Is Switzerland a tax haven

Key Takeaways. The European nation of Switzerland is considered to be an international tax haven due to low tax levels and privacy laws. Switzerland also has a history of favorable tax treaties, stable politics, and a wealth of advisors.

Is Dubai a tax haven

Dubai (one of the seven emirates that make up the United Arab Emirates) is perhaps the most famous tax haven on earth.

Is Singapore a tax haven

Tax Haven Companies – Low-tax

Apart from jurisdictions that guarantee zero tax for foreign companies, there is another category of tax haven that are known as low tax havens. These include countries such as Barbados, Gibraltar, and Singapore.

Is Hong Kong tax haven

Tax havens are countries with low tax rates, particularly for foreign investors, that make them attractive places for people to park their money. Hong Kong is considered a leading tax haven due to its laws that limit taxation on the island's wealthy foreign residents and corporations.

Is living in Switzerland tax free

All tax-resident individuals are taxed on their worldwide income and wealth. Non-tax-resident individuals are only taxed on Swiss sources of income and wealth.

What happens if you don’t pay taxes in Switzerland

As a general rule, if you cannot afford to make your tax payment on time, the tax office will charge interest on the amount owed. The onus normally rests on you to approach the tax office with a proposal for an installment payments plan.

Is Abu Dhabi tax-free country

The UAE does not levy a tax on income. There is, therefore, no need for an income tax return in the UAE as there is no applicable individual tax within the country. The same also applies to freelancers and self-employed individuals who are residents of the Emirates.

How does Dubai survive without income tax

Dubai's zero-income tax rate is definitely one of the pros of living there. It's no secret that the UAE earns its revenue mainly through the oil industry and uses its no-tax policy to attract skilled expats and global companies to diversify and enrich its economy further.

Is Sweden a tax haven

Sweden. Sweden disposed of a number of taxes including inheritance taxes and gift taxes. 20 Insurance bonds called kapitalförsäkring serve as unique investment vehicles that may be used by Swedish residents and foreigners who live in Sweden.

Why Hong Kong has no tax

In addition, under Article 106 of the Hong Kong Basic Law, Hong Kong has independent public finance, and no tax revenue is handed over to the Central Government in China. The taxation system in Hong Kong is generally considered to be one of the simplest, most transparent and straightforward systems in the world.

Is Luxembourg a tax haven

In its Corporate Tax Haven Index, the advocacy group Tax Justice Network considers the Cayman Islands the third worst tax haven for corporate tax avoidance. Luxembourg is placed three positions below, in sixth spot. Neither country is included in the EU's blacklist.

How to avoid Swiss wealth tax

Ways to reduce wealth taxesResidence in a tax-favourable municipality/canton;Investment in real estate (domestic or foreign);Investment in units of collective investment schemes with direct real estate ownership;Retirement savings;Investment in securities or items with no market value.

How much tax will I pay in Switzerland

Swiss taxes usually amount to around 15 to 35 percent of your salary. There are many different types of taxes in Switzerland, which all have their own various deductions and exemptions, so we recommend consulting a tax advisor for advice on paying your taxes if you earn a large income.

How long can you live in Switzerland without paying taxes

90 days

You can also be a tax resident if you're an American working in Switzerland for 30 consecutive days or more, or if you're there for at least 90 days, even if you're not working. The federal income tax rates range from 0% to 11.5%, but local taxes also apply.

Which EU country has the lowest taxes

11 Countries with The Lowest Taxes in Europe: 2023 Tax GuideAndorra. This medieval village nestled into the mountainside shows the beauty of the Andorran countryside.Hungary. Beating Bulgaria, Hungary has a corporate income tax rate of 9% tax rate with no minimum.Bulgaria.Czech Republic.Georgia.Gibraltar.Malta.Monaco.

Is Dubai full zero tax

Absence of taxation

There is currently no personal income tax in the United Arab Emirates. As such, there are no individual tax registration or reporting obligations.

What country has lowest taxes

Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance.

Can I move to Dubai and pay no tax

You'll need a visa to live and work abroad in Dubai. It's up to your employer to arrange your Residents Visa, your Emirates ID and your Labour Card during the 60 days you can work there with a pink visa. There's no income tax on salaries or wages paid in Dubai, and capital gains tax isn't charged either.

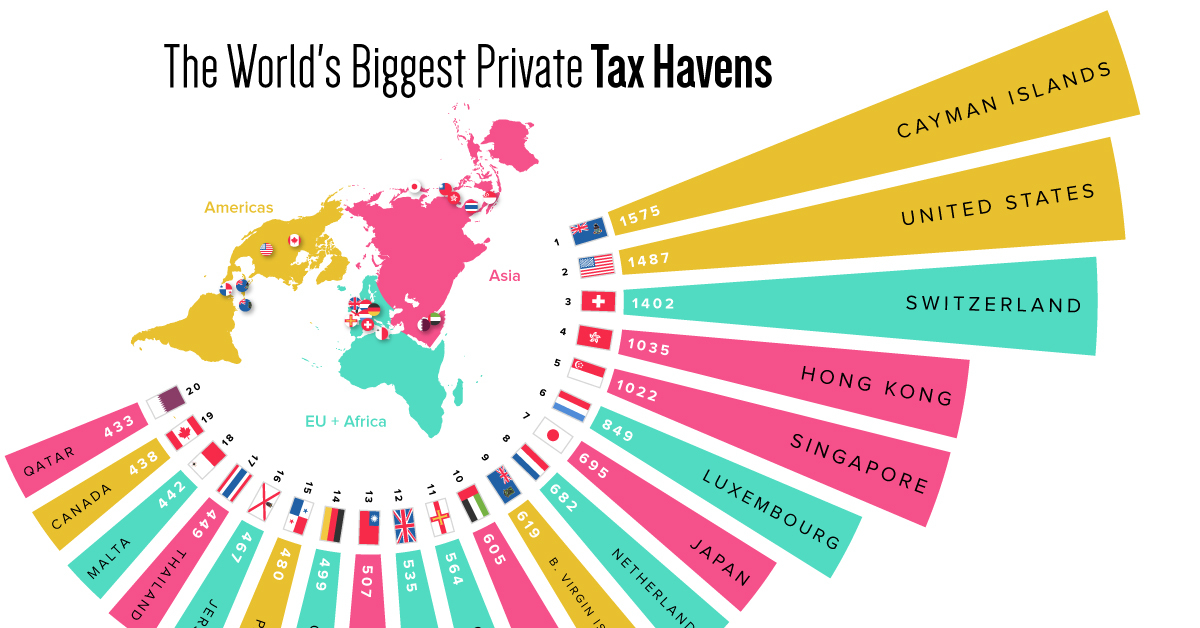

Where is the biggest tax haven in the world

British Virgin Islands and Cayman Islands are the world's most popular corporate tax havens in the world for 2021 according to Corporate Tax Haven Index (by Tax Justice Network) which publishes a ranking of jurisdictions most complicit in helping multinational corporations underpay corporate income tax.

Is China a low tax country

The Individual Income Tax in China (commonly abbreviated IIT) is administered on a progressive tax system with tax rates from 3 percent to 45 percent.

What countries have the worst tax

Top 10 Countries with the Highest Personal Income Tax Rates – Trading Economics 2021:Japan – 55.97%Denmark – 55.90%Austria – 55.00%Sweden – 52.90%Aruba – 52.00%Belgium – 50.00% (tie)Israel – 50.00% (tie)Slovenia – 50.00% (tie)

Why is Switzerland tax so low

The federal government sets a base level for income and corporate tax. Individual Swiss cantons then set their own rates on top of these levels. Historically, this system has resulted in cantons competing to offer the most favorable rates for foreigners looking to store assets.

Do foreigners pay wealth tax in Switzerland

As an expat working in Switzerland, you are liable for Swiss income and wealth tax. This tax varies from canton to canton.

Is Swiss healthcare free

Switzerland does not have free healthcare; in fact, it can be more expensive than other European countries. However, because health insurance is mandatory, everyone is insured, and those with a low income can benefit from social benefits or subsidies regarding health insurance.

Do foreigners pay taxes in Switzerland

Swiss citizens and foreign employees who have a residence permit must file a tax return each year. Foreign employees who do not hold a permit, but who are in employment are subject to a process known as 'withholding tax' and is deducted from monthly salaries by the employer.