How much tax will I pay on my dividends

In addition, any dividends received from investments in an ISA or pension such as a Self-Invested Personal Pension (SIPP) are free from income tax. Outside of any tax-sheltered investments and the dividend allowance, the dividend tax rates are: 8.75% for basic rate taxpayers. 33.75% for higher rate taxpayers.

How dividend is taxed for shareholders

As per Section 194K, a Domestic Company distributing dividends on equity mutual funds to a resident shareholder should deduct TDS at the rate of 10% if the amount exceeds INR 5000. The taxpayer should report such income under the head IFOS in the ITR filed on Income Tax Website.

How much dividend income is tax free

Qualified dividend taxes are usually calculated using the capital gains tax rates. For 2022, qualified dividends may be taxed at 0% if your taxable income falls below: $41,676 for those filing single or married filing separately, $55,801 for head of household filers, or.

Are stock dividends taxed differently

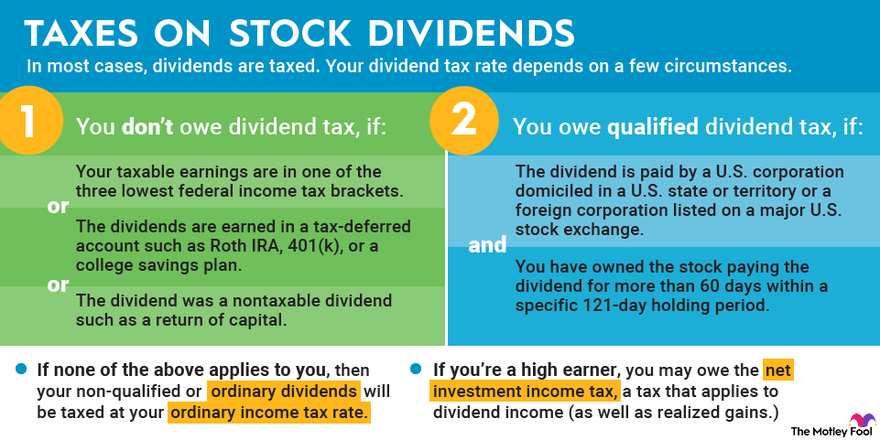

What is the dividend tax rate The tax rate on qualified dividends is 0%, 15% or 20%, depending on your taxable income and filing status. The tax rate on nonqualified dividends is the same as your regular income tax bracket. In both cases, people in higher tax brackets pay a higher dividend tax rate.

Are dividends taxed at 20%

Qualified dividends must meet special requirements issued by the IRS. The maximum tax rate for qualified dividends is 20%, with a few exceptions for real estate, art, or small business stock. Ordinary dividends are taxed at income tax rates, which as of the 2023 tax year, maxes out at 37%.

Are dividends taxed like income

They're paid out of the earnings and profits of the corporation. Dividends can be classified either as ordinary or qualified. Whereas ordinary dividends are taxable as ordinary income, qualified dividends that meet certain requirements are taxed at lower capital gain rates.

Are stock dividends taxed as capital gains and income tax

Investors who earn dividends or capital gains are subject to taxes on those gains. Short-term capital gains and ordinary dividends are treated the same as income and taxed at the current income tax bracket level.

Are stock dividends considered earned income

Unearned income includes money-making sources that involve interest, dividends, and capital gains. Additional forms of unearned income include retirement account distributions, annuities, unemployment compensation, Social Security benefits, and gambling winnings.

How do you avoid tax on dividends

You may be able to avoid all income taxes on dividends if your income is low enough to qualify for zero capital gains if you invest in a Roth retirement account or buy dividend stocks in a tax-advantaged education account.

Is dividend income taxable at 20%

For any dividend income paid out, TDS will be deducted at the rate of 20%. This is also subject to the provisions of the relevant DTAA.

How do I avoid dividend tax on shares

Any dividends you receive on investments held in an ISA are tax free, so the simplest way to reduce the amount of dividend tax you pay is to maximise your ISA allowance each year.

How do you avoid tax on dividend income

Invest in growth option: Instead of investing in dividend-paying stocks or mutual funds, you can opt for the growth option. Under the growth option, the profits made by the company or mutual fund are reinvested in the business, and no dividend is paid out. Therefore, no TDS is applicable on such investments.

Do I need to report dividends under $20

All dividends are taxable and this income must be reported on an income tax return, including dividends reinvested to purchase stock. If you received dividends totaling $10 or more from any entity, then you should receive a Form 1099-DIV stating the amount you received.

Should I count dividends as income

Ordinary dividends are the most common type of dividends. They're taxable as ordinary income unless they're qualified dividends. Qualified dividends are dividends taxed at the lower rates that apply to net long-term capital gains.

Are dividends taxed higher than capital gains

Companies pay dividends to their shareholders, while capital gains are realized when an investment is sold for more than the purchase price. Dividends are generally taxed at a lower rate than ordinary income, while capital gains are taxed at a lower or higher rate, depending on the holding period.

Is dividend exempt from tax

Is the dividend taxable in 2022 Yes, all the dividend income you receive in India is taxable, including the dividends you receive from mutual fund investments and direct equity investments.

Are dividends good passive income

Receiving dividends every quarter, month or year is an excellent passive income source. Therefore, finding companies that pay out regularly and have a history of success is crucial.

How are dividends taxed in USA

Qualified dividends must meet special requirements issued by the IRS. The maximum tax rate for qualified dividends is 20%, with a few exceptions for real estate, art, or small business stock. Ordinary dividends are taxed at income tax rates, which as of the 2023 tax year, maxes out at 37%.

What is the tax disadvantage of dividends

Timing is Everything

One disadvantage of dividend-paying stocks (or mutual funds that invest in dividend-paying stocks) is that they accelerate taxes. Regardless of how long you hold the stock, you'll owe taxes on dividends as they're paid, which erodes your returns over time.

Are ordinary dividends taxed at 15%

| 2023 Qualified Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly |

|---|---|---|

| 0% | Up to $44,625 | Up to $89,250 |

| 15% | $44,625-$492,300 | $89,250-$553,850 |

| 20% | More than $492,300 | More than $553,850 |

26 thg 6, 2023

Do stock dividends count as income

Dividends can be classified either as ordinary or qualified. Whereas ordinary dividends are taxable as ordinary income, qualified dividends that meet certain requirements are taxed at lower capital gain rates.

Why is stock dividend not taxable

If shares are held in a retirement account, stock dividends and stock splits are not taxed as they are earned. 1 Generally, in a nonretirement brokerage account, any income is taxable in the year it is received. This includes dividends, realized capital gains and interest.

Do you pay tax when you sell shares

Capital Gains Tax (CGT) is normally charged at a simple flat rate of 20% when you sell shares unless they are in a CGT free investment such as an ISA or qualifying pension. If you only pay basic rate tax and make a small capital gain, you may only be subject to a reduced CGT rate of 10%.

Is a 20% stock dividend considered a small stock dividend

A small stock dividend (generally less than 20-25% of the existing shares outstanding) is accounted for at market price on the date of declaration. A large stock dividend (generally over the 20-25% range) is accounted for at par value.

What happens if I don’t report dividends

If you don't, you may be subject to a penalty and/or backup withholding. For more information on backup withholding, refer to Topic No. 307. If you receive over $1,500 of taxable ordinary dividends, you must report these dividends on Schedule B (Form 1040), Interest and Ordinary Dividends.