What is the best age to get life insurance

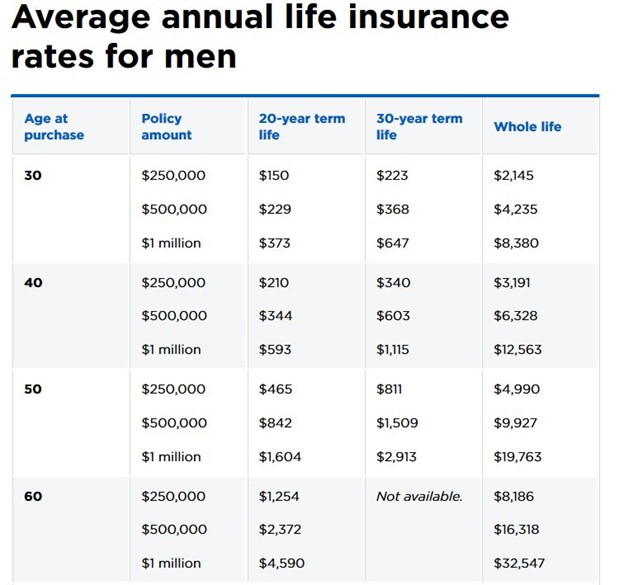

As we age, we're at increased risk of developing health conditions, which can result in higher mortality rates and higher life insurance rates. You'll typically pay less for life insurance at age 25 than at age 40. Waiting until age 60 may mean an even bigger rate increase and limited policy options.

What age is too late to get life insurance

At What Age Can You No Longer Buy Life Insurance 90 years old is the highest issue age we've seen from any life insurance company. But many companies won't issue policies to people older than 85.

Who is most likely to need life insurance

Parents With Young Children or Dependents with Functional Needs. For many adults, the arrival of a baby is when they start thinking about life insurance for the first time and with good reason.

Is 40 too old to get life insurance

It's never too late to buy life insurance. If you're in your 40s or 50s and are just considering a midlife life insurance policy, or if you have coverage but want more, you have plenty of options. The type of life insurance you need depends on your finances, your health and your goals.

Is 50 too old to get life insurance

While life insurance coverage typically costs more as you age, you can still apply for a policy later in life to help protect loved ones from having to pay your obligations. A life insurance policy can also serve other estate planning and business protection purposes.

Does age matter in life insurance

“Every birthday puts you one year closer to your life expectancy and thus, you are more expensive to insure,” says Huntley. He estimates that rates increase every year by 5% to 8% in your 40s, and by 9% to 12% each year if you're over age 50.

How much life insurance do I need in my 30s

Many factors influence the size of the policy you might need at age 30. Not all 30-year-olds are in the same financial situation or have the same insurance needs. A general rule to follow is to purchase a policy that has benefits that are at least 10 times your annual income.

Is it important to get life insurance

Why is life insurance important Buying life insurance protects your spouse and children from the potentially devastating financial losses that could result if something happened to you. It provides financial security, helps to pay off debts, helps to pay living expenses, and helps to pay any medical or final expenses.

Is 60 too late for life insurance

Life insurance can provide peace of mind at any age, but isn't always necessary after age 60. To see if you need life insurance, assess your family's needs, your financial resources and assets, your outstanding debts and your long-term financial goals.

What is the cash value of a $10000 life insurance policy

The $10,000 refers to the face value of the policy, otherwise known as the death benefit, and does not represent the cash value of life insurance policy. A $10,000 term life insurance policy has no cash value. However, a permanent life insurance policy might.

Is it OK to not have life insurance

You may not need life insurance for a number of reasons, such as if you don't need to provide for someone after your death, if you have no room in your budget for premium payments, or if you have other plans to financially support your loved ones.

What happens if you never use your life insurance

Your coverage ends if you outlive your term life policy. Before it expires, you can choose to convert your policy to permanent insurance, buy a new policy, or go without coverage.

How much cash is a $100 000 life insurance policy worth

The cash value of your settlement will depend on all the other factors mentioned above. A typical life settlement is worth around 20% of your policy value, but can range from 10-25%. So for a 100,000 dollar policy, you would be looking at anywhere from 10,000 to 25,000 dollars.

Can I cash out life insurance

You can cash out a life insurance policy. How much money you get for it, will depend on the amount of cash value held in it. If you have, say $10,000 of accumulated cash value, you would be entitled to withdraw up to all of that amount (less any surrender fees).

Is life insurance always worth it

If your life and earning ability ends prematurely, life insurance can help adequately fill the financial gap. Older people, however, may not always benefit from taking out a life insurance policy. They're likely to be more financially secure and have fewer people depending on them financially.

Is life insurance a necessity or is it a luxury

Not everyone needs life insurance. Those who've accumulated enough wealth and assets to care for their own and their loved one's needs independently in the event of their death can forgo paying for life insurance, especially if it's a term policy.

Why do people not take life insurance

When you consider the top reason for not purchasing life insurance is that it is too expensive, overestimating the true cost of coverage may deter many from purchasing it. For many underinsured individuals, it's not that they don't want the life insurance they need.

What is the cash value of a $25 000 life insurance policy

Example of Cash Value Life Insurance

Consider a policy with a $25,000 death benefit. The policy has no outstanding loans or prior cash withdrawals and an accumulated cash value of $5,000. Upon the death of the policyholder, the insurance company pays the full death benefit of $25,000.

How much is a $10,000 life insurance policy worth

It's usually a payout of the full coverage amount defined in the policy (a $10,000 policy pays a $10,000 death benefit). Face Value: The face value of the policy is simply the coverage amount the policy is worth. So, the face value of a $10,000 policy is $10,000. This is usually the same amount as the death benefit.

Can I use life insurance while alive

Permanent life insurance policies will allow you to access the cash portion of your account while you're alive. Term life insurance, meanwhile, does not have a cash element for policyholders to access. So, if you're planning on using your life insurance as a backup cash resource you'll want to avoid term policies.

Do the rich use life insurance

Wealthy individuals with a net worth over $1 million can use life insurance as income replacement, an investment vehicle, or protection against estate taxes. Amanda Shih. Her expertise has appeared in Slate, Lifehacker, Little Spoon, and J.D. Power.

What happens if you don’t have life insurance

If you die without life insurance, any assets you left behind will be distributed to your heirs, but your loved ones won't receive an insurance payout. That may leave them to cover your funeral costs and unpaid debts on their own.

Can life insurance be paid out before death

You can cash out part of your life insurance policy before you die in certain situations, such as a terminal illness, qualifying medical conditions, or if your policy has a cash value component. Tory Crowley.

Why do rich people buy whole life

Is buying a whole life policy a smart idea There are many different estate planning techniques wealthy people can use to try to minimize taxes and keep their estate intact. Buying a whole life policy is just one of the different approaches a person could use to shield their wealth from the government.

Do you always need life insurance

The majority of individuals who are single, financially independent, have no dependents, and do not own a business, do not need life insurance.