Is CFA worth it for CPA

With bonuses and profit-sharing, your final compensation could be much higher. Plus, if you have several credentials, your salary could be higher in jobs that require more advanced skills. For example, the CPA and CFA combination salary could be higher than if you only have a CPA license.

Is CFA better than CPA

Professionals with the CFA designation are considered experts in investment analysis. Like the CPA, the CFA opens additional career opportunities and can lead to higher earnings. The primary difference between the CPA and CFA is that the CPA is an accounting credential, while the CFA is for financial analysis.

Is CFA more difficult than CPA

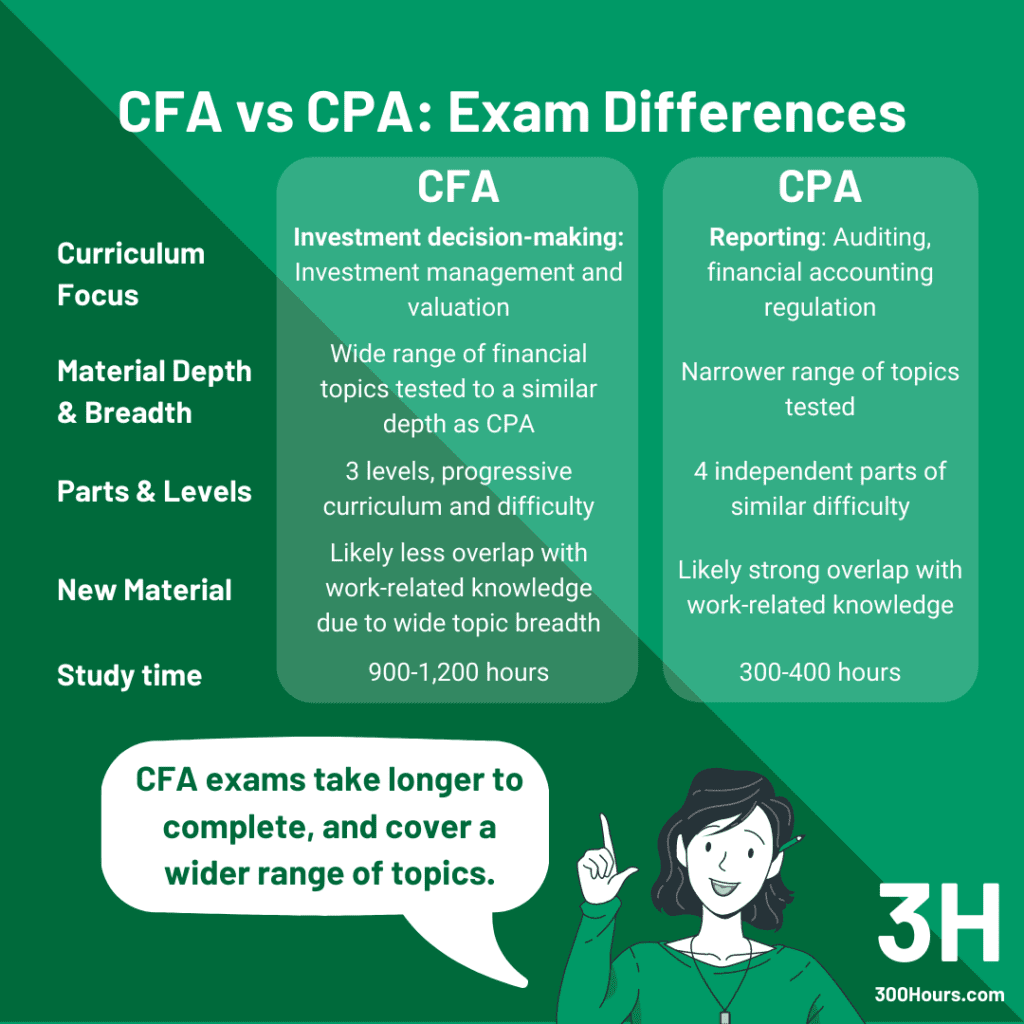

The pass rates for the CFA and CPA exams are similar, but the CFA certification typically takes candidates several years longer to obtain than the CPA certification. In that respect, the CFA certification is typically viewed as harder than the CPA because of the greater time commitment and work experience requirements.

What is the difference between CFA Level 1 and CPA

CFA® Program vs. CPA. The certified public accountant (CPA) credential is well established but is primarily associated with careers in accounting. The CFA Program is designed to advance investment careers and provides deep knowledge of investment analysis and portfolio management as well as professional ethics.

Which is more difficult ACCA or CFA

ACCA exams are computer-based and can be taken at any time of the year, while CFA exams are paper-based and are offered once a year in June. 4) Difficulty: CFA is considered more difficult and requires more study time than ACCA. The pass rate for CFA exams is also lower than the pass rate for ACCA exams.

Can an accountant take CFA

Many different roles in finance can benefit from CFA certifications. Investment bankers, portfolio managers, accountants, and risk analysts commonly obtain CFAs to make themselves more marketable and to improve their analytical skills.

Who earns more CPA or CFA in USA

CFA Charterholder vs. CPA Salary. Salaries can vary widely for both CFAs and CPAs based on location, experience level, and company size. That being said, according to Payscale the average salary for a CFA is $102,000 and the average salary for a CPA is $94,000.

Is CFA more valuable than ACCA

However, CFA is more suited for experienced finance professionals looking to specialize in a certain area. In contrast, ACCA is best for entry-or mid-level professionals looking to widen their career horizons while acquiring useful accounting.

What is the hardest CPA subject

Financial Accounting and Reporting (FAR)

Often considered the most difficult exam, Financial Accounting and Reporting (FAR) has had the lowest passing scores of the four exams. The amount of material CPA Exam candidates have to learn for the exam, coupled with the combination of memorization and application, makes this exam more difficult.

Is CFA harder than ACCA

Some claim that CFA is harder than ACCA as only one in five candidates who enroll in the course successfully completes it. [3] Furthermore, it takes 4 years to complete the course vs. the 3 to 4 years more typiucal of the ACCA student. And if you check the syllabus, CFA is indeed a "longer" qualification than ACCA.

Which is better CPA CFA or ACCA

To clear up the confusion and make an informed decision, one has to look into the difference and the similarities in ACCA vs CFA While they are both excellent courses – recognized internationally, they differ in the scope and work profiles. ACCA is the internationally recognizable alternative to completing CA in India.

Is CFA easier after ACCA

CFA vs ACCA – which is harder Both CFA and ACCA (Association of Chartered Certified Accountants) are well-known certification courses in the financial sector. But CFA is much more difficult than ACCA. It has been observed that only 10% of candidates who enroll in the CFA course successfully complete it.

Can CFA be done after ACCA

There are even some universities that offer combined law and accounting degrees. Just keep in mind that you'll ideally want a few years' working experience before moving onto levels like these. Yes, you can do CFA after ACCA!

What CPA gets paid the most

Average annual salary for highest-earning accounting jobs

| Job Title | Average Annual Salary |

|---|---|

| Chief Financial Officer (CFO) | $214,500 |

| Chief Compliance Officer (CCO) | $181,750 |

| Treasurer | $199,750 |

| Vice President of Finance | $192,750 |

Who earns more CPA or CFA in Canada

Both of these certifications can lead to a great salary. ZipRecuiter states that CPAs make an average of $72k each year. However, those with more experience can end up making over $110k a year down the line. By contrast, CFAs make an average of $95k a year.

Is CFA harder or ACCA

CFA vs ACCA – which is harder Both CFA and ACCA (Association of Chartered Certified Accountants) are well-known certification courses in the financial sector. But CFA is much more difficult than ACCA. It has been observed that only 10% of candidates who enroll in the CFA course successfully complete it.

In which country CFA is most valued

The U.S., needless to say, being the home country of the program, values the CFA® designation greatly. Australia is another country that provides great opportunities for its members.

What is the easiest CPA to get

CPA Exam Written Communication Testlets

BEC is the only CPA exam section with WCTs. Some students find this makes the exam easier, but some do find WCTs to be harder than TBSs. Either way, BEC is considered the easiest part of the CPA exam because it has the highest pass rate.

Which CPA is the easiest

BEC

So, we know that BEC is widely considered to be the easiest CPA exam, but where are the other CPA exam sections in order of difficulty After BEC, the next easiest CPA exam is Regulation (REG). At 60.7%, it has a similar pass rate to BEC (based on the most recent cumulative results).

Should I take CFA or ACCA

However, CFA is more suited for experienced finance professionals looking to specialize in a certain area. In contrast, ACCA is best for entry-or mid-level professionals looking to widen their career horizons while acquiring useful accounting.

Is CPA recognized in Europe

Yes, CPA USA is a globally recognized certification and provides amazing career opportunities to certified professionals. After acquiring the CPA certification & license and gaining the required experience, a person can become an established CPA in the UK.

Is CFA after ACCA worth it

Chartered Financial Analyst status is globally recognised and a common qualification for many accountants who've completed an ACCA course. Potential roles for those who are CFA certified include: Asset Management, Risk Management, Consulting, and Corporate Banking.

Can an accountant become a CFA

The CFA Program is typically completed by those with backgrounds in finance, accounting, economics, or business. CFA charterholders earn the right to use the CFA designation after program completion, application, and acceptance by CFA Institute.

Which Big 4 accounting firm pays the best

If you want to make the most money in consulting, Deloitte pays the best. However if you want to make the most money in auditing or tax PwC is likely your best bet.

What type of accounting is in most demand

Top in-demand accounting jobsManagerial Accountant.Auditor.Information Technology Accountants.Forensic Accountants.Financial Analysts.Financial Controller.Chief Financial Officer.Money Matters.