Is KPI a leading or lagging indicator

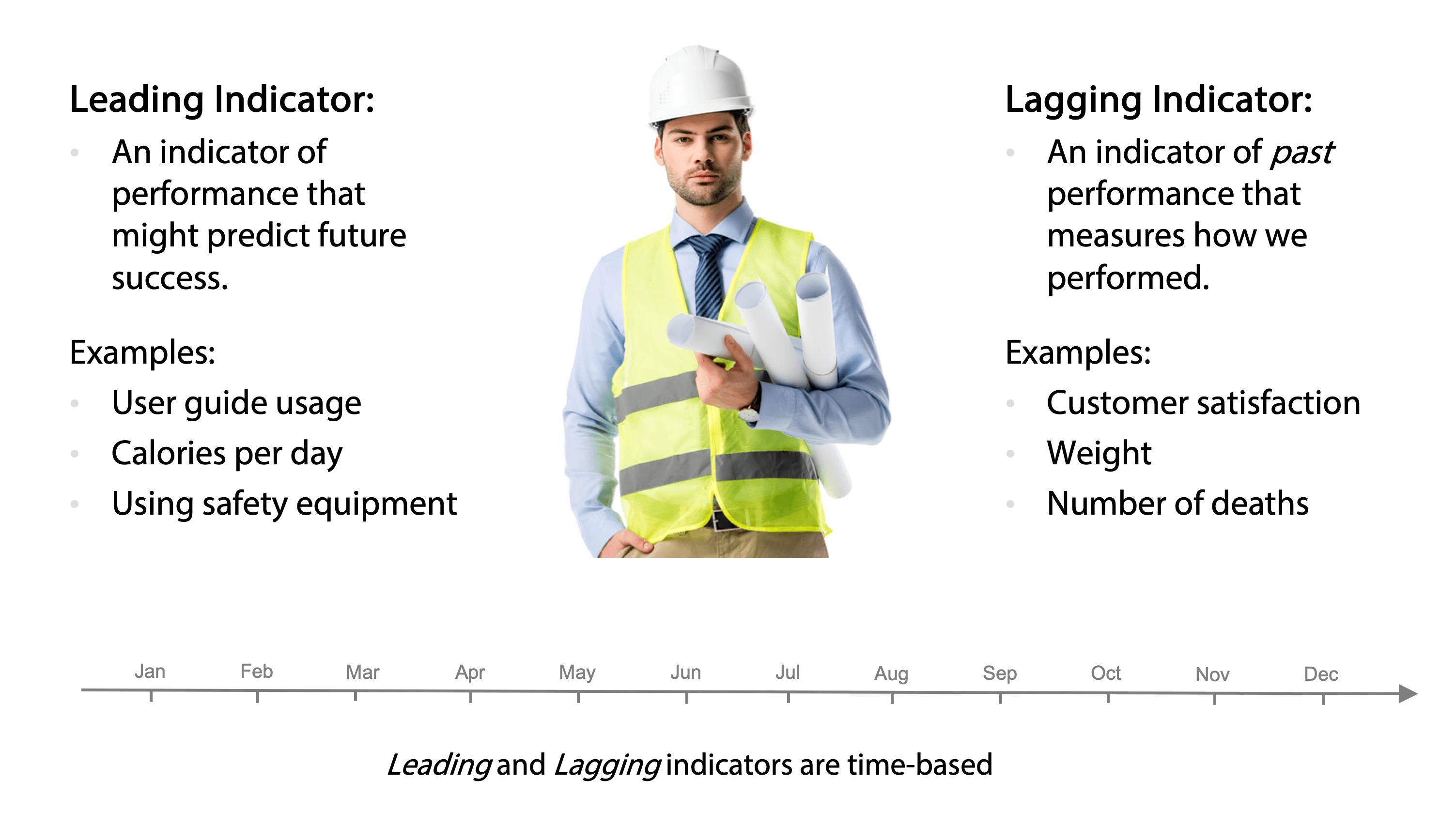

These KPIs, such as the number of enquiries, help predict future sales and give you the ability to plan and make strategic decisions. The key difference between Leading and Lagging KPIs is that Leading KPIs indicate where you're likely to go, while Lagging KPIs only measure what you have already achieved.

What are lagging indicators of KPI

Lagging indicators in business are a kind of key performance indicator (KPI) which measure business performance after the fact, such as sales, customer satisfaction, or revenue churn. They can be difficult or impossible to influence directly.

What types of indicators are lagging

Moving Averages, MACD, and Bollinger Bands are three types of lagging indicators. They cannot predict the future as the lagging indicators shift only upon major economic events.

What are KPI leading indicators

What are Leading Indicator KPIs Leading Indicators can help predict what will happen in the future. They let you know if you are on track to achieve the results you want. Leading Indicators are measurable, and you have the ability to influence or move them.

What is an example of leading and lagging KPI

The following are few examples of leading KPIs: User adoption/retention rate: An increasing user adoption and retention rate can indicate that the product growth is in the right direction and product monetization goals (lagging KPIs) can be achieved.

What are leading lagging indicators examples

A leading indicator is a predictive measurement, for example; the percentage of people wearing hard hats on a building site is a leading safety indicator. A lagging indicator is an output measurement, for example; the number of accidents on a building site is a lagging safety indicator.

What is the best lagging indicator

Three popular lagging indicatorsMoving averages.The MACD indicator.Bollinger bands.

Which indicators are not lagging

A trader building a trade strategy can use a combination of lagging and non-lagging indicators to maximize their profit potential. The top five non-lagging indicators for beginners are the True Strength Index (TSI), Fisher Transform (FT), Pivot Points (PP), Stochastic RSI (StochRSI), and Williams Alligator (WA).

What are leading and lagging KPIs in marketing

So while leading indicators are used to predict future results, lagging indicators report past results that have already happened. As such, leading indicators are dynamic, but can be hard to measure, whereas lagging indicators are easy to measure but not changeable.

What is an example of a lagging and leading metrics

What are some examples of Leading vs Lagging indicators

| Output (what you do) | Leading indicator | Lagging indicator |

|---|---|---|

| Marketing | # of leads | Signed deals |

| Staff quality training | Checklist Usage (behaviour) | Reduce work defects |

| Software deployment automation | Time to deploy | Monthly deployments |

What is a lagging indicator example

A lagging indicator is an output measurement, for example; the number of accidents on a building site is a lagging safety indicator. The difference between the two is a leading indicator can influence change and a lagging indicator can only record what has happened.

What are leading and lagging KPIs sales

Leading indicators include items such as created leads/opportunities, created accounts, and won opportunities. Lagging indicators include won opportunities, lost opportunities, won amount and lost amount.

What is an example of a lag measure

An Example:

You might say “I want to lose 2 pounds this month!”. To do this let's apply the principles of 4DX. The 2 pounds is the Lag Measure, a way to measure if you're successful or not at the end of the month. To actually achieve the weight loss you would apply Lead Measures.

What indicators don’t lag

What Are Non-Lagging Indicators Non-lagging trend indicators provide trading signals in real time. Non-lagging indicators often rely on crossovers to indicate trend reversals. For example,the Williams Alligator(WA)indicator uses the contraction and expansion of lines to signal a trending market.

Are all technical indicators lagging

Most technical indicators are lagging indicators, as they only look at historical data and aren't suggesting which way the price will go next. However, lagging indicators can lead price in some contexts, such as divergence.

What is an example of a leading lagging KPI

The following are few examples of leading KPIs: User adoption/retention rate: An increasing user adoption and retention rate can indicate that the product growth is in the right direction and product monetization goals (lagging KPIs) can be achieved.

What is an example of a lagging indicator in marketing

Lagging indicators tell you about what has already happened, with common examples being revenue, profit and revenue growth. They're typically easy to identify, measure and compare against elsewhere in your industry, which makes lagging indicators very useful.

How do you know if its lagging or leading

Difference between Lagging and Leading Power Factor

For a given load, if the load current lags behind the voltage, then the power factor of the load is called lagging power factor. For a given load, if the load current leads or advances in phase the voltage, then the load power factor is called leading power factor.

What are leading vs lagging indicators examples

Leading indicators give us real-time coaching opportunities — for example, looking at rep activities or call connects. Lagging indicators, such as revenue or quota attainment, tell us what's already happened. These measures give us the ability to review and strategize.

What is an example of a lag and lead indicator

A leading indicator is a predictive measurement, for example; the percentage of people wearing hard hats on a building site is a leading safety indicator. A lagging indicator is an output measurement, for example; the number of accidents on a building site is a lagging safety indicator.

What is an example of a lead vs lag indicator

Pipeline volume (leading) + sales revenue (lagging)

Sales Revenue is your lagging indicator because it takes time to grow,and it measures what's already happened—revenue earned.To measure your progress on an ongoing basis, you focus on improving your overall Pipeline Volume.

What indicators are not lagging

A trader building a trade strategy can use a combination of lagging and non-lagging indicators to maximize their profit potential. The top five non-lagging indicators for beginners are the True Strength Index (TSI), Fisher Transform (FT), Pivot Points (PP), Stochastic RSI (StochRSI), and Williams Alligator (WA).

Which indicators don’t lag

Non-lagging indicators often rely on crossovers to indicate trend reversals. For example,the Williams Alligator(WA)indicator uses the contraction and expansion of lines to signal a trending market. The WA indicator sends real-time signals when a trend is formed based on line movements.

What is lagging KPI in Six Sigma

Lagging indicator:

A lagging indicator is an outlier that is already outside the upper or lower control limit. This is a lagging indicator that the defect has already occurred in the process.

What are lead vs lag indicators examples

Leading indicators look forwards, through the windshield, at the road ahead. Lagging indicators look backwards, through the rear window, at the road you've already travelled. A financial indicator like revenue, for example, is a lagging indicator, in that it tells you about what has already happened.