What is the 80-20 rule in real life

The 80-20 Rule in Business and Investments

For project management, many managers have noted the first 20% of the effort put in on a project yields 80% of the project's results. Thus, the 80-20 rule can help managers and business owners focus 80% of their time on the 20% of the business yielding the greatest results.

What is the best example of 80-20 rule

80% of sleep quality occurs in 20% of sleep. 80% of results are caused by 20% of thinking and planning. 80% of family problems are caused by 20% of issues. 80% of retail sales are produced by 20% of a store's brands.

What is the 80 20 theory

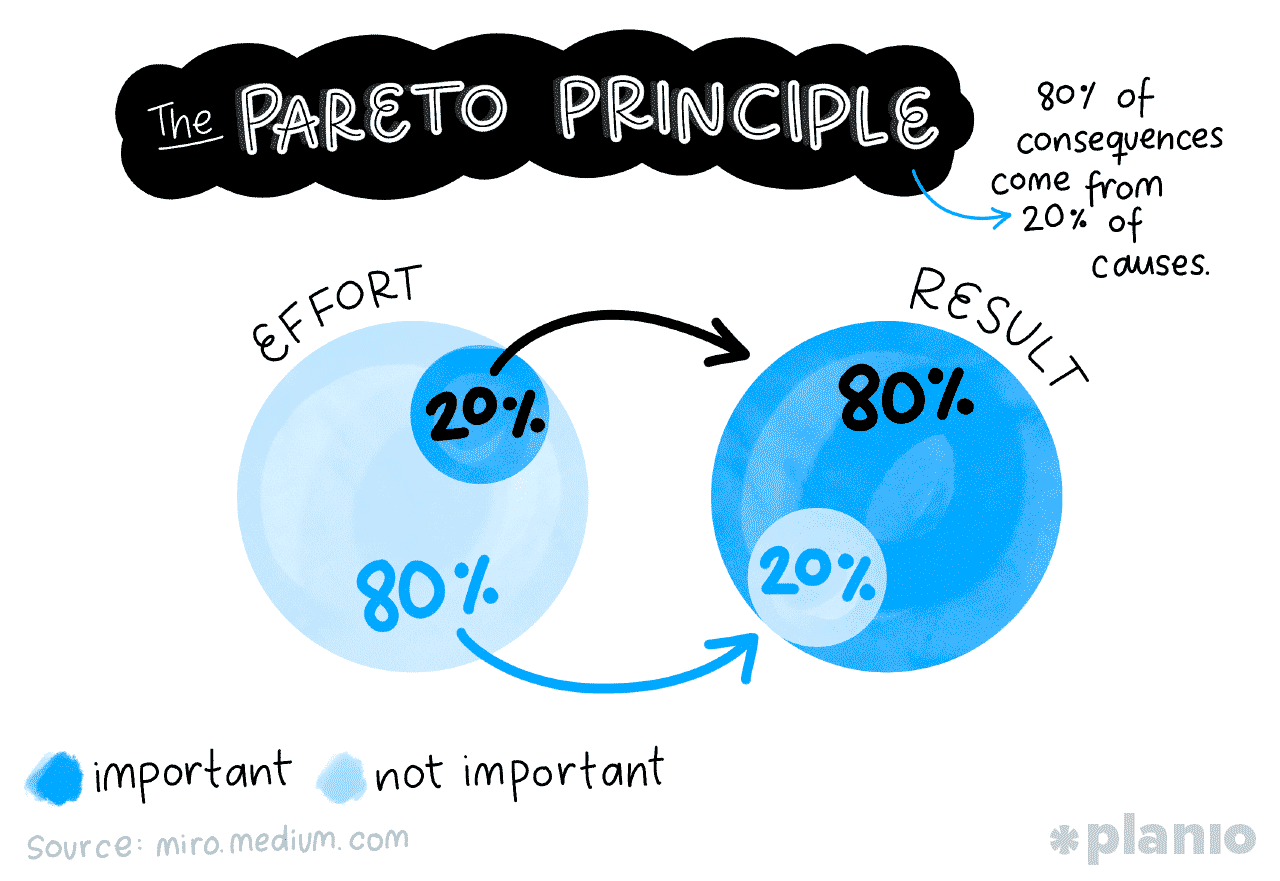

The Pareto principle states that for many outcomes, roughly 80% of consequences come from 20% of causes (the "vital few"). Other names for this principle are the 80/20 rule, the law of the vital few, or the principle of factor sparsity.

How can you use Pareto Principle in real life

So, here are some Pareto 80 20 rule examples:20% of criminals commit 80% of crimes.20% of drivers cause 80% of all traffic accidents.80% of pollution originates from 20% of all factories.20% of a companies products represent 80% of sales.20% of employees are responsible for 80% of the results.

Does the 80-20 rule still apply

The 80% can be important, even if the decision is made to prioritize the 20%. Business managers from all industries use the 80-20 rule to help narrow their focus and identify those issues that cause the most problems in their departments and organizations.

Who is behind the 80-20 rule

Vilfredo Pareto, an Italian economist, “discovered” this principle in 1897 when he observed that 80 percent of the land in England (and every country he subsequently studied) was owned by 20 percent of the population. Pareto's theory of predictable imbalance has since been applied to almost every aspect of modern life.

Is 80 20 a good investment strategy

Investors might prefer an 80/20 asset allocation strategy for the following reasons: They might want potentially higher returns and growth from their portfolio. They might have a higher personal tolerance and appetite for risk. They might have a longer investment timeline.

What are the limitations of the 80-20 rule

Oversimplification: One of the biggest limitations of the 80–20 rule is its oversimplification of complex systems and situations. The rule assumes that the relationship between cause and effect is straightforward and that the most significant causes can be easily identified.

Who created the 80-20 rule

Vilfredo Pareto

Vilfredo Pareto, an Italian economist, “discovered” this principle in 1897 when he observed that 80 percent of the land in England (and every country he subsequently studied) was owned by 20 percent of the population. Pareto's theory of predictable imbalance has since been applied to almost every aspect of modern life.

Why is the 80-20 rule effective

Key Takeaways. The 80-20 rule maintains that 80% of outcomes comes from 20% of causes. The 80-20 rule prioritizes the 20% of factors that will produce the best results. A principle of the 80-20 rule is to identify an entity's best assets and use them efficiently to create maximum value.

Does the Pareto Principle always apply

Disadvantage: it doesn't always apply

The Pareto principle is not a mathematical law. It is a general observation, but that doesn't mean it's true in every case. Natural variations of the Pareto principle can occur. For example, 30% of your salespeople might be responsible for 60% of your sales.

Why does the Pareto Principle work

In business, it's designed to help you focus on the 20% of efforts that are directly linked to outcomes that drive sales, revenue, and growth. The Pareto Principle works by pinpointing what influences revenue and keeps customers happy. By focusing on the 20% of success drivers, teams can let the unimportant fall away.

What is the opposite of 80-20 rule

Notice that attention to detail works the opposite of the 80/20 rule. It says to focus on the last few percent, so I call it the 20/80 rule, or the 10/90 rule. I'm not saying to drop the 80/20 rule. I'm saying it applies in some situations.

What is the 64 4 rule

Thus, 64% of revenue comes from 4% of customers, 64% of accidents are caused by 4% of hazards, 64% of software errors can be traced to 4% of bugs, and so on. In guiding innovation investments, the 64/4 rule is highly useful because of how much leverage it produces.

Is 80 20 aggressive

The 80/20 Aggressive investment option allocates your money to a mix of 80% equity and 20% fixed income and capital preservation. It aims for growth through a higher allocation to stocks and is intended for investors with a higher tolerance for risk.

What is the #1 rule of investing

Rule No.

1 is never lose money.

Who is the 80-20 rule guy

The 80/20 dating theory stems from The Pareto Principle, which was conceptualized by Italian philosopher and economist Vilfredo Federico Pareto in 1906.

What are the disadvantages of Pareto Principle

The main disadvantage of Pareto analysis is that it does not provide solutions to issues; it is only helpful for determining or identifying the root causes of a problem(s). In addition, Pareto analysis only focuses on past data.

Does Pareto efficiency exist

Pareto efficiency is when an economy has its resources and goods allocated to the maximum level of efficiency, and no change can be made without making someone worse off. Pure Pareto efficiency exists only in theory, though the economy can move toward Pareto efficiency.

Why does the Pareto Principle not work

The Numbers Can Be Misleading

The 80/20 rule represents a key feature of statistics: generalization. This poses a problem if the rule is interpreted literally. In some cases 65% of output may come from 4% of input or 70% from 10% and so forth. The 80/20 ratio does not apply to all situations.

Is the 4% rule dead

The 4% rule is outdated and inflexible. To sleep well at night, your retirement must be immune to market conditions. The income method can sustain a highly flexible retirement with no fears of erosion during bear markets.

Is 70 30 the new 60 40

The 70/30 asset allocation strategy is an alternative to the potentially less-risky 60/40 model or the riskier 80/20 allocation strategy. There can be a lot of variation within the 70/30 strategy, though, especially with equity stocks.

Is 80 20 or 70 30 better

The main difference between the 70/30 and 80/20 asset allocation models is how much risk you're taking. With an 80/20 allocation, you're devoting a larger share of your money to stocks, which can mean greater exposure to stock market volatility.

What is the 70% rule investing

The rule states that an investor should pay no more than 70% of the after-repair value (ARV) of a property, minus the cost of repairs. So, if a property's ARV is $200,000 and it needs $30,000 worth of repairs, the most an investor should pay for the property is $110,000 ($200,000 x 0.7 – $30,000).

What is Warren Buffett 70 30 rule

What Is a 70/30 Portfolio A 70/30 portfolio is an investment portfolio where 70% of investment capital is allocated to stocks and 30% to fixed-income securities, primarily bonds.