What is the risk between a personal account and a business account

Using a personal bank account for business purposes can blur the lines between personal and business assets, making it difficult to protect your personal assets in case of a lawsuit or debt. If your business is sued, your personal assets can be at risk if they are not clearly separated from your business assets.

Does a business need a business bank account

Not all businesses are legally required to have a business bank account but there are several advantages to opening one. This guide outlines why you might need a business bank account, how to find the right one for your business and how to successfully apply.

Can you use current account for business

Legally, you can use your personal bank account for both business and non-business transactions, or you can set up a second personal bank account to use for your business. As a limited company is a separate legal entity, it needs to have its own business bank account.

Can I link business account to personal account

If you are a sole proprietor using your Social Security number as your Tax ID number, you can link a Business Checking account with a personal account using the same ID.

Should I use business account or personal account

Some of the main differences include: Business bank accounts have more legal protections than personal bank accounts, meaning you won't be offered protection from business liabilities when using a personal checking account for business expenses. Business bank accounts can do a better job at solidifying your brand.

What is a disadvantage of using your personal savings to start your business

Disadvantages of self-financing your business:

You may not have enough money left over to cover your living costs. You should try to leave a contingency fund, in case you need extra money to see you through a difficult period. If your business were to fail, you could lose your home and other personal possessions.

Can I convert my personal bank account to a business account

The bank you use for your personal banking may not allow you to use your account for business banking. Each bank will have its own policies in regards to how accounts can be used. It's important for you and your new business to abide by the rules; otherwise, there is a risk that your account could be closed altogether.

What bank account do I need for a business

One of the first things you may want to set up is a business bank account1, which for ease of accounting and reporting is separate from any personal accounts. It will record your income and outgoings, making it an important source of information at tax and BAS (Business Activity Statement) time.

Can I use my personal bank account if I’m self employed

Can a sole trader use a personal bank account As a sole trader, you're not legally required to have a business bank account opens in new window. You can use your personal bank account for all business transactions.

Why do business people prefer a current account

Business Bank Accounts allow business owners to document and track their expenses, organise their cash flow and allow for easier calculations of tax liabilities. A current account for business, therefore, allows for deposits, withdrawals and contra transactions.

Is it OK to have a personal and business account at the same bank

As the owner of a sole proprietorship, you have the choice of opening multiple bank accounts. However, the law also allows you to use the same bank account for your personal and business finances. You may even use your personal checking account, as long as it is under the same name.

Is it wise to have a business account and personal account with the same bank

For one thing, some banks offer free personal checking to customers who also have a small business checking account. This can save you quite a bit of money in banking fees. But beyond the savings, having both accounts at the same bank can also make it easier to borrow money for yourself or your business.

Is personal account better than professional account

If you're looking for a Social Media platform to connect with friends, family and businesses, then you should start by creating a Personal profile. However, if you're an influencer or marketing a business, then a Professional account is what you need.

Is business account better than personal

Protecting Assets

According to the Small Business Administration, business checking accounts can offer limited liability protection to business owners. Additionally, enrolling in merchant services can offer purchase protections to your customers and keep their personal information secure.

What are 2 disadvantages to owning your own business

Disadvantages Of Owning A BusinessFinancial Risks. Depending on the type of business you're creating, you generally need to spend money to make money – and in the beginning, you may find you're spending more.Stress & Health Issues.Time Commitment.Numerous Roles, Whether You Like It Or Not.

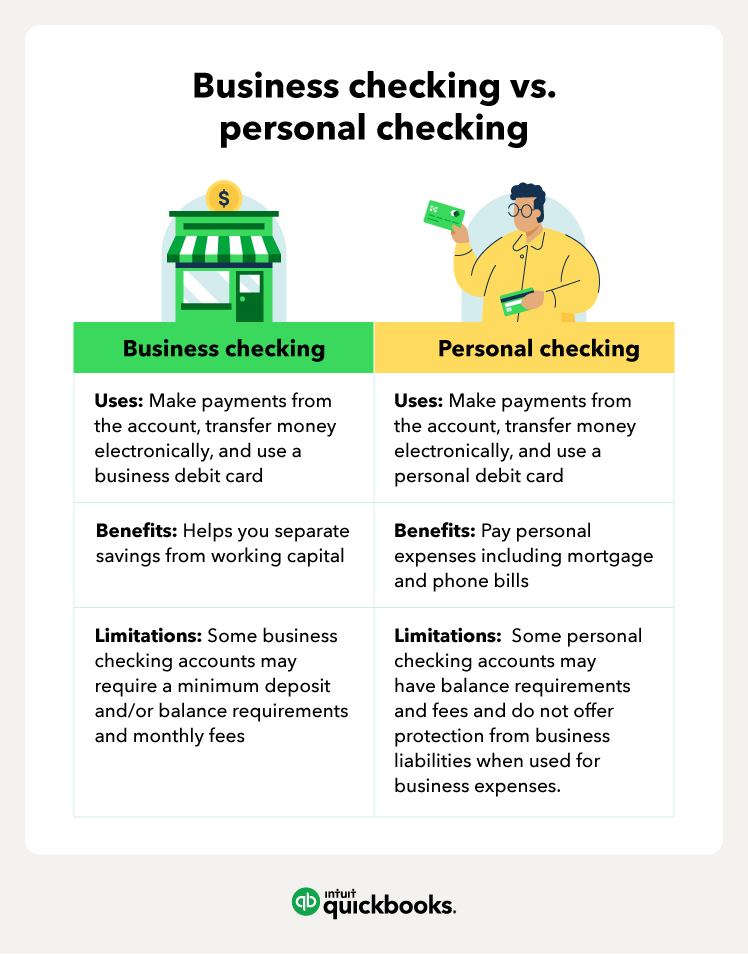

Is there a difference between a personal and business bank account

A business checking account helps business owners hold and manage money made within a company. Personal checking accounts help individuals hold and manage their personal funds.

Can I use a regular bank account for my business

Although having two bank accounts appears inconvenient, you shouldn't use a personal account for your business finances primarily because it can affect your legal liability. In fact, one of the first steps to owning a business should be opening a business bank account, in addition to a personal bank account.

What is the difference between a personal account and a business account

What's the difference between a business bank account and a personal bank account The main difference between business and personal bank accounts, as the name suggests, is that business bank accounts are used to manage business transactions while personal bank accounts are for personal expenses.

Is it best to have a separate bank account for business

You'll have more financial security

By keeping your accounts separate, then your personal assets, like your house, can't be taken if you get into debt through your business – as long as you've set up as a limited company.

Which type of account is most suitable for business

1. Business checking accounts. A business checking account is the most versatile and widely used form of deposit account. Just like a personal bank account, you can put in money, withdraw cash, make payments and transfer funds.

Why is a business account better than a personal account

Keeping personal assets separate from business assets can offer an advantage if your business is sued or you default on a debt. According to the Small Business Administration, business checking accounts can offer limited liability protection to business owners.

Is a personal account better than a business account

Some of the main differences include: Business bank accounts have more legal protections than personal bank accounts, meaning you won't be offered protection from business liabilities when using a personal checking account for business expenses. Business bank accounts can do a better job at solidifying your brand.

Can I use personal bank account for small business

If you're operating as a: sole trader – you don't have to have a business bank account, but it's a good idea to so. partnership, company or a trust – you must have a separate bank account for tax purposes.

Should I use my personal Instagram for business

So if you are personality-based brand (like a blogger or Instagram influencer) and feature both personal and business content on your account, sticking with a personal account may be better, as your followers may engage with your account more than if you limit your content to just business posts.

Is it important to have a business account

It can keep you legally compliant, provide some financial security and help you appear more professional to customers and vendors. Plus, having one account for the sole purpose of collecting from customers and paying your vendors makes it easier to log transactions and manage your business.