What’s the best age to get life insurance

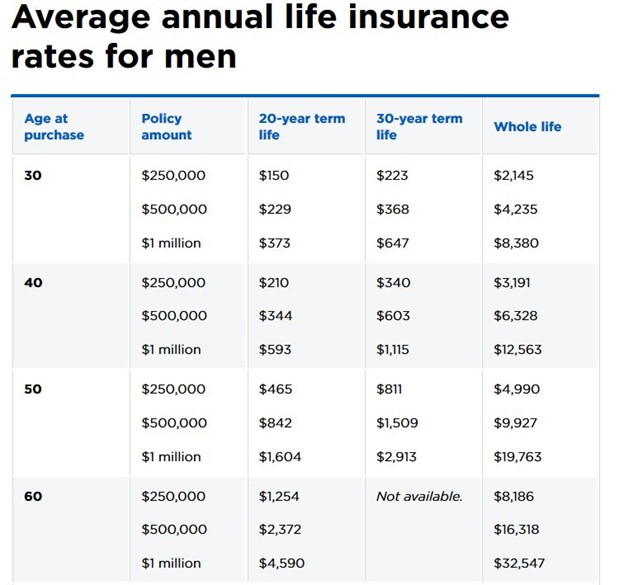

As we age, we're at increased risk of developing health conditions, which can result in higher mortality rates and higher life insurance rates. You'll typically pay less for life insurance at age 25 than at age 40. Waiting until age 60 may mean an even bigger rate increase and limited policy options.

Is 50 too old to get life insurance

While life insurance coverage typically costs more as you age, you can still apply for a policy later in life to help protect loved ones from having to pay your obligations. A life insurance policy can also serve other estate planning and business protection purposes.

How many years should my life insurance be

Level Term Insurance

Most people aim to do this over their mortgage period of 25 years. This is to ensure that if a death occurs, any debts or payments will be covered in this time. This policy is also ideal if you have children still living at home or in full-time education.

Who is most likely to need life insurance

Parents With Young Children or Dependents with Functional Needs. For many adults, the arrival of a baby is when they start thinking about life insurance for the first time and with good reason.

Is 40 too old to get life insurance

It's never too late to buy life insurance. If you're in your 40s or 50s and are just considering a midlife life insurance policy, or if you have coverage but want more, you have plenty of options. The type of life insurance you need depends on your finances, your health and your goals.

What age is too late to get life insurance

At What Age Can You No Longer Buy Life Insurance 90 years old is the highest issue age we've seen from any life insurance company. But many companies won't issue policies to people older than 85.

Is 60 too late for life insurance

Life insurance can provide peace of mind at any age, but isn't always necessary after age 60. To see if you need life insurance, assess your family's needs, your financial resources and assets, your outstanding debts and your long-term financial goals.

What happens after 20 years of life insurance

What does a 20-year term life insurance policy mean This is life insurance with a policy term of 20 years. If the policyholder dies during that time, the life insurance company pays a death benefit to his or her beneficiaries, often dependents or family. After 20 years, there is no more coverage, and no benefit paid.

What happens after a 10 year life insurance policy

Generally, when term life insurance expires, the policy simply expires, and no action needs to be taken by the policyholder. A notice is sent by the insurance carrier that the policy is no longer in effect, the policyholder stops paying the premiums, and there is no longer any potential death benefit.

When can you stop life insurance

Can you cancel a life insurance policy at any time Yes, you can, although the only way to get back all your premium payments is to do so during the initial “free look” period.

Do most people have enough life insurance

Overall, 52% of American adults report owning life insurance, and 41% of adults — both insured and uninsured — say they don't have sufficient life insurance coverage.

Which is better term or whole life insurance

Is whole life better than term life insurance Whole life provides many benefits compared to a term life insurance policy: it is permanent, it has a cash value component, and it offers more ways to protect your family's finances over the long term.

What is the cash value of a $10000 life insurance policy

The $10,000 refers to the face value of the policy, otherwise known as the death benefit, and does not represent the cash value of life insurance policy. A $10,000 term life insurance policy has no cash value. However, a permanent life insurance policy might.

Does life insurance end at 80

If you took out a 20-year term life insurance policy at age 30, it will expire when you're 50. But there are age-related factors that can affect the terms available to you. Typically, it's challenging to find term life insurance policies that extend past the age of 80.

Do you get your money back at the end of a whole life insurance

If you have a whole life policy, you may receive a check for the cash value of the policy, but a term policy will not provide any significant payout. If you have a whole life policy, fees may be subtracted from the cash value before you receive the remaining amount.

Do you pay life insurance forever

Generally, people seeking whole life insurance pay for it forever (i.e., until they die). But, you can choose to fund the entire cover in 10, 15, or 20 years. Although, doing so will extortionately raise your monthly premium for those years.

What happens to a 10-year life insurance policy after 10 years

What happens after 10 years At the end of the 10-year life insurance term, the period for fixed premiums expires. Assuming you've outlived the policy, no death benefit will be paid to your beneficiaries. And you won't be refunded any of the premiums paid.

What happens at the end of a 20 year whole life policy

This is life insurance with a policy term of 20 years. If the policyholder dies during that time, the life insurance company pays a death benefit to his or her beneficiaries, often dependents or family. After 20 years, there is no more coverage, and no benefit paid.

Do I get money back if I cancel my whole life insurance

Surrendering a whole life insurance policy will end your coverage and you'll be able to receive your cash surrender value, which is your cash value minus any fees. It's best to check your provider's surrender fee schedule before canceling your policy.

Do I get money back if I cancel my life insurance

Unless you've purchased a Return Of Premium Term Life Insurance Policy, you will not get your money back at the end of the term or at any time you cancel the policy.

Is life insurance always worth it

If your life and earning ability ends prematurely, life insurance can help adequately fill the financial gap. Older people, however, may not always benefit from taking out a life insurance policy. They're likely to be more financially secure and have fewer people depending on them financially.

What happens at the end of your term life insurance

Generally, when term life insurance expires, the policy simply expires, and no action needs to be taken by the policyholder. A notice is sent by the insurance carrier that the policy is no longer in effect, the policyholder stops paying the premiums, and there is no longer any potential death benefit.

Can you cash out a term life insurance

Can You Cash Out A Term Life Insurance Policy Term life insurance can't be cashed out because these policies do not accumulate cash value during the limited time they provide coverage. However, some term policies have an option that enables the policyholder to convert them into a form of permanent life insurance.

How much cash is a $100 000 life insurance policy worth

The cash value of your settlement will depend on all the other factors mentioned above. A typical life settlement is worth around 20% of your policy value, but can range from 10-25%. So for a 100,000 dollar policy, you would be looking at anywhere from 10,000 to 25,000 dollars.

What is the cash value of a $25 000 life insurance policy

Example of Cash Value Life Insurance

Consider a policy with a $25,000 death benefit. The policy has no outstanding loans or prior cash withdrawals and an accumulated cash value of $5,000. Upon the death of the policyholder, the insurance company pays the full death benefit of $25,000.