How is foreign income taxed in India

The income from foreign sources gets taxed at the same rate applicable to earnings in India. If the taxpayer receives his foreign income in India, he/she must pay taxes in the same fiscal year. If the income is not received in India, it gets taxed in the financial year in which it is realised or accrued.

How to show foreign income in India

If the income is a payment for your services rendered abroad, include it under 'Income from salary. Always select relevant income head based on the nature of income and list the foreign income under that particular head. 👉 After clubbing the foreign income, it would be a part of your income earned in India.

Is global income taxable in India

Resident with global income

If you are a resident Indian, your global income is taxable in India. This income may have been earned or received outside – but it shall be taxed in India. If this income is also taxable in another country, you can take benefit of DTAA (Double Tax Avoidance Agreement).

Which income is taxable in India to non resident individual

All components of salary including allowances, perquisites and non-cash benefits are taxable unless specifically exempted. Certain deduction is available on salary income. The rental income received by an NR from property owned in India is taxable in India as its source is in India.

Will NRI be taxed in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.

Is foreign income taxable in India for non resident

In case of resident taxpayer all his income would be taxable in India, irrespective of the fact that income is earned or has accrued to taxpayer outside India. However, in case of non-resident all income which accrues or arises outside India would not be taxable in India.

Is foreign income taxable in India for NRI

In case of resident taxpayer all his income would be taxable in India, irrespective of the fact that income is earned or has accrued to taxpayer outside India. However, in case of non-resident all income which accrues or arises outside India would not be taxable in India.

Is money transferred to India taxable

Even if the money is being sent as a wedding gift or inheritance, it is not taxable. However, if an NRI transfers money to someone not related by blood, then there is a tax aspect. Any amount over Rs 50,000 in a year is taxable. Let us say that you are sending Rs 1, 00,000 to a friend in India.

Do I have to pay tax in India if I live abroad

Indians working abroad do not need to pay tax in India for their income earned abroad. However, any income earned through an Indian source-profession or business is liable to be taxed.

Is money sent to India taxable if NRI

However, if an NRI sends money to somebody who is not related by blood, then there is a tax implication. An amount over Rs 50,000 per year is subject to taxation in the hands of the receiver. For an NRI who is sending money from the US, then blood relation does not make a difference.

Is NRI account taxable in India

Interest earned in the NRE account is exempt from tax for NRIs in India. If the NRI becomes a resident of India in a financial year, the entire interest would be taxable unless the taxpayer takes prior permission from RBI.

Do non residents pay taxes in India

In case of resident taxpayer all his income would be taxable in India, irrespective of the fact that income is earned or has accrued to taxpayer outside India. However, in case of non-resident all income which accrues or arises outside India would not be taxable in India.

How much NRI is tax free in India

As a Non-resident, you still get the benefit of the basic exemption limit of Rs. 2,50,000 from your total income. However, If your total income in India consists of only short-term capital gains or long-term capital gains, then the benefit of the basic exemption limit is not available in respect of such gains.

Do NRI need to declare foreign income in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.

How to file NRI tax return in India

Simple Steps to File ITR for NRIsDetermine the residential status. The first step is determining the residential status with respect to the given financial year.Calculate your taxable income.Claim double taxation treaty benefits.Verify ITRs for NRI.

How much tax NRI has to pay in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.

How much money can I send to India without tax

There is no limit on sending money from USA to India. But, there is a limit of US $14,000 per person per year for tax free transactions. Any amount sent above US $14,000 per person per year, the sender is responsible for paying the taxes. How India's currency ban will affect NRIs

Does an NRI have to pay tax in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.

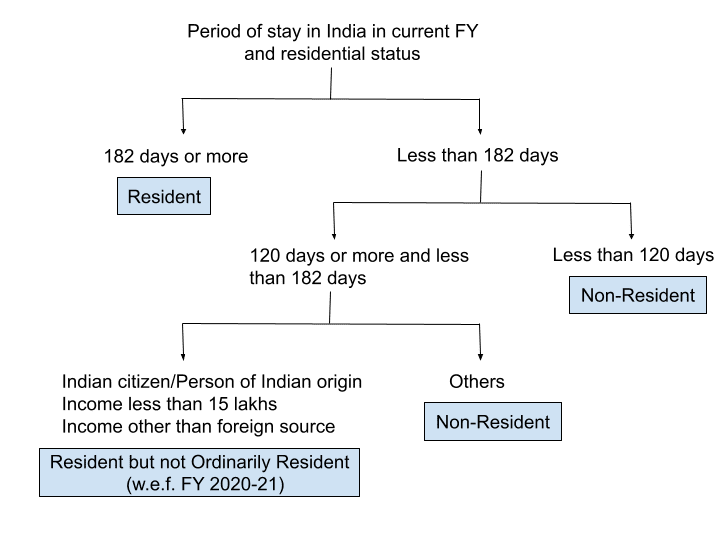

How long can I stay in India without paying tax

physically present in India for a period of 182 days or more in the tax year (182-day rule), or. physically present in India for a period of 60* days or more during the relevant tax year and 365 days or more in aggregate in four preceding tax years (60-day rule).

How much money can NRI transfer to India

There is no ceiling on the money an NRI can send to India. This money, however, needs to be earned through legit means. You also have to pay the required taxes on this money in the country it was earned. There is also an aspect of taxation to the money being sent to India.

How much money can I transfer to India

Amount of money I can transfer from the USA to India

According to the US Treasury Department, the Financial Crimes Enforcement Network (FinCEN) requires that financial institutions must file a Currency Transaction Report (CTR) for transactions which are over $10,000.

How much NRI salary is taxed in India

Tax Slabs of NRI for AY 2022-23:

| Taxable Income | Income-Tax Rates | Education Cess |

|---|---|---|

| Up to Rs.250,000 | Nil | Nil |

| Rs.250,000-500,000 | 10% | 2% |

| Rs.500,000-1,000,000 | 20% | 2% |

| Above 1,000,000 | 30% | 2% |

1 thg 8, 2022

How many months can NRI stay in India

NRI, PIO, and RNOR Status

The NRI status in India is attained by people who are Indian citizens but stay in India for less than 182 days in the preceding financial year or people who live outside India for employment, business, or any other purpose for an uncertain period.

Does OCI have to pay tax in India

Any Persons of Indian Origin (PIO), Overseas Citizens of India (OCI), or Foreign Citizens have to pay income tax and file an ITR if they have been a resident for more than eighty-two days. OCI card holders get to claim tax benefit as well. Indias follows a 'Residency'-based taxation system.

How NRI should pay tax in India

"An NRI's income taxes in India will depend upon his residential status for the year as per the income tax rules mentioned above. If your status is 'resident', your global income is taxable in India. If your status is 'NRI,' your income earned or accrued in India is taxable in India.