How to accumulate wealth with life insurance

How cash value accumulates in whole life insurance. Cash value accumulates over time in two ways: A portion of each premium you pay adds to your contract's cash value. Your cash value earns a guaranteed rate of return.

Are life insurance policies a good investment

Because whole life insurance is expensive and offers low returns, it isn't a good investment option for most people. If you need permanent life insurance, your assets exceed the estate tax, or you've exhausted other investing options, then you may benefit from investing with your life insurance.

How to use life insurance

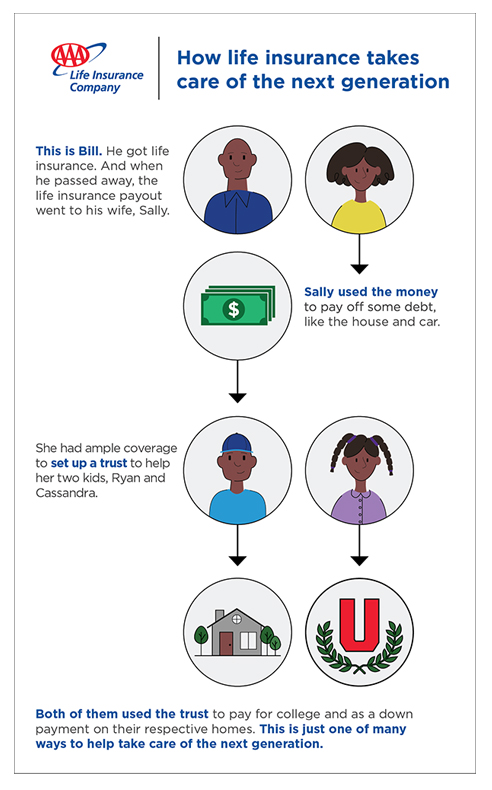

Money from life insurance money can be used to:Cover regular household expenses.Pay off a mortgage or other loans.Fund children's education.Keep a family business going.Pay for the funeral and other final expenses.

What are the benefits of having a life insurance policy

Among several advantages of life insurance, financial security, and peace of mind are hugely significant. You can rest assured your family will not have to compromise due to financial burdens in case of a mishap. It will also help them in taking care of financial liabilities, such as loan payments.

Do millionaires invest in life insurance

Wealthy individuals with a net worth over $1 million can use life insurance as income replacement, an investment vehicle, or protection against estate taxes. Amanda Shih. Her expertise has appeared in Slate, Lifehacker, Little Spoon, and J.D. Power. &Katherine Murbach.

Can you profit from life insurance

One way to make money with life insurance is to sell it as an investment. Another way is to use it as a retirement vehicle. Finally, life insurance can also pay for final expenses and estate taxes.

Is it smart to take money from life insurance

"Since a withdrawal generally reduces the policy's death benefit, a person who wants to maximize that payment should not withdraw cash value." Ultimately, deciding whether to draw cash from a life insurance policy comes down to personal need.

How do you use whole life insurance as an asset

Some types of permanent life insurance have an additional living benefit, called cash value. If your life insurance policy accumulates cash value, the cash value is considered an asset, because you can access it. Doing so, might reduce the death benefit and the available cash surrender value, however.

How to use life insurance cash value

Depending on the type of life insurance policy you have, here are four ways you may be able to access its cash value:Make a withdrawal.Take out a loan.Surrender the policy.Use cash value to help pay premiums.

How to use whole life insurance to your advantage

If you have a whole life policy with a mutual life insurer, you might be eligible for dividends each year based on the company's financial performance. You can choose to receive the dividend in cash, or use the funds to reduce your premium, repay cash value loans or buy additional coverage.

What are the 5 benefits of insurance

Benefits of Insurance CoverageProvides Protection. Insurance coverage does reduce the impact of loss that one bears in perilous situations.Provides Certainty. Insurance coverage provides a feeling of assurance to the policyholders.Risk Sharing.Value of Risk.Capital Generation.Economic Growth.Saving Habits.

Why do rich people use whole life insurance

For many rich people, it makes sense to purchase whole life insurance, because this kind of policy can provide a death benefit to loved ones that is generally tax free. And this money can be used to pay estate or inheritance taxes, so that other estate assets do not have to be liquidated to cover this cost.

Who is the richest insurance agent in the world

Gideon du Plessis

The highest-paid insurance agent is Gideon du Plessis.

He earns an annual commission amounting to $70 million.

Can you use life insurance while alive

Permanent life insurance policies will allow you to access the cash portion of your account while you're alive. Term life insurance, meanwhile, does not have a cash element for policyholders to access. So, if you're planning on using your life insurance as a backup cash resource you'll want to avoid term policies.

How much cash is a $100 000 life insurance policy worth

The cash value of your settlement will depend on all the other factors mentioned above. A typical life settlement is worth around 20% of your policy value, but can range from 10-25%. So for a 100,000 dollar policy, you would be looking at anywhere from 10,000 to 25,000 dollars.

What is the cash value of a $25 000 life insurance policy

Example of Cash Value Life Insurance

Consider a policy with a $25,000 death benefit. The policy has no outstanding loans or prior cash withdrawals and an accumulated cash value of $5,000. Upon the death of the policyholder, the insurance company pays the full death benefit of $25,000.

Is life insurance an investment asset

Term life insurance is not an asset because the death benefit only pays out after you die. A permanent policy with a cash value is an asset because the cash value earns interest and you can withdraw from it while you're alive.

How long does it take to build cash value on life insurance

Cash value: In most cases, the cash value portion of a life insurance policy doesn't begin to accrue until 2-5 years have passed. Once cash value begins to build, it becomes available to you according to your policy's guidelines.

What is the cash value of a $10000 life insurance policy

The $10,000 refers to the face value of the policy, otherwise known as the death benefit, and does not represent the cash value of life insurance policy. A $10,000 term life insurance policy has no cash value. However, a permanent life insurance policy might.

What is the cash value of a $25000 life insurance policy

Upon the death of the policyholder, the insurance company pays the full death benefit of $25,000. Money accumulated in the cash value becomes the property of the insurer. Because the cash value is $5,000, the real liability cost to the life insurance company is $20,000 ($25,000 – $5,000).

Is whole life insurance a good way to build wealth

The average annual rate of return on the cash value for whole life insurance is 1% to 3.5%, according to Quotacy. While whole life insurance offers fixed, guaranteed returns on your cash value, you may earn higher returns with other investments, such as stocks, bonds and real estate.

What are the 3 most important insurance

Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have.

Can I use life insurance while alive

Permanent life insurance policies will allow you to access the cash portion of your account while you're alive. Term life insurance, meanwhile, does not have a cash element for policyholders to access. So, if you're planning on using your life insurance as a backup cash resource you'll want to avoid term policies.

Can you make a million dollars as an insurance agent

So now, if you close just 4 sales per week for $5,000 each. Then you will earn $1,000,000. Yes, it is that simple to make a million dollars selling life insurance!

What is the top salary for an insurance CEO

Highest paid health insurance CEOs: Six CEOs raked in a record $123 million last year.Joseph Zubretsky, Molina Healthcare. 2022 pay: $22,131,256.Karen Lynch, CVS Health. 2022 pay: $21,317,055.David Cordani, Cigna.Gail Boudreaux, Elevance Health.Andrew Witty, UnitedHealth Group.Bruce Broussard, Humana.