonds, and mutual funds.

How much cash is a $100 000 life insurance policy worth

The cash value of your settlement will depend on all the other factors mentioned above. A typical life settlement is worth around 20% of your policy value, but can range from 10-25%. So for a 100,000 dollar policy, you would be looking at anywhere from 10,000 to 25,000 dollars.

What is the cash value of a $25 000 life insurance policy

Example of Cash Value Life Insurance

Consider a policy with a $25,000 death benefit. The policy has no outstanding loans or prior cash withdrawals and an accumulated cash value of $5,000. Upon the death of the policyholder, the insurance company pays the full death benefit of $25,000.

Do you have to be dead to claim life insurance

You can cash out part of your life insurance policy before you die in certain situations, such as a terminal illness, qualifying medical conditions, or if your policy has a cash value component.

Can life insurance be used for anything

Life insurance benefits can help replace your income if you pass away. This means your beneficiaries could use the money to help cover essential expenses, such as paying a mortgage or college tuition for your children. It can also be used to pay off debt, such as credit card bills or an outstanding car loan.

How to use life insurance to build wealth

Withdraw cash value from your life insurance contract

You may be able to withdraw or borrow against your contract's cash value during your lifetime. These options can help reduce your overall portfolio's market risk by giving you a noncorrelated asset to tap in a volatile market.

Do you have to pay off a life insurance policy to borrow from it

Policy loans are available on most permanent cash value life insurance policies. Life insurance policy loans are not the same as other loans: Policy owners are not required to repay the loan. Keep in mind, the insurance company will charge interest on the policy loan.

Can life insurance be used as an asset

Some types of permanent life insurance have an additional living benefit, called cash value. If your life insurance policy accumulates cash value, the cash value is considered an asset, because you can access it.

How do you make money with life insurance

One way to make money with life insurance is to sell it as an investment. Another way is to use it as a retirement vehicle. Finally, life insurance can also pay for final expenses and estate taxes. We will discuss each of these methods in more detail below.

How much is a million dollar policy

The cost of a $1 million life insurance policy for a 10-year term is $32.05 per month on average. If you prefer a 20-year plan, you'll pay an average monthly premium of $46.65. In addition to term length, factors such as your age, health condition or tobacco usage may affect your rates.

How much is a $10,000 life insurance policy worth

It's usually a payout of the full coverage amount defined in the policy (a $10,000 policy pays a $10,000 death benefit). Face Value: The face value of the policy is simply the coverage amount the policy is worth. So, the face value of a $10,000 policy is $10,000. This is usually the same amount as the death benefit.

How is life insurance paid out

Depending on the insurer, a life insurance payout can typically be distributed in three ways: in the form of a lump sum, via a life insurance annuity, or through a retained asset account. Check with the insurer to see which life insurance payout options they offer.

Do millionaires invest in life insurance

Wealthy individuals with a net worth over $1 million can use life insurance as income replacement, an investment vehicle, or protection against estate taxes. Amanda Shih. Her expertise has appeared in Slate, Lifehacker, Little Spoon, and J.D. Power. &Katherine Murbach.

How to use life insurance as an asset

When is life insurance considered an asset Term life insurance is not an asset because the death benefit only pays out after you die. A permanent policy with a cash value is an asset because the cash value earns interest and you can withdraw from it while you're alive.

Is life insurance an asset or investment

The death benefit of a life insurance policy is not considered an asset, but some policies have a cash value, which is considered an asset. Only permanent life insurance policies, like whole life, can grow cash value.

Is insurance an asset or investment

All insurance policies become an asset once the plan matures — that is, you have paid for it and are credited with a lump sum.

How is life insurance worth it

Life insurance can be a valuable investment, as it helps provide financial security for your loved ones after you pass away. If you're wondering if life insurance is worth it, consider the degree to which someone else would be impacted by the absence of your income.

What are the living benefits of life insurance

Unlike a death benefit that pays out when the insured person passes away… With this living benefit, the cash value money can be used while the insured is still alive! For example, they can borrow against the cash value of the policy for emergencies or medical payments — and even to supplement their retirement income!

Is a $3 million dollar net worth rich

U.S. Wealth Percentiles Provide Clearer Picture of Where You Rank. According to Schwab's 2023 Modern Wealth Survey, its seventh annual, Americans said it takes an average net worth of $2.2 million to qualify a person as being wealthy. (Net worth is the sum of your assets minus your liabilities.)

Can you spend $1 million dollars in a lifetime

A recent analysis determined that a $1 million retirement nest egg may only last about 20 years depending on what state you live in. Based on this, if you retire at age 65 and live until you turn 84, $1 million will probably be enough retirement savings for you.

What is the most expensive life insurance ever

$201 million

According to Guinness World Records, the $201 million policy beats the previous record for a life insurance policy—a $100 million policy for an unnamed American entertainer. SG won't disclose the buyer's name.

How long does it take to get life insurance money

14 to 60 days

After a beneficiary files a claim, life insurance companies pay out the death benefit in a tax-free lump sum, an annuity, or a retained asset account. How quickly do you get a life insurance payout After you file a claim, you should be paid within 14 to 60 days.