How can I avoid double taxation in Switzerland

In order to avoid double taxation of corporations and individuals generating income in two countries, Switzerland runs so-called Double Taxation Agreements (DTA). The treaties between Switzerland and the contracting countries help dismantle the barriers surrounding cross-border economic transactions.

Can you avoid taxes in Switzerland

You might assume that you won't need to pay any tax at all in a tax haven, but this is a myth. Swiss nationals and foreigners must pay Swiss taxes, but rates are lower than in many other countries. The federal government sets a base level for income and corporate tax.

Is foreign income taxable in Switzerland

If you work and live in Switzerland, you are liable to pay income tax there. Likewise, you must file a tax return in Switzerland if you receive income exclusively from abroad but have your tax residence in Switzerland. Your worldwide income and assets are thus subject to the tax progression in Switzerland.

Are Swiss bank accounts tax free

Swiss law mandates that banks have high capital requirements and strong depositor protection, guaranteeing that deposits are protected from any possible financial crisis and conflict. Accounts held in Swiss Francs will earn a low-interest rate, but they will also have to pay the Swiss withholding tax.

Which area in Switzerland is tax free

municipality of Samnaun

It's the only duty-free zone in the country and popular with holiday guests of all ages. Since 1982, the Swiss municipality of Samnaun has been free of duty and ever since attracts plenty of shopping fans. But why is it duty-free

How much tax free income in Switzerland

CHF 14,800 and couples with a taxable income below CHF 28,800 no federal tax is levied. On cantonal level, tax rates vary heavily with a maximum rate in Zurich of approximately 41.1%, compared to 22.7% in Zug or 31.7% in Lucerne, 41.5% in Lausanne and to 48.0% in Geneva (all rates including federal income tax).

Is Switzerland a tax friendly country

Key Takeaways. The European nation of Switzerland is considered to be an international tax haven due to low tax levels and privacy laws. Switzerland also has a history of favorable tax treaties, stable politics, and a wealth of advisors.

Do foreigners pay taxes in Switzerland

Swiss citizens and foreign employees who have a residence permit must file a tax return each year. Foreign employees who do not hold a permit, but who are in employment are subject to a process known as 'withholding tax' and is deducted from monthly salaries by the employer.

Can I do tax free in Switzerland

When you return from abroad or enter Switzerland, goods up to a total value of CHF 300 may be imported VAT-free (tax-free limit), provided they are intended for your personal use or as gifts.

Can you avoid tax in Switzerland

Do you need to pay tax in Switzerland You might assume that you won't need to pay any tax at all in a tax haven, but this is a myth. Swiss nationals and foreigners must pay Swiss taxes, but rates are lower than in many other countries. The federal government sets a base level for income and corporate tax.

Do non residents pay wealth tax in Switzerland

All tax-resident individuals are taxed on their worldwide income and wealth. Non-tax-resident individuals are only taxed on Swiss sources of income and wealth.

How long can you live in Switzerland without paying taxes

90 days

You can also be a tax resident if you're an American working in Switzerland for 30 consecutive days or more, or if you're there for at least 90 days, even if you're not working. The federal income tax rates range from 0% to 11.5%, but local taxes also apply.

What town in Switzerland is tax free

municipality of Samnaun

It's the only duty-free zone in the country and popular with holiday guests of all ages. Since 1982, the Swiss municipality of Samnaun has been free of duty and ever since attracts plenty of shopping fans.

Does Switzerland tax non residents

Both residents and non-residents who remain in Switzerland for employment purposes are subject to tax on employment income. In general, residents are not subject to withholding tax on employment income.

Which canton in Switzerland has the lowest wealth tax rate

The canton with the lowest wealth tax rates in Switzerland is the canton of Nidwalden, where the wealth tax rate is uniformly 0.0665%, except for at least 10% shareholdings in corporations where the wealth tax rate is 0.0532%.

What happens if you don’t pay taxes in Switzerland

As a general rule, if you cannot afford to make your tax payment on time, the tax office will charge interest on the amount owed. The onus normally rests on you to approach the tax office with a proposal for an installment payments plan.

Where is the best place to live in Switzerland for tax

Looking for somewhere with low taxes

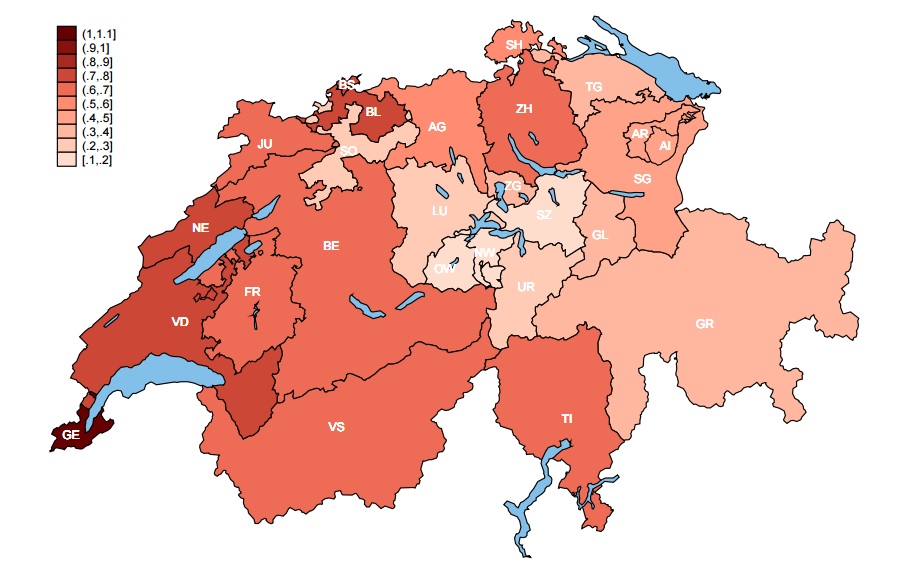

The study also reveals that for private individuals, central Switzerland is the most attractive region for tax purposes, especially the cantons of Zug, Schwyz, Nidwalden and Uri. Western Switzerland has much higher tax rates.

Do foreigners pay wealth tax in Switzerland

As an expat working in Switzerland, you are liable for Swiss income and wealth tax. This tax varies from canton to canton.

Do non residents pay tax in Switzerland

Both residents and non-residents who remain in Switzerland for employment purposes are subject to tax on employment income. In general, residents are not subject to withholding tax on employment income.

Which village in Switzerland is tax free

The Federal Council decided in 1892 that Samnaun would be duty-free. This status was also retained on Swiss territory in 1912 with the opening of the Samnaun road from Martina to Samnaun; the village in Graubünden still enjoys this status today – as the only region in Switzerland.

Which Swiss canton has lowest taxes

Canton Zug

In Canton Zug has the lowest tax rate in the whole of Switzerland at 22.2 percent. The highest load is 23.1 percent and applies in various municipalities. In the municipality of Baar, the tax burden is the lowest at 22.1 percent. In Zug, a reduced cantonal tax rate of 80 percent applies until 2023.

Which Swiss canton has lowest wealth taxes

According to the Credit Suisse tax index for natural persons, the income and wealth tax burden is lowest in the Canton of Zug – as was the case last year. The winner is followed by the cantons of Schwyz and Nidwalden. Individuals pay the highest rates in the cantons of Bern, Vaud, and Neuchâtel.

Is there a wealth tax in Switzerland for non residents

Persons Abroad Subject to Wealth Tax in Switzerland

Although these persons are subject to wealth tax in Switzerland, they are only subject to limited taxation. This means that only the assets that are in Switzerland or are drawn from Switzerland are subject to wealth tax.

Who is subject to Swiss wealth tax

Both Swiss citizens and taxable individual persons living in Switzerland are subject to wealth tax. Taxpayers are those who are resident or domiciled in Switzerland for tax purposes. Taxable is the net wealth.