What is the difference between market price and value

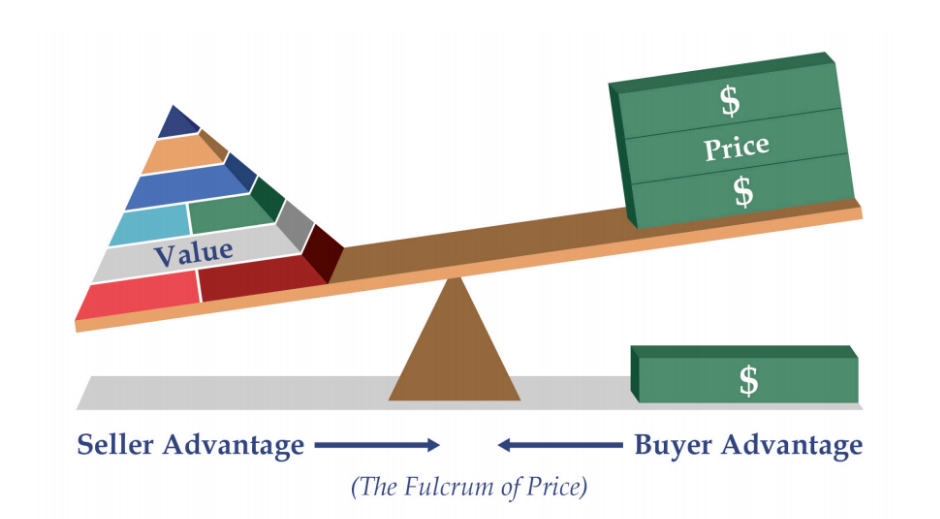

If you want to be a successful real estate investor, you need to understand the difference between market price and market value. Essentially, market price is what someone is willing to pay for a property. Market value, on the other hand, indicates what a property is actually worth.

What is the difference between price and value of a stock

Price is what you pay and value is what you get

When you buy a product or a stock, there is a certain market price that you pay. Especially, when it comes to stocks, market price is based on a mix of subjective and objective factors. What you actually pay for the stock is the price or the market price of the stock.

What is the value of a stock price

The stock's price only tells you a company's current value or its market value. So, the price represents how much the stock trades at—or the price agreed upon by a buyer and a seller. If there are more buyers than sellers, the stock's price will climb.

What is the difference between return and price

The market value of a stock is the market price, or quoted price, at which an investor buys (or sells) the shares of a publicly traded company. The return is the amount that the investor makes or loses on the investment after completing the transaction.

Is price and value the same

In simple terms, price is what we pay for something (in cold hard cash baby). Value, on the other hand, is harder to measure. It's based on how useful something is to someone, or how much it means to them. It's totally dependent on the individual person.

What is price worth and value

Price is measured in numerical terms, cost is also calculated in numerical terms, but worth and value can never be calculated in numbers. Price and cost are same for all the customers, while value varies from customer to customers and worth is subjective to every owner.

Does stock price equal company value

Market price shows only how much the market is willing to pay for its shares, not how much it is actually worth. Even though market cap measures the cost of buying all of a company's shares, it does not determine the amount the company would cost to acquire in a merger transaction.

What determines a stock price

Share price is ultimately determined by supply and demand in the marketplace. The more shares in circulation there are relative to demand for this stock, the lower its price will fall. The more demand there is relative to shares in circulation, the higher its price will climb.

How is stock value determined

The price of a stock is largely determined by supply and demand. If demand is high, the price tends to go up, and if supply is high, the price tends to go down.

What is the meaning of price and value

price is your financial reward for providing the product or service. value is what your customer believes the product or service is worth to them.

What is the relationship between price and return

If the required return rises, the stock price will fall, and vice versa. This makes sense: if nothing else changes, the price needs to be lower for the investor to have the required return. There is an inverse relationship between the required return and the stock price investors assign to a stock.

Is price always lower than value

However, lower prices do not always equate to greater value. If a consumer believes they are getting a good deal, then lower prices can help get you the sale. On the other hand, low prices can also give the impression that the product is of low quality.

Why are prices different from values

The most important distinction between price and value is the fact that price is arbitrary and value is fundamental. For example, consider a person selling gold bars for $5 a piece. The price of those gold bars is, in this instance, $5. It's an arbitrary amount chosen by the seller for reasons known only to them.

Is value determined by price

Value-based pricing is dependent on the value that customers are willing to assign to or pay for particular products, features, and services. On the other hand, cost-based pricing assigns a selling price to an item by factoring in the costs associated with producing that item.

Is stock valued at cost or selling price

Accounting regulations require that stock is valued at the lower of its cost or its net realisable value. Net realisable value is defined as the market value of the products, less the costs associated with selling them.

What determines the value of a stock

Supply and demand is a key factor in determining stock prices. “The price of a stock is determined by how many people want the stock and how much of it there is,” explained William Haight, a director at Capital Choice Financial Group in Phoenix. “If more people want to buy a stock, then the price will go up.

What factors affect the price and value of a stock

There are four main factors that can affect stock prices:Company news and performance.Industry performance.Investor sentiment.Economic factors.

What are 3 things that determine a stock’s price

In summary, the key fundamental factors are as follows: The level of the earnings base (represented by measures such as EPS, cash flow per share, dividends per share) The expected growth in the earnings base. The discount rate, which is itself a function of inflation.

What 3 factors determine the value of a stock

In summary, the key fundamental factors are as follows: The level of the earnings base (represented by measures such as EPS, cash flow per share, dividends per share) The expected growth in the earnings base. The discount rate, which is itself a function of inflation.

How to calculate market price

When the shares of a company are already publicly-held, the easiest way to calculate its market value is to multiply the number of shares outstanding by the current price at which the shares sell on the applicable stock exchange.

Do price and value have the same meaning

Price can be understood as the money or amount to be paid, to get something. And value implies the utility of worth of the commodity of service for an individual. Price is the amount of money paid by the buyer to the seller in exchange for any product or service.

What is the relationship of price and value

Price is taken to be the amount of money that is mainly paid for a particular product or service. On the other hand, the value is the quality of the product or service that one gets after paying the relevant price associated or set by its producer or manufacturer.

What is the relationship between the value of money and the price level

The value of money is directly related to the price level because when the price level rises, the value of money decreases. Conversely, during a period of deflation, the price level falls and the value of money rises because more goods and services can be purchase with less money.

What is price always equal to

price is always equal to marginal revenue. In perfect competition, firms have no market power and have to accept the price set by the market. All units are sold at the same price. This means that the marginal revenue of each unit sold is the same and equal to the price.

Is cost price equal to selling price loss

Answer– The formula for Profit is S.P. – C.P. If the selling price is lesser than the cost price, whatever difference you get between the two is the loss suffered. Similarly, Loss is C.P. – S.P. Always remember that you calculate profit or loss on the cost price.