What are the 5 levels of personal finance

Personal finance deals with an individual or household's income, spending, and savings. The five fundamental focus areas of personal finance are income, spending, savings, investing, and protection. Understanding a country's tax system can help individuals save a lot of money. This requires proper tax planning.

What are the 6 areas of personal finance

Watch to learn about six personal finance topics that can have a big impact on your life: budgeting, saving, debt, taxes, insurance, and retirement.

What are the 4 components of personal finance

Regardless of income or wealth, number of investments, or amount of credit card debt, everyone's financial state fits into a common, fundamental framework, that we call the Four Pillars of Personal Finance. Everyone has four basic components in their financial structure: assets, debts, income, and expenses.

What are the categories of finances

Finance can be divided broadly into three distinct categories: public finance, corporate finance, and personal finance. More recent subcategories of finance include social finance and behavioral finance.

What is the rule of 5 financial

In investment, the five percent rule is a philosophy that says an investor should not allocate more than five percent of their portfolio funds into one security or investment. The rule also referred to as FINRA 5% policy, applies to transactions like riskless transactions and proceed sales.

What category is personal finance

We're discussing the five categories that attribute to personal finance, which are income, spending, savings, investing, and protection. These are critical to shaping your personal financial planning. Income is money received, especially on a regular basis, for work or through investments.

What are 7 steps in personal finance

7 Steps of Financial PlanningEstablish Goals. To begin, ask some questions about your future.Assess Risk.Analyze Cash Flow.Protect Your Assets.Evaluate Your Investment Strategy.Consider Estate Planning.Implement and Monitor Your Decisions.

What are the 4 areas financial planning

A financial plan consists of these key areas:Current Financial Position — to help you understand where you stand today.Investment Planning — to help you fund your goals.Retirement Planning — the goal of being able to maintain your lifestyle in retirement.Tax Planning* — to help avoid paying unnecessary taxes.

What are 4 steps to personal finance planning

Your 4-step guide to financial planningAssess your financial situation and typical expenses.Set your financial goals.Create a plan that reflects the present and future.Fund your goals through saving and investing.

What are 7 categories of a financial plan

A financial plan lays out a comprehensive view of your current finances, financial goals, and future financial endeavors. The plan should include details about your income, expenses, savings, debt management, insurance, taxes, investments, retirement, and estate planning.

What are the 4 levels of financial

The four levels of financial success are:Financial Dependence.Financial Independence.Financial Freedom.Wealth.

What are the 5 investment guidelines

Invest early. Starting early is one of the best ways to build wealth.Invest regularly. Investing often is just as important as starting early.Invest enough. Achieving your long-term financial goals begins with saving enough today.Have a plan.Diversify your portfolio.

What is the 10 rule in personal finance

The 10% rule is a savings tip that suggests you set aside 10% of your gross monthly income for retirement or emergencies. If you still need to start a savings account, this is a great way to build up your savings. You should create a monthly budget before starting your savings journey.

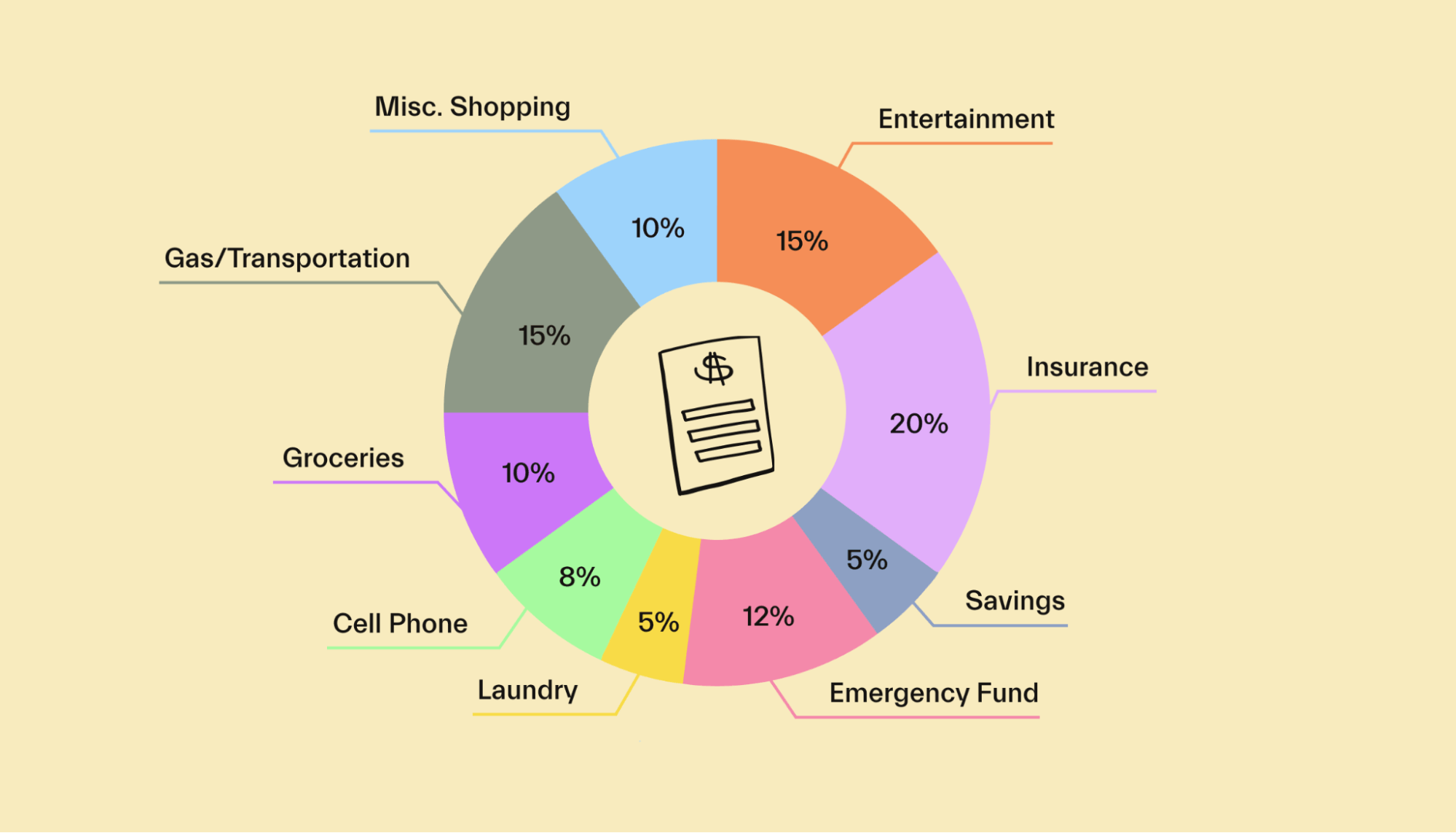

What are the 3 main budget categories

We recommend the 50/30/20 system, which splits your income across three major categories: 50% goes to necessities, 30% to wants and 20% to savings and debt repayment.

What are examples of personal finance

Examples of personal finance include:Income.Savings and Investments.Checking accounts.Spending/Budgeting.Credit and Credit Scores.Insurance.Taxes.

What are the 8 steps of financial planning

8 steps to a flexible financial planStep 1: Set your goals.Step 2: Make a budget.Step 3: Build your emergency savings.Step 4: Protect your income.Step 5: Ditch the debt.Step 6: Save and plan for retirement.Step 7: Invest some of your savings.Step 8: Make your final plans.

What are the 7 components of a financial plan

A good financial plan contains seven key components:Budgeting and taxes.Managing liquidity, or ready access to cash.Financing large purchases.Managing your risk.Investing your money.Planning for retirement and the transfer of your wealth.Communication and record keeping.

What are the four main 4 types of financial planning

What are the Different Types of Financial PlanningCash Flow Planning and Budgeting. The first step in the financial planning process is to develop a budget and cash flow plan.Insurance Planning.Retirement Planning.Investment Planning.Tax Planning.Legacy Plan for Wealth Distribution.

What are the 5 components of a financial plan

There are five essential components of a financial plan such as Insurance planning, Retirement Planning, Investment Planning, Tax Planning and Estate Planning.

What are the 4 pillars of financial planning

The Four Pillars of Wealth ManagementManaging finances and budgeting.Investment and Risk Management.Planning for retirement.Tax efficiency.

What are the 4 phases of financial planning

Financial Planning for Individuals & Families

For individuals and families, we focus on asset/liability matching, tax-efficiency, and cost-effective planning throughout the four key phases of financial management: accumulation, distribution, preservation, and legacy. Plan to budget, determine investments, set goals.

What is principle 5 strategic investment

Principle 5: Strategic investment

It is the methods that the learner employs to internalize and to perform in the language that are important too. After all, successful mastery of L2 will be due to a learner's own personal investment of time, effort, and attention to L2.

What is 20 of personal finance

20% — Savings and Debt Repayment

Savings can include retirement contributions, an emergency fund, or a goal like homeownership or travel. If you are debt-free or your only debt is a low-interest mortgage, you may want to devote the full 20% of your net income to savings.

What is the 80% Rule personal finance

The 80/20 budgeting method is perfect for anyone searching for a quick way to create a powerful budget in less time. The basic rule is 80% of your income goes to your needs and wants, and 20% of your income goes directly to your savings.

What are 5 characteristics of a successful budget

To be successful, a budget must be Well-Planned, Flexible, Realistic, and Clearly Communicated.The Budget Must Address the Enterprise's Goals.The Budget Must be a Motivating Tool.The Budget Must Have the Support of Management.The Budget Must Convey a Sense of Ownership.The Budget Should be Flexible.