How do I check my VAT in Europe

There are several ways to VAT number check: VIES (VAT Information Exchange System) – This is an online system provided by the European Commission that allows you to verify the validity of a VAT number in real-time by checking it against the database of VAT numbers of EU member states.

How do I find my EU VAT number

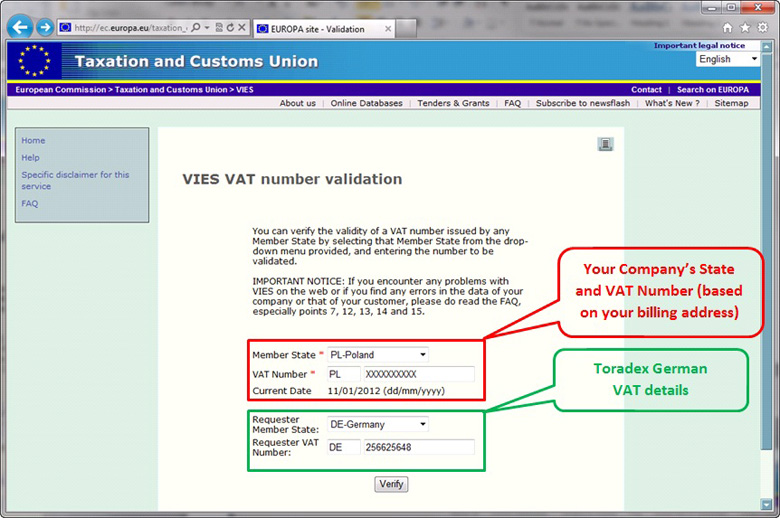

You can check an EU VAT number (including the UK) on-line (http://ec.europa.eu/taxation_customs/vies/). The EU data base is only updated monthly so including delays in the local Member States tax authorities the data could be 6 – 8 weeks out-of-date.

Do I have a EU VAT number

How do I check an EU VAT number To check your own VAT number or the VAT number of another business, you can use VIES. VIES is a tool developed by the European Commission to confirm the validity of VAT numbers across the EU.

How do I get my VAT number

You will need to create a VAT online account, which is often referred to as a “Government Gateway Account”. This is the account you will also use to submit your company's VAT returns to HMRC later. You should receive your certificate and VAT number within 30 days on your VAT online account.

Where can I see my VAT

You can locate your VAT number on the VAT registration certificate issued by HMRC.

Is EU VAT free

The EU's institutions do not collect the tax, but EU member states are each required to adopt in national legislation a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary.

Can I find my VAT number online

HMRC Online Services

If you've registered for HMRC's online services, you can find your VAT number by logging into your account. Once you've logged in, you'll be able to view your VAT number in the 'My Business' section.

How do I check if VAT registered

Call the HMRC VAT Helpline on 0300 200 3700. This line is open between 8am and 8pm during the week, alternatively, qualified accountants and tax advisors can also assist with VAT registration and compliance.

What does a European VAT number look like

European Union VAT identification numbers. 'BE' + 8 digits + 2 check digits – e.g. BE09999999XX. At this time no numbers starting with "1" are issued, but this can happen any time.

What does VAT number look like

VAT number format

In England, Scotland, and Wales, a VAT number consists of the letters 'GB' followed by nine numbers. An example of a VRN that follows the UK VAT number format could be 'GB123456789'. If your business is located in Northern Ireland and you trade to the EU, you will use the prefix “XI” instead of GB.

How do I check when is my VAT due

If you're unsure of your VAT return deadline you can log into your online account, and tick to receive reminders of your VAT due date. It will also tell you when the payment is received by HMRC. Every VAT registered business must keep a VAT account, and this will help in the completion of your VAT return.

How do I know if VAT is registered

On the Certificate of Registration (Form 2303), you can find the information on whether your company is VAT-registered or not.

How much is VAT Europe

The EU's average standard VAT rate is 21 percent, six percentage-points higher than the minimum standard VAT rate required by EU regulation. Generally, consumption taxes are an economically efficient way of raising tax revenue.

Can I claim EU VAT

If you're charged VAT in an EU member state, you'll normally be able to reclaim this from the tax authority in that country. You'll need to make your claim using either: the EU VAT refund system.

How can I check if I am registered for VAT

Call the HMRC VAT Helpline on 0300 200 3700. This line is open between 8am and 8pm during the week, alternatively, qualified accountants and tax advisors can also assist with VAT registration and compliance.

How do I know if I have a VAT receipt

A VAT receipt will be provided by VAT registered suppliers to you, the customer. It will show details of the sale including the tax date, the suppliers VAT registration number and the amount paid for the goods or services.

What is the check digit on a VAT registration number

Valid nine-figure VAT registration numbers include a check digit as their last two numbers (also known as 'modulus check characters'). Originally, the number could be tested as follows. (a)List the first seven digits of the VAT registration number vertically.

Is VAT the same in the EU

The EU has standard rules on VAT, but these rules may be applied differently in each EU country. In most cases, you have to pay VAT on all goods and services at all stages of the supply chain including the sale to the final consumer.

How many digits is a VAT number check

Once registered for VAT, each of the traders mentioned in this section is given a nine-digit registration number. The number is unique to them and they must quote it on all the invoices they raise for the taxable supplies they make.

How many digits is a VAT number

What is a VAT number A UK VAT number is nine (9) digits long, with two letters at the front indicating the country code of the registered business.

Is VAT due every 3 months

You usually need to send a VAT Return to HMRC every 3 months. This is known as your 'accounting period'. If you're registered for VAT , you must submit a VAT Return even if you have no VAT to pay or reclaim. This guide is also available in Welsh (Cymraeg).

Do you charge VAT if not VAT registered

Legally, you're not permitted to charge VAT to customers before you've registered for VAT. The penalty for charging VAT when not registered can be up to 100 percent of the VAT on the invoice.

How do you know if a company is a VAT vendor

Verify a company's VAT number

The VAT Number search confirms a valid VAT number for a registered VAT vendor/company. A search can be performed by providing a company name, registration number or VAT number as search criteria. The VAT Number result includes: The company's registered name.

How much is my VAT

Total price including VAT – Standard Rate

The standard rate applies to most goods and services. To work out the total price at the standard rate of VAT (20%), multiply the original price by 1.2.

How do I get my VAT refund

Usually you'll need to mail your stamped VAT refund form to an address the shop provides. But you don't always have to wait to get back home. Some big airports, ports and train stations have VAT refund offices where you can get your refund right away — if the retailer you shopped at uses that office.