How much is non-resident tax on US dividends

Nonresident aliens are subject to a dividend tax rate of 30% on dividends paid out by U.S. companies. If you are a resident alien and hold a green card—or satisfy resident rules—you are subject to the same tax rules as a U.S. citizen.

How much is non-resident US stock tax

In summary, foreign investors ('non-resident aliens' in IRS tax speak) are not liable for capital gains tax, but are subject to dividend and estate taxes. Dividends are withheld by the broker before distributions are made to the investor.

Are dividends paid to non residents withhold tax

Unfranked dividends

To the extent that the unfranked dividend is declared to be conduit foreign income, it is not assessable income and is exempt from withholding tax. Any other unfranked dividends paid or credited to a non-resident are subject to a final withholding tax.

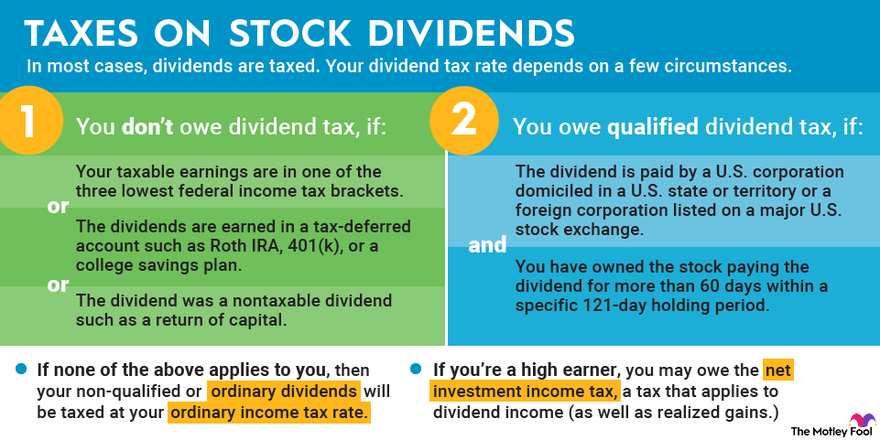

How are dividends taxed in the US for residents

Qualified dividends are taxed at 0%, 15%, or 20%, depending on your income level and tax filing status. Ordinary (nonqualified) dividends and taxable distributions are taxed at your marginal income tax rate, which is determined by your taxable earnings.

Are dividends tax free in USA

Dividends can be classified either as ordinary or qualified. Whereas ordinary dividends are taxable as ordinary income, qualified dividends that meet certain requirements are taxed at lower capital gain rates.

How much tax do you pay on foreign dividend income

Dividends received from a foreign company will be included in the total income of the taxpayer and will be charged to tax at the rates applicable to the taxpayer. For instance, if the taxpayer comes in at the 30% tax slab rate, then such dividend will also be taxable at 30% along with cess.

Do non US citizens pay taxes on US stocks

U.S. Tax for Foreign Investors

As a general rule, foreign investors (i.e., non-U.S. citizens and residents) with no U.S. business are typically not obligated to file a U.S. tax return, including on income generated from U.S. capital gains on U.S. securities trades.

Can non US residents own US stocks

Investors from around the world can buy and sell US stocks through brokerages that cater to foreign investors. Not every international brokerage is available in every country, so you will need to find one that specifically provides services in your country of origin.

How can I avoid US withholding tax

Investors are generally exempt from U.S. withholding tax when they hold U.S. listed ETFs or U.S. stocks directly in a Registered Retirement Saving Plan (RRSP) or Registered Retirement Income Fund (RRIF).

Which dividend is exempt from tax

However, no tax is deducted on the dividends paid to resident individuals, if the aggregate dividend distributed or likely to be distributed during the financial year does not exceed INR. 5000. A 10% TDS is payable on the dividend income amount over INR 5,000 during the fiscal year.

How do I avoid US dividend withholding tax

Investors are generally exempt from U.S. withholding tax when they hold U.S. listed ETFs or U.S. stocks directly in a Registered Retirement Saving Plan (RRSP) or Registered Retirement Income Fund (RRIF).

Is US dividend tax 30%

Dividends paid by a REIT are subject to a 30% rate. An election can be made to treat this interest income as if it were industrial and commercial profits taxable under article 8 of this treaty. Interest received by a financial institution is tax exempt.

How do I report foreign dividends on my US tax return

If you receive foreign source qualified dividends and/or capital gains (including long-term capital gains, unrecaptured section 1250 gain, and/or section 1231 gains) that are taxed in the U.S. at a reduced tax rate, you must adjust the foreign source income that you report on Form 1116, Foreign Tax Credit (Individual, …

How is foreign dividend exemption calculated

The full amount of the dividend must be shown in the tax return, however SARS will allow a tax exemption which equates to 25/45 of the Rand value of the foreign dividend. If the taxpayer has paid foreign tax on the dividend, this must also be declared, and SARS will reduce the local tax by the foreign tax paid.

Do foreigners pay taxes on US interest income

Interest income

Non-resident aliens' US-source interest is generally subject to a flat 30% tax rate (or lower treaty rate), usually withheld at source. Note that certain 'portfolio interest' earned by a non-resident alien is generally exempt from tax.

Can I invest in the US as a non resident

You don't need to be a U.S. citizen to trade in the U.S. stock market. You can open an online trading account with a U.S. broker, even as a foreigner, but more documentation is needed. Alternatively, you can make use of local financial institutions that have access to the U.S stock market.

Do non US citizens pay taxes on U.S. stocks

U.S. Tax for Foreign Investors

As a general rule, foreign investors (i.e., non-U.S. citizens and residents) with no U.S. business are typically not obligated to file a U.S. tax return, including on income generated from U.S. capital gains on U.S. securities trades.

How can I invest in U.S. stocks without paying taxes

9 Ways to Avoid Capital Gains Taxes on StocksInvest for the Long Term.Contribute to Your Retirement Accounts.Pick Your Cost Basis.Lower Your Tax Bracket.Harvest Losses to Offset Gains.Move to a Tax-Friendly State.Donate Stock to Charity.Invest in an Opportunity Zone.

How much is withholding tax in USA

30%

Payments subject to withholding include compensation for services, interest, dividends, rents, royalties, annuities, and certain other payments. Tax is withheld at 30% of the gross amount of the payment. This withholding rate may be reduced under a tax treaty.

How can I avoid U.S. tax on foreign income

With the Foreign Tax Credit, you can show the U.S. how much money you paid in taxes to that foreign country and receive a credit for every dollar you owe, so you don't have pay taxes for that same income again on your U.S. tax filing. If you qualify, you claim the Foreign Tax Credit by filing Form 1116.

How do you calculate dividend tax

((dividend amount ÷ (1 – company tax rate)) – dividend amount) x franking percentage.

How do you calculate dividend distribution tax

This is when 15% is applicable on the gross amount.For instance, Dividend distributed is 100.Grossing up of dividend [100/85*100] = 117.65 DDT @ 15% on 117.65=17.65.Surcharge @ 10%=1.76.Education cess @ 3%=0.58.Effective tax rate of 19.994% on INR100.

Is US dividend withholding tax 15%

As a result, most major countries have deals with the U.S. to apply only a 15% withholding tax to dividends paid to nonresident shareholders. Some examples include Australia, Canada, France, Germany, Ireland, and Switzerland.

Is dividend income taxable at 20%

For any dividend income paid out, TDS will be deducted at the rate of 20%. This is also subject to the provisions of the relevant DTAA.

Do I pay tax on foreign dividends

Non ISA overseas dividends are treated as foreign income and are taxable in the UK. You would need to report the foreign dividends in your self assessment tax return .