How does your money grow in whole life insurance

Whole life policies provide “guaranteed” fixed cash value accounts that grow according to a formula the insurance company determines. Universal life policies accumulate cash value based on current interest rates and investments. Variable life policies invest funds in subaccounts, which operate like mutual funds.

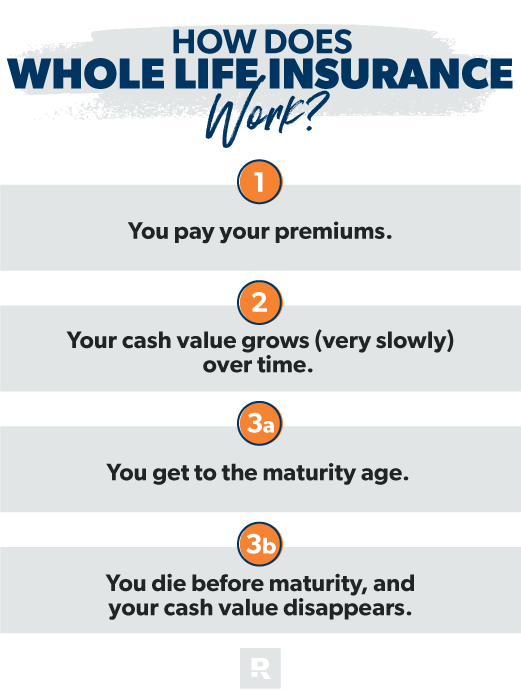

What is whole life and how does it work

Whole life insurance is the simplest form of permanent life insurance, with guarantees for the death benefit amount, premium costs, and cash value growth. Compared to universal life (another form of permanent coverage), whole life typically offers more guarantees but less payment flexibility.

Does whole life always pay out

Whole life insurance is good for people who want lifelong coverage, premiums that don't change and a cash value component. Your beneficiary will get a life insurance payout no matter when you die, as long as you've paid the premiums needed to keep the policy in force.

How does whole life insurance work as an investment

How whole life insurance works as an investment. Whole life insurance provides permanent coverage that accumulates a cash value. When you pay your premium, the insurer invests a portion to give your policy a cash value. The cash value grows over time at a fixed rate guaranteed by your insurer.

What is the cash value of a $10000 life insurance policy

The $10,000 refers to the face value of the policy, otherwise known as the death benefit, and does not represent the cash value of life insurance policy. A $10,000 term life insurance policy has no cash value. However, a permanent life insurance policy might.

Is whole life better than term life

Is whole life better than term life insurance Whole life provides many benefits compared to a term life insurance policy: it is permanent, it has a cash value component, and it offers more ways to protect your family's finances over the long term.

What happens to a whole life policy

Most whole life policies endow at age 100. When a policyholder outlives the policy, the insurance company may pay the full cash value to the policyholder (which in this case equals the coverage amount) and close the policy. Others grant an extension to the policyholder who continues paying premiums until they pass.

How long does it take to build cash value on a whole life insurance policy

You should expect at least 10 years to build up enough funds to tap into whole life insurance cash value. Talk to your financial advisor about the expected amount of time for your policy. Remember that the government taxes those funds.

What are the disadvantages of whole life

The benefits of whole life insurance may sound too good to be true, but there really isn't a catch. The main disadvantage of whole life is that you'll likely pay higher premiums. Also, you're likely to earn less interest on whole life insurance than other types of investments.

When can I withdraw from whole life

You'll typically need to pay premiums for several years before there's enough cash value to be useful. Plus, permanent life insurance policies have high surrender charges — or early withdrawal penalties — for the first five to 15 years the policy is active, so that cost might be prohibitive.

How much cash is a $100 000 life insurance policy worth

The cash value of your settlement will depend on all the other factors mentioned above. A typical life settlement is worth around 20% of your policy value, but can range from 10-25%. So for a 100,000 dollar policy, you would be looking at anywhere from 10,000 to 25,000 dollars.

What is the cash value of a $25000 life insurance policy

Upon the death of the policyholder, the insurance company pays the full death benefit of $25,000. Money accumulated in the cash value becomes the property of the insurer. Because the cash value is $5,000, the real liability cost to the life insurance company is $20,000 ($25,000 – $5,000).

Why choose term life vs whole life

Term life insurance tends to be much cheaper than whole life coverage because term policies do not have a cash value component and may expire without paying any benefits. Whole life insurance is a form of permanent life insurance that covers the person for their entire life rather than a fixed period of time.

Can I cash out my whole life insurance policy

Generally, you can withdraw a limited amount of cash from your whole life insurance policy. In fact, a whole life insurance cash-value withdrawal up to your policy basis, which is the amount of premiums you've paid into the policy, is typically non-taxable.

What happens at the end of a 20 year whole life policy

This is life insurance with a policy term of 20 years. If the policyholder dies during that time, the life insurance company pays a death benefit to his or her beneficiaries, often dependents or family. After 20 years, there is no more coverage, and no benefit paid.

Can you lose cash value of whole life insurance

The insurance company also invests your money in a “cash value account.” This cash value account grows slowly over time, but it's not guaranteed to make any money. Many whole life policies have lost money in recent years due to low-interest rates.

Can I get out of a whole life insurance policy

Can you cancel a life insurance policy at any time Yes, you can, although the only way to get back all your premium payments is to do so during the initial “free look” period.

What are the pros and cons of whole life insurance in general

The Bottom Line

It's more expensive than term life insurance, so for the same amount of money your death benefit will be smaller. Nevertheless, it's yours for life, so you don't have to worry about it running out. If you need more protection earlier in life, say for a growing family, term probably makes more sense.

How much is a million dollar policy

The cost of a $1 million life insurance policy for a 10-year term is $32.05 per month on average. If you prefer a 20-year plan, you'll pay an average monthly premium of $46.65. In addition to term length, factors such as your age, health condition or tobacco usage may affect your rates.

Can I cash out a whole life insurance policy

Can you cash out a life insurance policy before death If you have a permanent life insurance policy, then yes, you can take cash out before your death.

What is the main disadvantage of whole life

The main disadvantage of whole life is that you'll likely pay higher premiums. Also, you're likely to earn less interest on whole life insurance than other types of investments.

What are the major advantages and disadvantages of whole life policy

Pros and cons of whole life insurance at a glance

| Pro | Con |

|---|---|

| The death benefit will not decrease | Your protection needs may change as your life changes |

| Builds tax-deferred cash value at a guaranteed rate | Cash value may grow at a slower pace than some other permanent policies |

How long do you have to pay off whole life insurance

Whole Life Insurance Policies

Your coverage will still last a lifetime. For Children's Whole Life Insurance, your payment options are 10 Year Pay or 20 Year Pay. A type of whole life insurance, where instead of paying premiums for a limited number of years, they continue for your “whole life.”

Do you get your money back at the end of a whole life insurance

If you have a whole life policy, you may receive a check for the cash value of the policy, but a term policy will not provide any significant payout. If you have a whole life policy, fees may be subtracted from the cash value before you receive the remaining amount.

What is the bad side of whole life insurance

Whole life policies can underperform compared to the level of returns you might be able to get with other investments. Withdrawing money or taking a policy loan and not paying it back will reduce the death benefit that's paid out when you pass away.