How to calculate price ratio

Components of P/E ratio

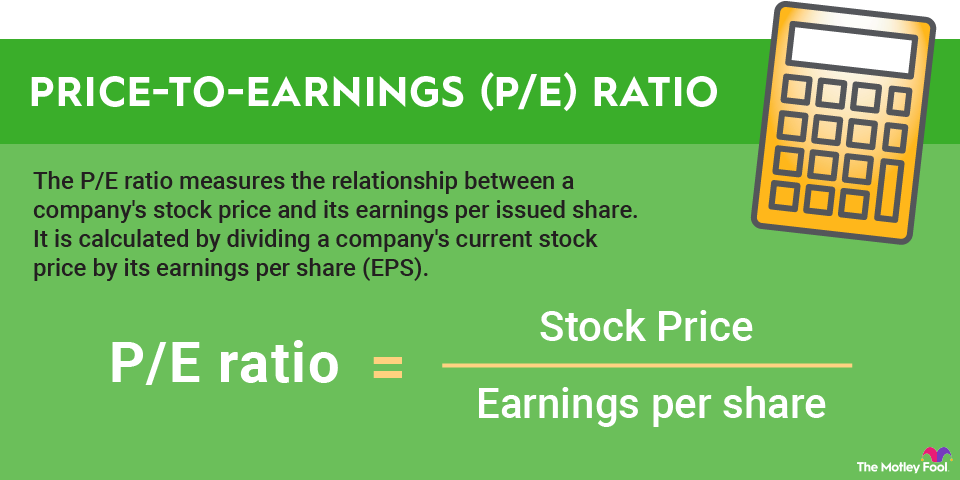

The P/E for a stock is computed by dividing the price of a stock (the "P") by the company's annual earnings per share (the "E"). If a stock is trading at $20 per share and its earnings per share are $1, then the stock has a P/E of 20 ($20/$1).

What is the formula for PS ratio

The price-to-sales ratio (Price/Sales or P/S) is calculated by taking a company's market capitalization (the number of outstanding shares multiplied by the share price) and divide it by the company's total sales or revenue over the past 12 months. 1 The lower the P/S ratio, the more attractive the investment.

What is pricing ratio

What Is the Price-to-Earnings (P/E) Ratio The price-to-earnings ratio is the ratio for valuing a company that measures its current share price relative to its earnings per share (EPS).

What is an example of price ratio

Example of a P/E Ratio Calculation

If a company's stock is trading at $30 for one share, and the company's annual earnings per share is $1, then that company's P/E ratio is 30/1 or 30x. All that really tells us is that for every $30 stock, the company earns $1 per year.

What is price ratio of product

The price ratio is defined as the price of an article divided by the average market price of that article. An average price ratio below 1 indicates that your prices are lower than the market average, whereas a price ratio above 1 indicates that your prices are higher than the market average.

What is a good price ratio

Typically, the average P/E ratio is around 20 to 25. Anything below that would be considered a good price-to-earnings ratio, whereas anything above that would be a worse P/E ratio. But it doesn't stop there, as different industries can have different average P/E ratios.

What is PE and PS ratio

While the P/E ratio compares a company's stock price to its annual earnings (profit), the P/S ratio compares its stock price to its annual revenue (sales).

What is PE or PS ratio

Key Differences. There are a few key differences between P/E and P/S ratios: P/E ratio is based on earnings, while P/S ratio is based on sales. P/E ratio tells you how much you are paying for each dollar of earnings, while P/S ratio tells you how much you are paying for each dollar of sales.

What is high price ratio

If the share price grows much faster than the earnings growth then PE ratio becomes high. If the share price falls much faster than earnings, the PE ratio becomes low. A high PE ratio means that a stock is expensive and its price may fall in the future.

Is PE and PS ratio the same

Key Differences. There are a few key differences between P/E and P/S ratios: P/E ratio is based on earnings, while P/S ratio is based on sales. P/E ratio tells you how much you are paying for each dollar of earnings, while P/S ratio tells you how much you are paying for each dollar of sales.

What is a good PS ratio

between one and two

While the ideal ratio depends on the company and industry, the P/S ratio is typically good when the value falls between one and two. A price-to-sales ratio with a value less than one is better.

What is a good p s ratio

between one and two

While the ideal ratio depends on the company and industry, the P/S ratio is typically good when the value falls between one and two. A price-to-sales ratio with a value less than one is better.

How do you explain PE ratio and EPS

The key difference between EPS and P/E ratio is that EPS is a measure of a company's profitability while P/E ratio is a measure of a stock's valuation. EPS is calculated by dividing a company's net income by the number of shares outstanding. P/E ratio is calculated by dividing a stock's price by the company's EPS.

What is a good price value ratio

A good price to book value ratio according to value investors is less than 1.0. On the other hand, a high ratio implies that the company's market value is significantly higher than its accounting value. Investors would want the management to create more value for the stock to become more attractive for investors.

Why is Tesla PE ratio so high

Tesla has positioned itself as a leader in the electric vehicle market and has also expanded into other areas, such as energy storage and solar power. To do this, Tesla spends a lot of money on capital expenditures and because of this reduces its current earnings which makes the P/E ratio higher.

What is price to PE ratio

P/E Ratio is calculated by dividing the market price of a share by the earnings per share. For instance, the market price of a share of the Company ABC is Rs 90 and the earnings per share are Rs 9 . P/E = 90 / 9 = 10.

Is a high or low PS ratio better

Investments with lower P/S ratios are generally more attractive as this indicates the company is generating more revenue for every dollar investors have put into the company.

Is a low PS ratio good

Price to Sales Ratio Analysis Definition

A higher ratio means that the market is willing to pay for each dollar of annual sales. In general, the lower the P/S, the better the value is. However, the value of the ratio varies across industries. A better benchmark is to compare with industry average.

What is PE ratio explained with example

P/E Ratio is calculated by dividing the market price of a share by the earnings per share. For instance, the market price of a share of the Company ABC is Rs 90 and the earnings per share are Rs 9 . P/E = 90 / 9 = 10.

How do you calculate PE ratio without EPS

If you don't know the EPS, you can calculate it by determining the company's earnings (subtract the company's preferred dividends from its net income) and then dividing the earnings by the number of shares outstanding.

What does a high PS ratio mean

overvalued

The P/S ratio is calculated by dividing the stock price by the underlying company's sales per share. A low ratio could imply the stock is undervalued, while a ratio that is higher-than-average could indicate that the stock is overvalued.

Does high PE ratio mean overvalued

The P/E ratio is calculated by dividing the market value price per share by the company's earnings per share. A high P/E ratio can mean that a stock's price is high relative to earnings and possibly overvalued. A low P/E ratio might indicate that the current stock price is low relative to earnings.

Is Apple PE ratio high

According to Apple's latest financial reports and stock price the company's current price-to-earnings ratio (TTM) is 32.099. At the end of 2021 the company had a P/E ratio of 29.2.

Is PE ratio the same as price to sales

P/E ratio is based on earnings, while P/S ratio is based on sales. P/E ratio tells you how much you are paying for each dollar of earnings, while P/S ratio tells you how much you are paying for each dollar of sales. P/E ratio is more commonly used than P/S ratio.

How much PE ratio is overvalued

Investors and analysts consider stocks which have a P/E ratio of 50 or above to be an overvalued share, especially in comparison to a stock which has a ratio at par with or below 10. As it allows investors to determine that its share prices are considerably higher than what a company can afford to pay as dividends.