What is the tax rate for foreigners in the UK

There are three bands: 20% – the basic rate which is for those who earn between £12,571 to £50,270. 40% – the higher rate which is if you earn between £50,271 to £125,140. 45% – the additional rate which is applicable if you earn over £125,141.

Is there annual property tax in UK

Owners of property in the UK must pay tax annually to the local government. This tax is based on property prices at the time the property was built, starting from 1 April 1991. UK Tax liability for property owners also requires them to pay tax on rental income from property in the UK.

How much salary is tax free in UK

If you earn £12,570 or less, you currently pay no income tax. On earnings between £12,570 and up to £50,270, you pay the basic income tax rate of 20 per cent. Income of £50,271 and above are taxed at the higher rate of 40 per cent.

How much income tax is tax free in UK

Your tax-free Personal Allowance

The standard Personal Allowance is £12,570, which is the amount of income you do not have to pay tax on. Your Personal Allowance may be bigger if you claim Marriage Allowance or Blind Person's Allowance. It's smaller if your income is over £100,000.

Why is tax so high in the UK

The rise in interest rates is a key reason why the government have had to increase taxes, despite the political costs. But, it's not just short-term problems, Other long-term problems include the UK's planning systems, which make it easy to block or at least delay the building of housing and investment projects.

What taxes do you pay in UK

There are two main types of tax people pay when working in the UK and the amount you pay will depend on how much you are earning.Income Tax.National Insurance.Further tax information.National Insurance number.

How much tax do you pay if you earn 100k UK

On a £100,000 salary, your take home pay will be £65,600 after tax and National Insurance. This equates to £5,467 per month and £1,262 per week. If you work 5 days per week, this is £252 per day, or £32 per hour at 40 hours per week.

How do I avoid paying taxes on my salary UK

The following list offers a more detailed overview of ten potential ways to reduce your tax bill in the UK:Maintain your income tax allowance.Utilise any marriage tax allowances.Use your personal savings allowance.Utilise ISA contributions.Consider the dividends allowance.Make use of annual pension contributions.

Who doesn’t pay tax UK

You do not pay tax on things like: the first £1,000 of income from self-employment – this is your 'trading allowance' the first £1,000 of income from property you rent (unless you're using the Rent a Room Scheme) income from tax-exempt accounts, like Individual Savings Accounts (ISAs) and National Savings Certificates.

Why is the UK tax so high

The rise in interest rates is a key reason why the government have had to increase taxes, despite the political costs. But, it's not just short-term problems, Other long-term problems include the UK's planning systems, which make it easy to block or at least delay the building of housing and investment projects.

Are taxes worse in US or UK

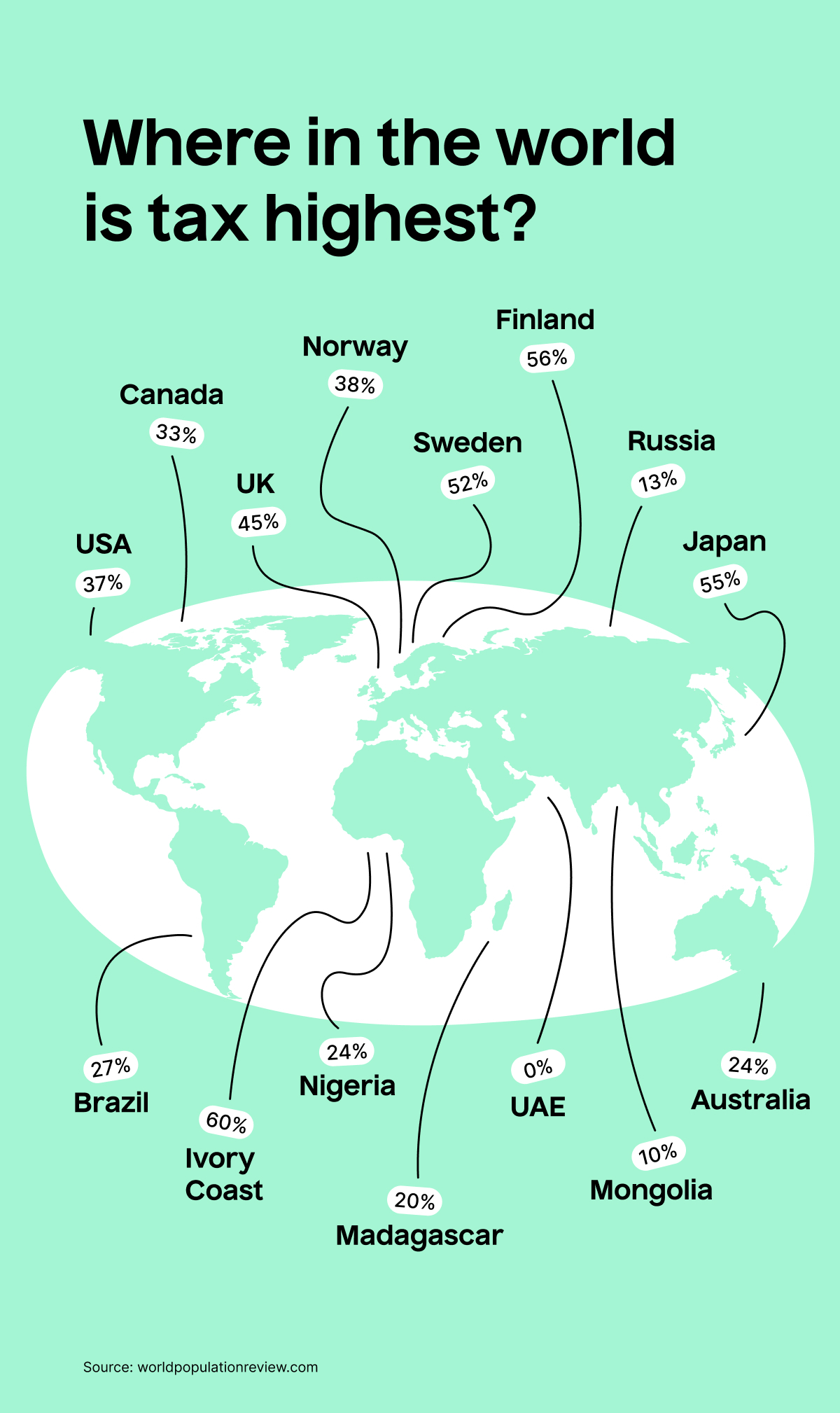

The United Kingdom has taxes that are marginally more demanding than those of the United States. On the other hand, the scope and availability of social services in the United States are significantly narrower than in the United Kingdom.

Is tax higher in UK or USA

In absolute terms, you pay less income tax in the US. The highest rate of income tax in the US is 37% if you earn over $523k. In the UK, it's 45% if you earn over £150k. In many US states, you also have to pay state taxes – some states pay nothing, but New York, for example, the state taxes can be an additional 8.8%.

Who pays most tax in UK

Income tax payments are concentrated amongst those with the largest incomes. The 10% of income taxpayers with the largest incomes contribute over 60% of income tax receipts.

Is 50k a good salary UK

Earning a 50k salary in the UK can generally be considered a good income that allows for a comfortable lifestyle. It provides the means to cover living costs, including housing, utilities, transportation, and leisure activities. Additionally, it allows for saving towards long-term goals and financial security.

What salary is tax exempt UK

£12,570

Your tax-free Personal Allowance

The standard Personal Allowance is £12,570, which is the amount of income you do not have to pay tax on. Your Personal Allowance may be bigger if you claim Marriage Allowance or Blind Person's Allowance. It's smaller if your income is over £100,000.

How much tax will I pay on 500 a week UK

Weekly income: £500. Personal allowance: £12,570 per year / 52 weeks = £241.73 per week. Taxable income: £500 – £241.73 = £258.27 per week. Income tax: £258.27 × 20% = £51.65 per week.

Who is eligible to pay tax in UK

If you're employed your employer will deduct Income Tax from your wages. You'll have to send a Self Assessment tax return if you work for yourself or you have other UK income. You may also have to send a tax return if you: made a profit when selling (or 'disposing of') certain assets, such as shares or a second home.

Is UK a high tax country

The United Kingdom ranked 23rd¹ out of 38 OECD countries in terms of the tax-to-GDP ratio in 2021. In 2021, the United Kingdom had a tax-to-GDP ratio of 33.5% compared with the OECD average of 34.1%. In 2020, the United Kingdom was ranked 25th out of the 38 OECD countries in terms of the tax-to-GDP ratio.

Why is UK tax so high

The rise in interest rates is a key reason why the government have had to increase taxes, despite the political costs. But, it's not just short-term problems, Other long-term problems include the UK's planning systems, which make it easy to block or at least delay the building of housing and investment projects.

Why is the UK so heavily taxed

The rise in interest rates is a key reason why the government have had to increase taxes, despite the political costs. But, it's not just short-term problems, Other long-term problems include the UK's planning systems, which make it easy to block or at least delay the building of housing and investment projects.

Is 5000 pounds a month enough to live in London

With that said: A single person living in London would need about £50,000 a year; A couple should be able to get by with £60,000 a year; A family of four would need an average income of £70,000 to cover the cost of living in London.

Is 100k dollars a good salary in UK

Earning a 100k salary in the UK is generally considered a good income that provides the means to cover living costs, housing expenses, and save for the future. It allows for comfortable accommodation options, both for renters and potential homeowners.

How much is tax in England

Income tax on earned income is charged at three rates: the basic rate, the higher rate and the additional rate. For 2023/24 these three rates are 20%, 40% and 45% respectively. Tax is charged on 'taxable income' at the basic rate up to the basic rate limit, set at £37,700.

How much is 750 000 after tax uk

£399,447

On a £750,000 salary, your take home pay will be £399,447 after tax and National Insurance. This equates to £33,287 per month and £7,682 per week.

How much is 150000 after taxes in UK

£88,947

On a £150,000 salary, your take home pay will be £88,947 after tax and National Insurance. This equates to £7,412 per month and £1,711 per week.