Is the CFA still valued

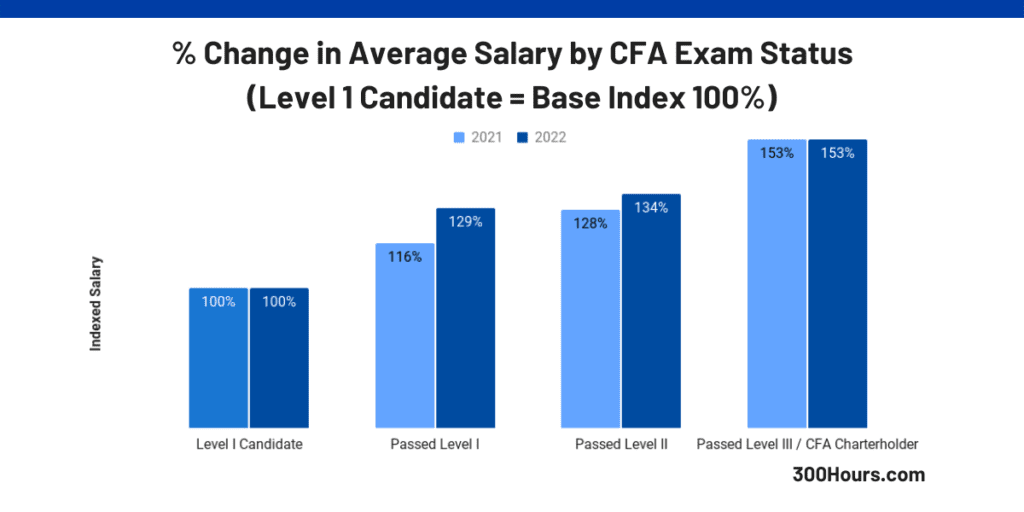

The CFA charter is relevant in a variety of careers including investment management, risk management, private wealth, banking, and consulting, just to name a few. Furthermore, the prospects for career advancement and increases in total compensation may be expected for candidates who ultimately earn the CFA marks.

Is a CFA respected

The CFA charter is one of the most respected designations in finance and is widely considered to be the gold standard in the field of investment analysis. To become a charter holder, candidates must pass three difficult exams, have a bachelors degree, and have at least four years of relevant professional experience.

Is CFA relevant in 2023

Yes, CFA exam is helpful for getting into Investment banking as it trains the candidate for the core finance skills such as valuations.

Is there a future for CFA

The scope of CFA is huge and a person can pick their own choice of interest and specialize in that. Some of the career scopes for CFA professionals are quality data analyst, consultant, trader, real estate, fixed income, investment banking etc.

Is CFA a big deal

The CFA charter is one of the most recognized professional qualifications in finance in the world. The great thing about this global recognition is that CFA charterholders enjoy better international career mobility.

In which country CFA is most valued

The U.S., needless to say, being the home country of the program, values the CFA® designation greatly. Australia is another country that provides great opportunities for its members.

Does CFA look good on CV

Key Takeaways. The Chartered Financial Analyst (CFA) qualification is a big asset for an investment professional and should be highlighted on a resume. The CFA Charterholder Program involves passing three six-hour exams and putting in four years of investment-related work.

Is 27 too old for CFA

Yes, you can absolutely pursue CFA at 27. There is no age for learning, one can pursue any course of their choice at any point in time in their life. No course is easy, one has to put constant efforts to pursue their interest.

Is 30 too old for CFA

No, it's not too late. I started the CFA Program at the tender age of 30 and I know many people who did the same or even started later in life. If you already work in the investment industry you'll have the benefit of reading the material through the eyes of experience, which is great! If you want to do it, go for it.

Is CFA valued in America

A CFA is a globally renowned professional designation from the CFA Institute. CFAs can get high-income jobs that assess financial analysts' competence and integrity. The average base CFA salary in the US is $126,000 USD, with total compensation of around $177,000 USD.

What is the average IQ of a CFA charterholder

A survey carried out using a sample of 50 CFA Level I candidates reveals an average IQ of 105.

Who hires most CFA

Top Recruiters of Chartered Financial Analyst

| Top Employers of Chartered Financial Analysts in India | |

|---|---|

| Recruiters | Salary Package (in Rs lakh per annum) |

| JP Morgan and Co | 3.08 to 20 |

| The Goldman Sachs Group Inc. | 2.06 to 40 |

| HSBC | 5.24 to 30 |

Should I put CFA after my name

If you are an active charterholder in good standing:

Include your designation after your name. (For example: “Jane Doe, CFA”) Include your charterholder status in the certifications or education section of your resume as “CFA® charterholder, CFA Institute.” You may also include the date your charter was issued.

What is the downside of CFA

Earning the CFA is a prolonged, pricey, and altogether challenging process that may not be right for every financial professional. To become a CFA, a candidate must pass the three-level exam, build up work experience in a related field, provide letters of reference, and apply to join the CFA Institute.

Who is the youngest CFA Level 1

About. Pranav Thakkar is a Chartered Accountant and a Chartered Financial Analyst (CFA, US), by qualification. He is one of the youngest to clear both CA and CFA in the whole of India at an age of 22 years only.

Do CEOS have CFA

The most common professions for those who hold the CFA designation are portfolio managers and research analysts, followed by a smaller percentage who work as chief executives and consultants.

Can I say I am a CFA charterholder

If you are an active charterholder in good standing:

Include your designation after your name. (For example: “Jane Doe, CFA”) Include your charterholder status in the certifications or education section of your resume as “CFA® charterholder, CFA Institute.” You may also include the date your charter was issued.

Why do so many fail CFA

Inefficient Study

One common mistake is spending too much time taking notes. One often fatal tactic is to try and produce your own set of notes covering the entire curriculum. The sheer size of the CFA Program curriculum means that preparing your own set of notes from scratch is simply too time intensive.

Do investment banks care about CFA

You can have all the degrees and qualifications in the world, but the impact a CFA Certificate will have on your career is unmatched. To pursue your dream of becoming an investment banker, you must attempt the CFA exams and obtain the certification.

What is the IQ for CFA Level 1

A survey carried out using a sample of 50 CFA Level I candidates reveals an average IQ of 105. Assuming that IQs are distributed normally, carry out a statistical test to determine whether the mean IQ is greater than 100.

Is CFA acceptable in USA

Twenty-eight countries/territories formally recognize our programs. The United States of America: The New York Stock Exchange (NYSE) exempts those who have passed CFA Level I and Part I of the NYSE Supervisory Analysts Qualification Exam (series 16) from part II of this two-part exam.

What are the disadvantages of CFA

However, there are some disadvantages to becoming a CFA charter holder.The CFA Program is very time-consuming and requires a significant commitment of time and energy.In addition, the exam fees can be costly, especially if you need to retake a level.

Does Goldman Sachs hire CFA

Investment Banking

Large banks such as Goldman Sachs and Merrill Lynch tend to be good examples of the specific types of companies that hire CFA charterholders.

Is CFA Level 1 the hardest

The Chartered Financial Analyst credential is one of the most demanding exams when it comes to preparation and study time required. The average pass rate for the CFA Level 1 is only 41%. For Level 2, you're looking at a buzzsaw passage rate of 45%. And Level 3 is not much easier at 52%.

Who is the youngest person to clear CFA Level 1

Pranav Thakkar is a Chartered Accountant and a Chartered Financial Analyst (CFA, US), by qualification. He is one of the youngest to clear both CA and CFA in the whole of India at an age of 22 years only. He had started his stock market journey at the age of 19 and had started his first business venture at that age.