What are the 5 major classification of accounts

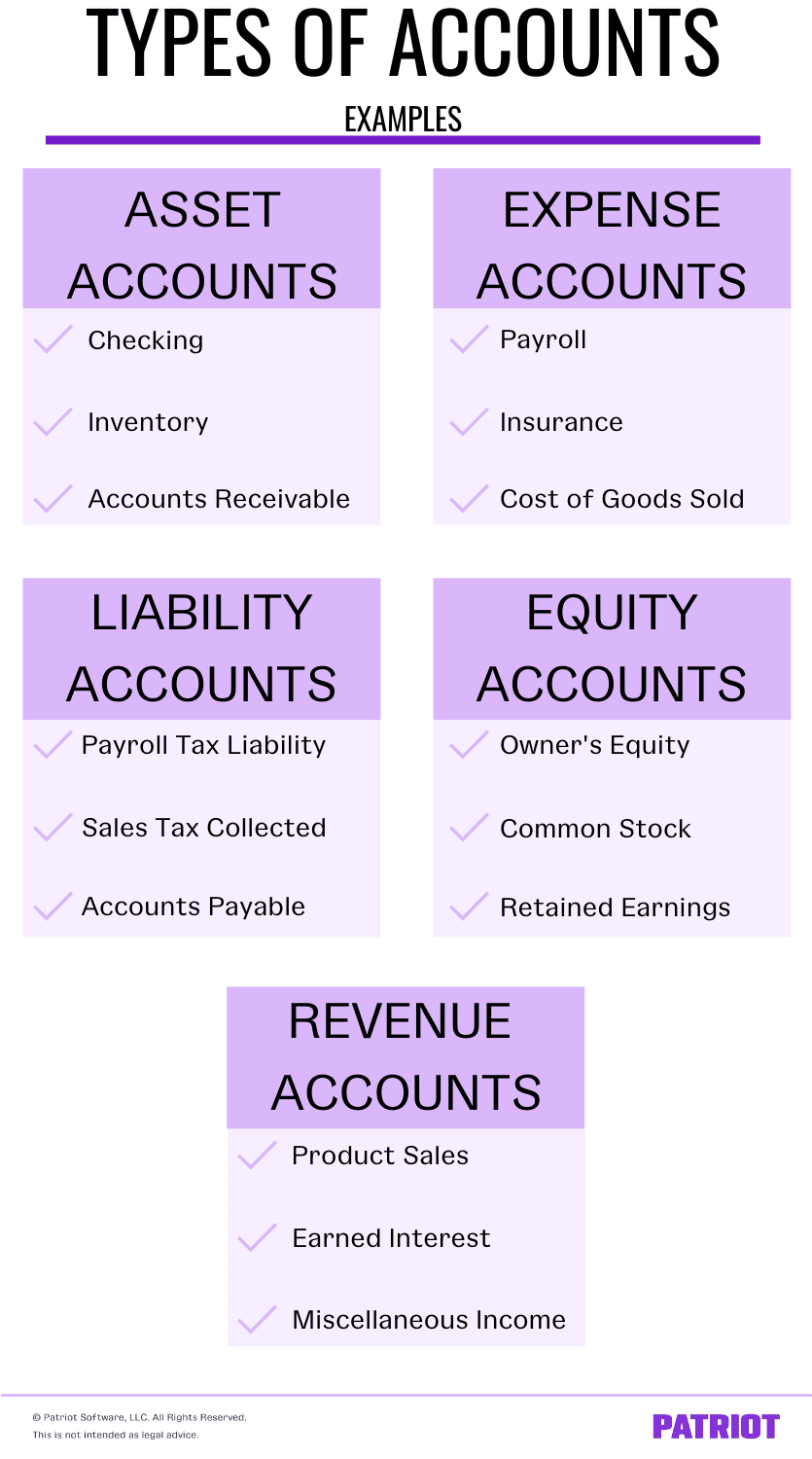

The 5 primary account categories (also called real accounts) are as follows:Assets.Liabilities.Equity.Expenses.Income (Revenue)

What are the classification of accounts

Accounts are classified in accounting using one of two methods: the current approach or the classic approach. The accounts are classified as asset accounts, liability accounts, capital or owner's equity accounts, withdrawal accounts, revenue/income accounts, and expense accounts, according to the modern approach.

What are the 3 types of account classifications in accounting

3 Different types of accounts in accounting are Real, Personal and Nominal Account. Real account is then classified in two subcategories – Intangible real account, Tangible real account. Also, three different sub-types of Personal account are Natural, Representative and Artificial.

How many types of accounting are there

Three

Three main types of accounting include financial accounting, managerial accounting, and cost accounting. Considering the differences in their working principle, each accounting type has different goals. However, all of them are equally important for a business organisation.

Which are included in the 5 types of accounts choose all that apply

5 Types of accountsAssets.Expenses.Liabilities.Equity.Revenue (or income)

What are 4 fundamentals of accounts

o Trial Balance.o Profit and Loss Account.o Balance Sheet.o Cash-Flow Statement.

What is the modern classification of accounts

However, the modern system classifies accounts into six types: asset, liability, revenue, expense, capital, and withdrawal.

Why are accounts classified

Accounts are classified in personal, real and nominal account depending upon the nature of account. All these three account have their own rule for recording the transaction. Ram's account is a personal account, Goods account is a real account and any expenses account is a nominal account.

What are the 4 parts of the account

The Four Current Account Components. The current account can be divided into four components: trade, net income, direct transfers of capital, and asset income. 1. Trade: Trade in goods and services is the largest component of the current account.

What are the 3 types of accounts and its rules

Golden rules of accounting

| Type of account | Golden rules |

|---|---|

| Real account | Debit what comes in Credit what goes out |

| Personal account | Debit the receiver Credit the giver |

| Nominal account | Debit the expenses or losses Credit the income or gain |

12 thg 8, 2020

What are the 8 types of accounting

What are the eight branches of accountingFinancial accounting.Cost accounting.Auditing.Managerial accounting.Accounting information systems.Tax accounting.Forensic accounting.Fiduciary accounting.

What are the 12 types of accounting

In this article, we'll cover:Financial Accounting.Cost Accounting.Auditing.Managerial Accounting.Accounting Information Systems.Tax Accounting.Forensic Accounting.Fiduciary Accounting.

What are the 5 main account types in Quickbooks

Understand the importance and purpose of account types

Accounts that have an opening balance feed into the Balance Sheet report. These include accounts payable and receivable, asset accounts, liability accounts, equity accounts, and credit card and bank accounts.

What are the 5 types of accounts that you can use to set up your chart of accounts in Sage

Account Types (Maintain Chart of Accounts)

| Accounts Payable | Expenses |

|---|---|

| Accounts Receivable | Fixed Assets |

| Accumulated Depreciation | Income |

| Cash | Inventory |

| Cost of Sales | Long term liabilities |

How are accounts classified modern and traditional

The classifications mentioned in the previous part (Asset, Liability, Equity, Revenue, and Expense accounts) are based on the modern accounting approach, while the Real, Personal, and Nominal accounts classification belongs to the traditional accounting approach.

What are the 6 parts of accounting

6 Important Steps in Full Accounting CycleStep 1: Identify the Transaction. The accounting cycle begins with: transactions.Step 2: Record Transactions in a Journal.Step 3: Post to the General Ledger.Step 4: Create a Trial Balance.Step 5: Create Financial Statements.Step 6: Closing the Books.

What are the 8 parts of accounting

What Are the 8 Steps of the Accounting CycleIdentify and analyze transactions.Record transactions in a journal.Post transactions to a general ledger.Determine the unadjusted trial balance.Analyze the worksheet.Adjust journal entries and fix any errors.Create financial statements.Close the books.

What are the 3 golden rules of accounting

Take a look at the three main rules of accounting: Debit the receiver and credit the giver. Debit what comes in and credit what goes out. Debit expenses and losses, credit income and gains.

What are the 10 types in accounting cycle

There are ten steps in an accounting cycle, which include analyzing transactions, journalizing transactions, post transactions, preparing an unadjusted trial balance, preparing adjusting entries, preparing the adjusted trial balance, preparing financial statements, preparing closing entries, posting a closing trial …

What are the 10 branches of accounting

The ten branches of accounting include the following:Financial Accounting.Management accounting.Cost Accounting.Tax accounting.Auditing.Accounting information systems.Forensic accounting.Fiduciary accounting.

What are the 5 major accounts define each and enumerate examples

5 types of accounts in accountingAssets. Asset accounts usually include the tangible and intangible items your company owns.Expenses. An expense account can include the products or services a company purchases to help generate additional income.Income.Liabilities.Equity.

What are the 5 main account types in the chart of accounts Quickbooks

Understand the importance and purpose of account types

Accounts that have an opening balance feed into the Balance Sheet report. These include accounts payable and receivable, asset accounts, liability accounts, equity accounts, and credit card and bank accounts.

What are the 5 main account types in the chart of accounts quizlet

Account titles are grouped by, and in the order of, the five major components of the expanded accounting equation: assets, liabilities, stockholders' equity, revenues, and expenses.

What is the difference between traditional and modern account

The traditional Approach classifies accounts while the Modern approach uses the Accounting equation for accounting. All the ledger accounts are classified as 'Personal' and 'Impersonal accounts' under the Traditional approach. Debit is what comes in whereas credit is what goes out.

What is the difference between traditional and modern method of accounting

While traditional rules revolved around three accounts – real, personal, and nominal, the modern version classifies the accounts into six types, making the transactions split into these categories, affecting the debit and credit sides.