Can you start day trading with $10

It is possible to begin Forex trading with as little as $10 and, in certain cases, even less. Brokers require $1,000 minimum account balance requirements. Some are available for as little as $5. Unfortunately, if your starting amount is $10, this may prevent you from getting the higher quality, regulated brokers.

How can I start trading without money

The first step to trading forex without money is to open a demo account with a broker. A demo account is a practice account that allows you to trade with virtual money. Most brokers offer demo accounts for free. This is a great way to learn how to trade forex without risking any real money.

How to trade forex

Steps Required to Trade ForexStep 1: Research and select a broker.Step 2: Open a forex trading account.Step 3: Verify your identity.Step 4: Fund your forex account.Step 5: Research currencies and identify trading opportunities.Step 6: Size up your first forex trade.Step 7: Monitor and manage your position.

What is forex money

The foreign exchange (forex or FX) market is a global marketplace for exchanging national currencies. Because of the worldwide reach of trade, commerce, and finance, forex markets tend to be the world's largest and most liquid asset markets. Currencies trade against each other as exchange rate pairs.

Can you day trade with $50 dollars

First, today, it is possible to start day trading with as little as $50. For one, companies like Robinhood and WeBull don't have a minimum balance requirement. You can download the application and deposit as little as $50 and buy your first stock. The same is true with forex and CFD brokers.

How many lots can I trade with $100

With this in mind, the lot size that is good for a $100 forex account would depend on the currency pair being traded and the stop-loss level. For example, if a trader is trading the EUR/USD currency pair and has a stop-loss of 20 pips, the lot size that is good for a $100 forex account would be 0.05 lots.

Can I start trading with just $1

Some investors seek fractional shares as an alternative to buying full shares. On Robinhood, investors can buy fractional shares of stocks and exchange-traded funds (ETFs) with as little as $1.

How much cash do I need to start day trading

$25,000

First, pattern day traders must maintain minimum equity of $25,000 in their margin account on any day that the customer day trades. This required minimum equity, which can be a combination of cash and eligible securities, must be in your account prior to engaging in any day-trading activities.

How much money do I need to trade forex

The Minimum Amount To Start Forex Trading Now

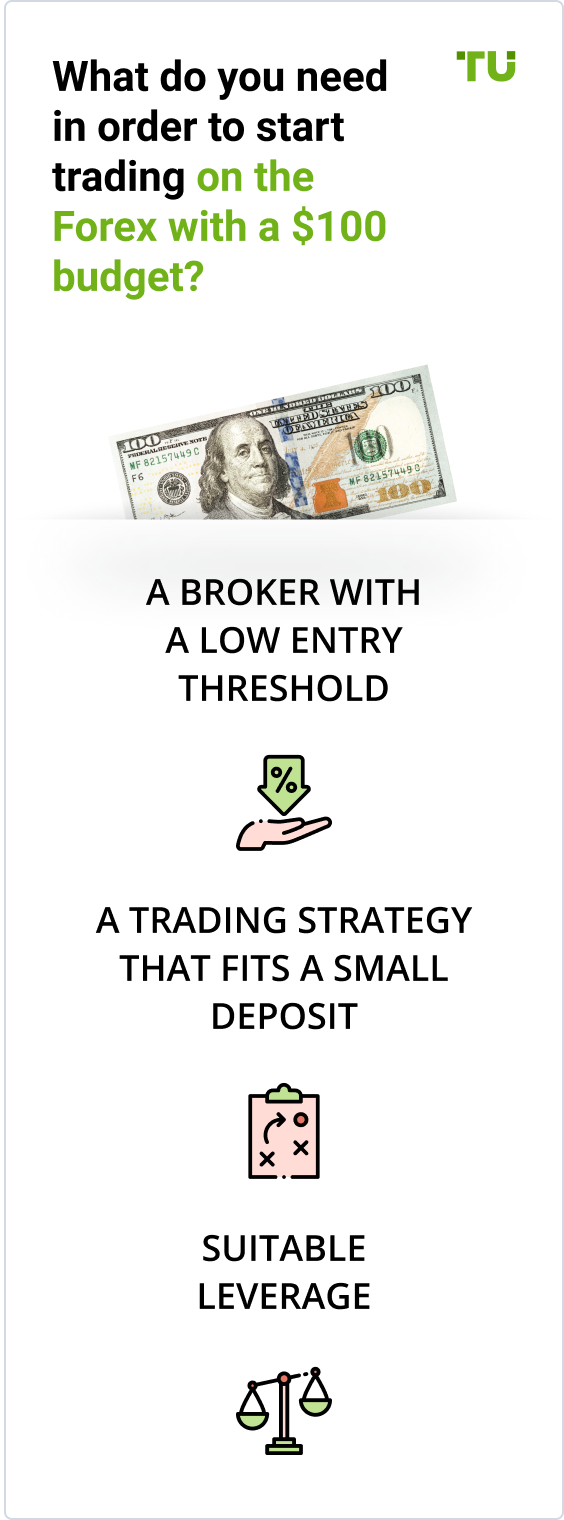

If you must start trading right away, you can begin with $100 but for a little more flexibility, you will need a minimum of $500. This will give you enough buying power to trade a standard lot, which is 100,000 units of currency.

Should beginners trade forex

Forex trading refers to buying and selling currencies from around the globe. For example, if you think the Euro will rise and the U.S. dollar will fall, you could buy Euros and sell U.S. dollars. Forex trading is fairly risky and likely isn't suitable for beginner investors.

Is $100 enough for forex

The amount of money you can make in forex trading with 0 is subjective and depends on several factors. However, it's possible to make a profit with a small investment of $100. For example, if you invest $100 and make a profit of 10%, you will have $110.

Is forex easy money

Forex trading may make you rich if you are a hedge fund with deep pockets or an unusually skilled currency trader. But for the average retail trader, rather than being an easy road to riches, forex trading can be a rocky highway to enormous losses and potential penury.

Can you make $200 a day trading

A common approach for new day traders is to start with a goal of $200 per day and work up to $800-$1000 over time. Small winners are better than home runs because it forces you to stay on your plan and use discipline. Sure, you'll hit a big winner every now and then, but consistency is the real key to day trading.

Can you day trade with $25

First, pattern day traders must maintain minimum equity of $25,000 in their margin account on any day that the customer day trades. This required minimum equity, which can be a combination of cash and eligible securities, must be in your account prior to engaging in any day-trading activities.

What lot size is good for $200

On a $200 forex account you should be using no more than 0.02 lot size. If your stop loss is large, in pips, you'll need to be using a lot size of 0.01. If you're trading with a very small stop loss, in pips, you could use a lot size of 0.03.

How do I turn $100 into $1000 in forex

Forex traders, especially those learning how to turn $100 into $1000 in Forex, should control leverage and use risk management strategies to reduce losses. Consider a scenario where you want to trade but only have $100 in capital. Your $100 will become $1000 to purchase this stock if you use a leverage ratio of 1:10.

How much can I earn from $100 trading

On average, a trader can expect to make a return of 10-20% per month on their investment in forex trading. Therefore, if a trader invests $100 in forex trading and makes a 15% return per month, they can expect to make a profit of $15 per month. In one year, the trader can make a profit of $180.

Can I start day trading with $50 dollars

You can start trading with an initial investment as low as $50. However, the amount of money you start with is a significant determinant of your ultimate success and will influence your trading experience and just because you can start trading with $50 doesn't mean that you should.

Why $25 000 for day trading

One of the most common requirements for trading the stock market as a day trader is the $25,000 rule. You need a minimum of $25,000 equity to day trade a margin account because the Financial Industry Regulatory Authority (FINRA) mandates it. The regulatory body calls it the 'Pattern Day Trading Rule'.

Can you day trade with $50

You can start trading with an initial investment as low as $50. However, the amount of money you start with is a significant determinant of your ultimate success and will influence your trading experience and just because you can start trading with $50 doesn't mean that you should.

Do beginner traders lose money

LACK OF PROPER RESEARCH ABOUT THE COMPANY:

This is the very first reason where 90% of traders loose the money when they start trading in the stock market in their beginning stage. They easily follow the tips they get from their neighbor, friends or from any financial expert, etc.

Why is forex trading so difficult

Maximum Leverage

The reason many forex traders fail is that they are undercapitalized in relation to the size of the trades they make. It is either greed or the prospect of controlling vast amounts of money with only a small amount of capital that coerces forex traders to take on such huge and fragile financial risk.

What lot size can I trade with $100

A nano lot is the name given to a trade size that is 1/1000th of a standard lot. The value of a nano lot is 100 units, or $100, and is the lowest lot you can trade. This is where most beginners start when selecting a recommended lot size because the lot value is very low.

Can forex make you a millionaire

Forex trading may make you rich if you are a hedge fund with deep pockets or an unusually skilled currency trader. But for the average retail trader, rather than being an easy road to riches, forex trading can be a rocky highway to enormous losses and potential penury.

Is crypto more profitable than forex

Additionally, forex trading is more heavily regulated than the crypto market, which may make it a safer option for some traders. Crypto trading, on the other hand, offers a higher potential for profit due to its volatility. However, this also means that there is a higher risk of loss.