What is a good strategy to help you save

A good idea would be to split your goals into short-term (e.g. emergency funds, down payments for a car) and long-term (e.g. college fund, retirement plan, house purchase). Your first goals should include urgent matters such as paying off your high-interest debts by paying them off one by one.

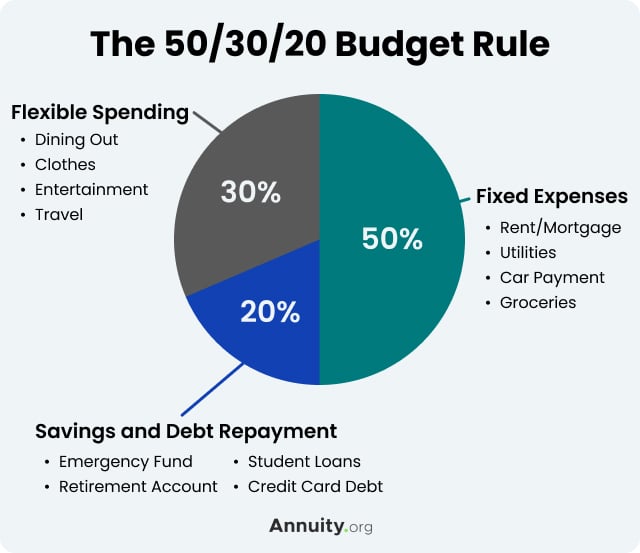

What percentage of your income should you use towards savings

20%

At least 20% of your income should go towards savings. Meanwhile, another 50% (maximum) should go toward necessities, while 30% goes toward discretionary items.

What does it mean to pay yourself first

Key takeaways. Generally, “pay yourself first” means what it says—set aside money for savings before paying bills and making other purchases. But it's still important to keep up with debt obligations. Automatic transfers can make it easier to pay yourself first.

What is a major benefit of the pay yourself first strategy

If you make a habit of depositing or moving money into your savings account every time you are paid, you may be less likely to spend it on your everyday expenses. This practice can help you foster a habit of saving that will add up over time and help you be prepared for large or unexpected expenses.

How to save $10,000 in a year

If you need to save $10,000 a year, that means saving $833.33 a month. Breaking it down even further, this means you'll have to save $192.31 each week or $27.40 every day. If you're sharing this with a spouse – cut these numbers in two. You will need to save $13.70 a day.

How can I save money when I am broke

Tips to save money on a low incomeSave what you can. Saving as a practice is not dependent on how much you earn.Save first. Save first, spend later.Open a savings account.Start a budget.Settle debt.Lower housing expenses.Lower car expenses.Spend less on food.

What is the 70 20 rule for savings

A new money rule: 70-20-10

That's why we really like the idea of a 70-20-10 rule for your money. Applying around 70% of your take-home pay to needs, letting around 20% go to wants, and aiming to save only 10% are simply more realistic goals to shoot for right now.

Is saving 20 percent of income is too much

There are various rules of thumb that relate to savings, whether it's retirement or emergency savings, but a general consensus is to set aside between 10 percent and 20 percent of your income each month for savings.

Why is investing a better option than saving

Saving provides a safety net and a way to achieve short-term goals, while investing has the potential for higher long-term returns and can help achieve long-term financial goals.

What does paying yourself first look like

The "pay yourself first" method has you put a portion of your paycheck into your savings, retirement, emergency or other goal-based savings accounts before you do anything else with it. After a month or two, you likely won't even notice this sum is "gone" from your budget.

Is PYF a strategy to save money

It's a budgeting strategy where a portion of your income is automatically saved or invested before you spend it on other things. This helps ensure that you're consistently saving and investing for the future, rather than only saving what's left over after spending. The concept of “reverse budgeting” is a form of PYF.

What are two reasons you should pay yourself first

The advantage of "paying yourself first" out of your paycheck is that you build up a nest egg to secure your future, and create a cushion for financial emergencies such as your car breaking down or unexpected medical expenses. Without savings, many people report experiencing a large amount of stress.

How long to save $1 million in 10 years

In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

How to save $1 000 in 30 days

Here are just a few more ideas:Make a weekly menu, and shop for groceries with a list and coupons.Buy in bulk.Use generic products.Avoid paying ATM fees.Pay off your credit cards each month to avoid interest charges.Pay with cash.Check out movies and books at the library.Find a carpool buddy to save on gas.

Why am I still broke

The biggest reason you might end up broke is simply math: You're spending all that you're earning — or more. Plenty of less-than-ideal money moves could put you in this position. Maybe you're buying unnecessary things or overspending to keep up with friends over fear of missing out.

What is the 80 10 10 money rule

The 80/10/10 budget is just one way this can be done! In this approach, like other popular budgets, 80% of income goes towards spendings, such as bills, groceries, or anything else needed. 10% of income goes directly into savings to ensure that money is added regularly. The last 10% of income goes to charity.

What is the 70 10 10 10 savings rule

This principle consists of allocating 10% of your monthly income to each of the following categories: emergency fund, long-term savings, and giving. The remaining 70% is for your living expenses. 10% – Long Term Savings – Saving for big expenses such as university, new home, retirement, etc.

What is the 70 20 10 rule money

The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered. The remaining 10% is your 'fun bucket', money set aside for the things you want after your essentials, debt and savings goals are taken care of.

Is 25% saving good

The amount you're able to save varies greatly depending on your income, expenses and financial goals. Alice Rowen Hall, director of Rowen Homes, suggests that “individuals should aim to save at least 20% of their annual income by age 25.”

Is it smarter to save or invest

Is it better to save or invest It's a good rule of thumb to prioritize saving over investing if you don't have an emergency fund or if you'll need the cash within the next few years. If there are funds you won't need for at least five years, that money may be a good candidate for investing.

Am I better off saving or investing

Savings are ideal for short-term or unexpected expenses such as holidays or the boiler breaking down. But if you're looking to build your wealth for the future, it's worth considering investing because stock markets tend to perform better than cash over the longer-term.

What should you always pay first

Generally, the bills you should pay first are the ones that cover necessities — the main resources that keep you and your family safe and healthy. These necessities include shelter, water, heat and food. Once necessities are paid for, focus on expenses related to your vehicle.

How to save your first $100 000

If you can afford to put away $1,400 per month, you could potentially save your first $100k in just 5 years. If that's too much, aim for even half that (or whatever you can). Thanks to compound interest, just $700 per month could become $100k in 9 years.

How can I save my first $100000 fast

The best way to save your first 100k is to do the following:Consistently invest most of your income in a diverse range of assets (e.g., real estate, private equity, crypto, and stocks).Live below your means.Cut the frivolous purchases.Avoid large and unnecessary purchases.Implement the buy five rule.

What is the ratio for pay yourself first

What's a Good Percentage To Pay Yourself When you're creating a pay-yourself-first budget, one of the first questions you may have is “How much should I pay myself” Most experts recommend saving at least 20% of your income each month.