Is it still good to invest in stocks right now

Whether you're a first-timer or seasoned stock buyer, many experts advise it's never a bad time to invest in the stock market—as long as you have a well-researched investment plan that focuses on long-term yields. We'll take you through some of the important factors to consider before buying stocks below.

Is it a smart idea to invest in stocks

Long-term investing FAQs

If you're taking a long-term perspective on the stock market and are properly diversifying your portfolio, it's almost always a good time to invest. That's because the market tends to go up over time, and time in the market is more important than timing the market, as the old saying goes.

Is it good or bad to invest in stocks

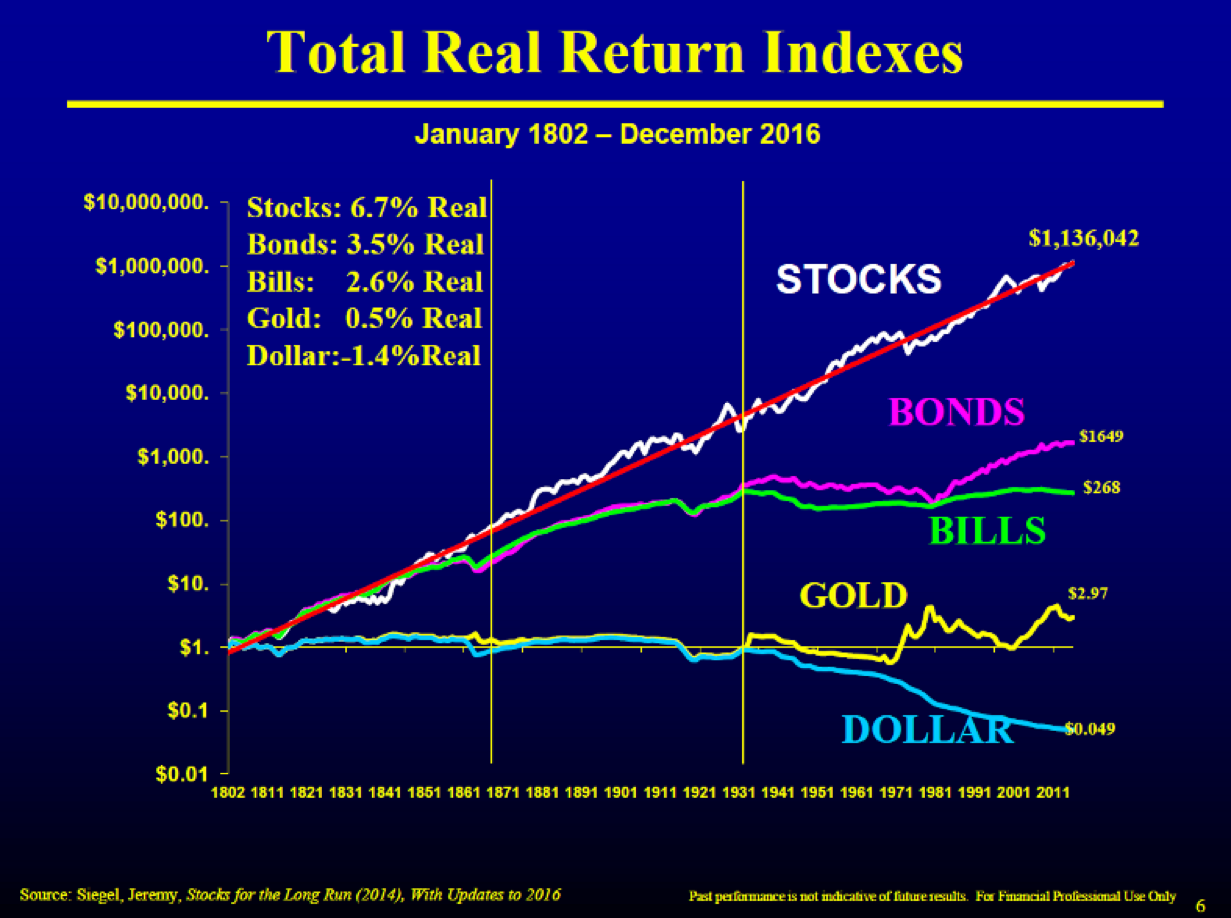

Pros of Buying Stocks Instead of Bonds

The chief advantage stocks have over bonds, is their ability to generate higher returns. Consequently, investors who are willing to take on greater risks in exchange for the potential to benefit from rising stock prices would be better off choosing stocks.

Is it worth investing in stocks 2023

Analysts project full-year S&P 500 earnings growth of just 0.7% in 2023, but Wall Street analysts are more optimistic about some market sectors than others. The energy sector has the highest percentage of analyst “buy” ratings at 64%, followed by communication services (62%) and information technology (60%).

Will the stock market recover in 2023

Although there's no way to answer this question with any level of certainty, there's a strong chance that the bear market will come to an end and the market will begin to recover in 2023. It usually takes between 12 and 18 months for Fed rate hikes to lead to economic stability.

Should I go 100% stocks

In theory, young people investing for retirement should absolutely have 100% of their portfolio invested in equities. The biggest risk in the stock market is a crash which brings lower prices. Your best-case scenario as a young saver/investor is that you get to put more savings to work at lower prices.

Should I buy stocks or save money

In general, you should save to preserve your money and invest to grow your money. Depending on your specific goals and when you plan to reach them, you may choose to do both.

Is it better to invest or not

It's a good rule of thumb to prioritize saving over investing if you don't have an emergency fund or if you'll need the cash within the next few years. If there are funds you won't need for at least five years, that money may be a good candidate for investing.

Will stock market recover in 2024

U.S. strategists expect a meaningful earnings recession of -16% for 2023 and a significant recovery in 2024. Strategists expect falling inflation could hurt margins and that investors are overly optimistic about the positive impact of AI.

Will shares recover in 2023

Meanwhile, experts from Goldman Sachs recently predicted in their 2023 outlook that the stock market will “most likely rally” by the end of 2023. The brokerage you choose matters. Try Public.com, the investing platform helping people become better investors. See what makes us different.

Is 2023 a good time to invest in the stock market

Analysts project full-year S&P 500 earnings growth of just 0.7% in 2023, but Wall Street analysts are more optimistic about some market sectors than others. The energy sector has the highest percentage of analyst “buy” ratings at 64%, followed by communication services (62%) and information technology (60%).

Should I pull my money out of the stock market

Key Takeaways. While holding or moving to cash might feel good mentally and help avoid short-term stock market volatility, it is unlikely to be wise over the long term. Once you cash out a stock that's dropped in price, you move from a paper loss to an actual loss.

Is 70 stocks too much

So, unless your current portfolio is under-diversified or you find an attractive stock to invest in, you can keep investing in your existing stocks. It's okay for mutual funds to hold 60-70 stocks.

Is 20 stocks too much

Here's the number of stocks you should own in portfolios, according to professional money managers. Portfolio concentration is risky. Targeting 20 to 30 stocks is common advice, but many pros own more. Pros tend to own lots of stocks, but they weigh them unequally.

When should you stop investing

Once you touch a certain age, your priorities change, and the goal becomes to live a comfortable life. If your age is above 50 years, you might want to stop investing in risky assets like stocks/ equities, because they are more volatile than other investments.

Is it hard to lose money in stocks

If you do not use borrowed money, you will never owe money with your stock investments. Stocks can only drop to $0.00 per share, meaning you can lose 100% of your investment but not more than that, seeing as the stock cannot be of negative value.

Is it smarter to save or invest

Is it better to save or invest It's a good rule of thumb to prioritize saving over investing if you don't have an emergency fund or if you'll need the cash within the next few years. If there are funds you won't need for at least five years, that money may be a good candidate for investing.

Is it OK if I don’t invest

Investing is an essential part of any financial plan. Unfortunately, many people don't invest their savings, offering a wide range of excuses for keeping their money out of the market. This can be crippling to your long-term financial health.

Are stocks expected to rise in 2023

Stock Market Performance In 2023

U.S. stock market gains in the first half of 2023 have been rosier than some entire years in the past. This alone raises the risk for a spill in prices. The S&P 500's rise in 2023 reached almost 16% in mid-June.

Will 2023 be a good year for the stock market

10% Return for S&P 500 a Real Possibility by End of 2023

Short of a recession — a very real possibility — consensus estimates are for about 5% earnings growth for S&P 500 companies in 2023. That's certainly less than what it was in years past, but still respectable.

Why is stock market falling

A stock market collapse typically occurs when the economy is overheated, inflation is rising, market speculation is rampant, and there is significant uncertainty about the path of an economy.

Is 100% stocks too risky

In theory, young people investing for retirement should absolutely have 100% of their portfolio invested in equities. The biggest risk in the stock market is a crash which brings lower prices. Your best-case scenario as a young saver/investor is that you get to put more savings to work at lower prices.

Is 100% stocks a bad idea

There's no universal answer as to whether someone should invest entirely in stocks. Bonds can help take the anxiety out of wild price swings. However, a 100% stock portfolio can be a fit for younger investors far from retirement.

Is 22 too late to invest

No matter how old you are, the best time to start investing was a while ago. But it's never too late to do something. Just make sure the decisions you make are the right ones for your age—your investment approach should age with you.

Is 20 too late to invest

No matter how old or young you are, it is never too late to start investing in the stock market. Investing now will allow you to take advantage of compounding returns sooner rather than later. This can make all the difference when it comes down to long-term financial goals such as retirement.