Is the US in a bear or bull market

The S&P 500 is in a bull market.

Is the US currently in a bear market

Here's why investors see better days ahead. Americans' investments are out of the grip of one of the longest bear markets in recent history. The S&P 500 gained 0.6% on Thursday, pushing the market 20% higher than the trough stocks hit in October, closing at 4,294.

Are we in a bear or bull market 2023

Traders on the floor of the NYSE, June 29, 2023. The majority of Wall Street investors believe stocks have entered a new bull market and the U.S. economy will skirt a recession in 2023, according to the new CNBC Delivering Alpha investor survey.

Is The Nasdaq in a bull market

Both the Dow Jones Industrial Average and the Nasdaq are already in bull markets, having entered them in November and May, respectively.

Is it a bull market right now

S&P 500 enters a bull market

The S&P 500 index on June notched an over 20% surge from its October 2022 low, entering a new bull market and bringing an end to the bear market that began in January 2022.

How long have we been in a bear market 2023

4, 2023, the S&P 500 had spent 282 calendar days in a bear market, per Yardeni.

Is bull market coming 2023

June 8, 2023, at 4:26 p.m. The S&P 500 is now in what Wall Street refers to as a bull market, meaning the index has risen 20% or more from its most recent low. Here are some answers to questions about bull and bear markets: WHY IT IS CALLED A BULL MARKET

Is the S&P 500 in a bull market

The S&P 500 Is in a Bull Market.

How long do bear markets last

about 9.7 months

Bear markets tend to be short-lived.

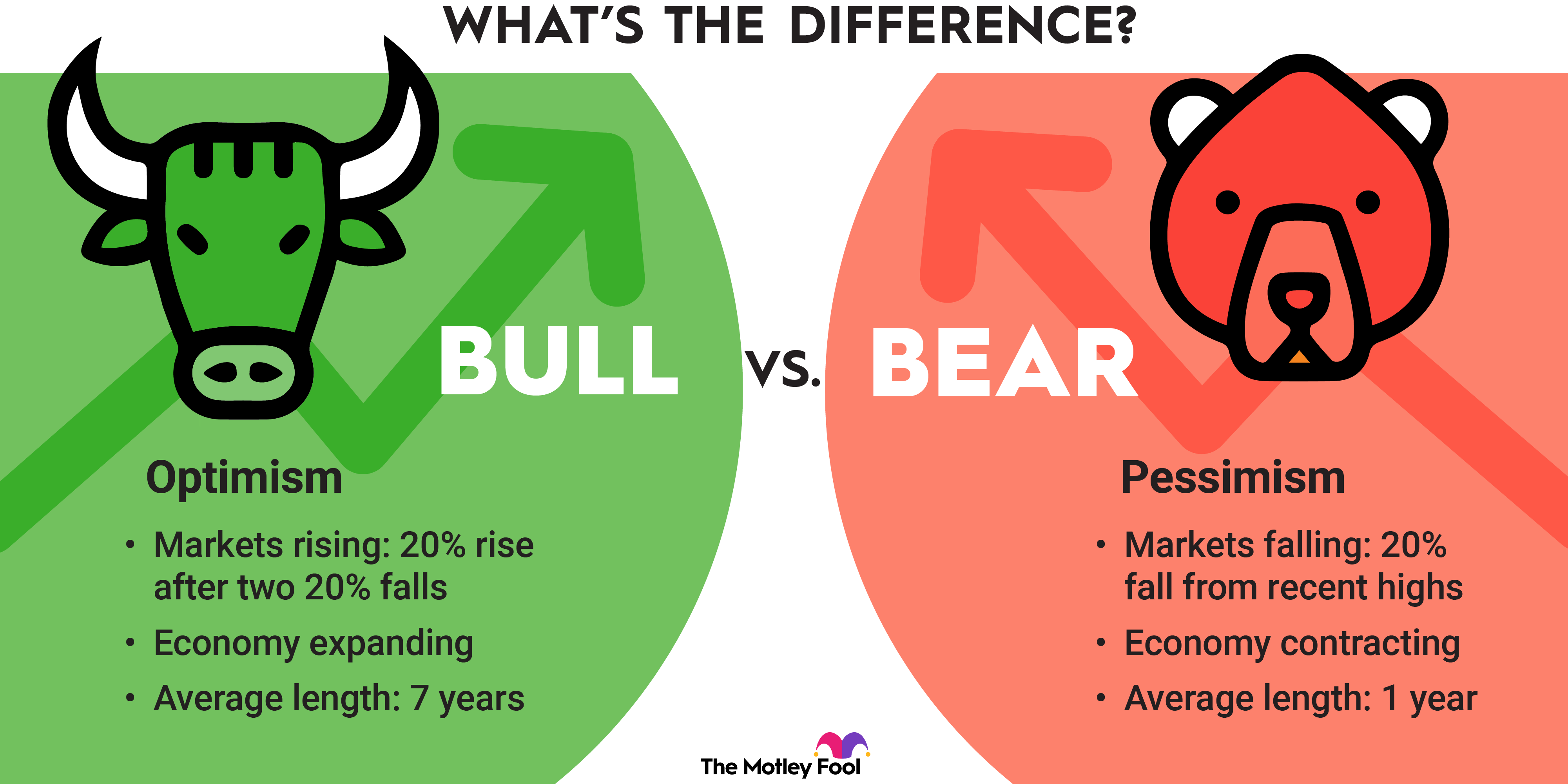

The average length of a bear market is 292 days, or about 9.7 months. That's significantly shorter than the average length of a bull market, which is 992 days or 2.7 years. Every 3.5 years: That's the long-term average frequency between bear markets.

Are we in a recession 2023

Halfway through 2023, "The market has told us: no recession, no correction, no more rate hikes," Amanda Agati, chief investment officer for PNC Financial Services Asset Management Group, said in a report.

Will 2023 be a good year for the stock market

The stock market is entering the second half of 2023 with positive momentum, which historically bodes well for returns for the rest of the year. The S&P 500 could be on track for its best annual performance since 2019.

Is the S and P 500 overvalued

The metric aggregates the index's 10-year average earnings per share ratio and adjusts its current price-earnings accordingly to discover a relative comparison. According to GuruFocus' data, the current CAPE ratio of 29.9 shows the S&P 500 is overvalued on an inflation-adjusted basis.

Is the USA in a recession

Though the economy occasionally sputtered in 2022, it has certainly been resilient — and now, nearly midway into 2023, the U.S. is still not currently in a recession, according to a traditional definition.

Which country is in recession now

Germany, which is Europe's largest economy, has officially entered into recession after the nation's growth in GDP fell by 0.3% in the first quarter of 2023, which follows a drop of 0.5% in the last quarter of 2022. The annual rate of inflation in Germany is at 6.4% in June, up from 6.1% in May.

Will stock market recover in 2024

U.S. strategists expect a meaningful earnings recession of -16% for 2023 and a significant recovery in 2024. Strategists expect falling inflation could hurt margins and that investors are overly optimistic about the positive impact of AI.

How long does bear market last

about 9.7 months

Bear markets tend to be short-lived.

The average length of a bear market is 292 days, or about 9.7 months. That's significantly shorter than the average length of a bull market, which is 992 days or 2.7 years. Every 3.5 years: That's the long-term average frequency between bear markets.

Are US stocks overvalued now

Based on the latest S&P 500 monthly data, the market is overvalued somewhere in the range of 72% to 127%, depending on the indicator, up from last month's 65% to 117%.

Will S&P 500 hit $10,000

The S&P 500 could approach or exceed the 10,000 level by the early to mid-2030s. Many investors take it as a given that—since returns on the S&P 500 have been strong for 10-plus years—stocks are expensive and over-owned.

Is America in a recession 2023

Brusuelas still thinks a recession is highly likely — just not in 2023. "It's not looking like this year — maybe early next year," he said. "We need some sort of shock to have a recession. Energy could have been one, the debt ceiling showdown could have been one — and it still could."

Is the US still in a recession

According to a traditional definition, the U.S. is not currently in a recession.

Is USA into recession

Despite fears of a possible recession in 2023, so far the U.S. economy continues to prove itself resilient. First quarter economic growth, originally estimated at just over 1%, was revised to a 2% annualized growth rate in the latest report on Gross Domestic Product (GDP).

Will US stock market recover in 2023

The S&P 500 (. SPX) is up 15.9% in 2023 – a rebound that surprised many analysts after equities' brutal 2022 decline. The tech-heavy Nasdaq Composite (. IXIC) has gained 31.7%, its best first half in 40 years.

Will stocks go up again in 2023

Stock Market Performance In 2023

U.S. stock market gains in the first half of 2023 have been rosier than some entire years in the past. This alone raises the risk for a spill in prices. The S&P 500's rise in 2023 reached almost 16% in mid-June.

Is it safe to invest in US stocks now

Stock market investments in the US are protected under the Securities Investor Protection Act (SIPA) and overlooked by the Securities Investor Protection Corporation (SIPC).

Is US market going to recover

The good news is the U.S. stock market is up 14% on a year-to-date basis through June 28 as measured by the S&P 500 index, and both housing and industrial production are swinging back into positive territory at the midpoint of 2023.