What are the 5 components of accounting

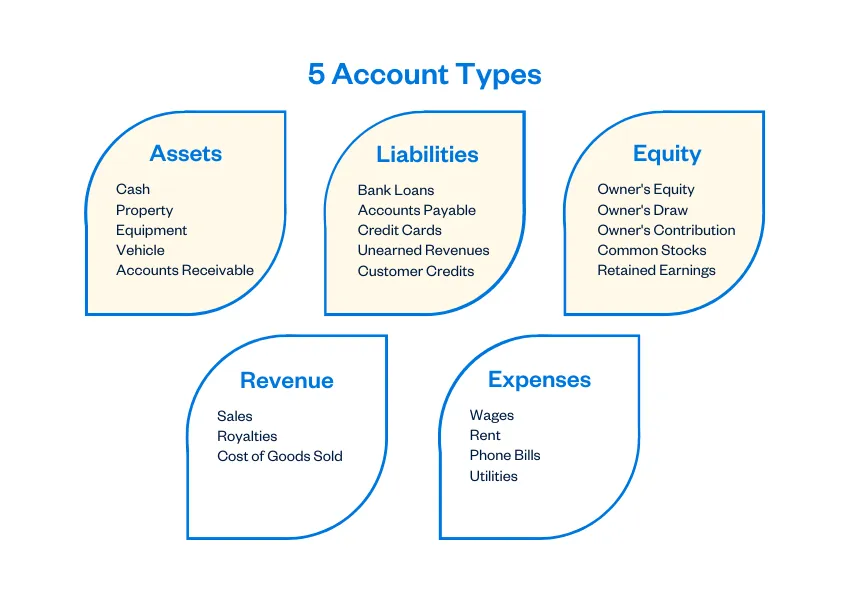

Whenever you need to record a new transaction, like an invoice to a client, an expense, a loan, etc., you need to record it correctly. In general, there are 5 major account subcategories: revenue, expenses, equity, assets, and liabilities.

What are components of accounts

The accounting elements are Assets, Liabilities, Owners Equity, Capital Introduced, Drawings, Revenue and Expenses.

What are the 5 components of financial statement

The elements of the financial statements will be assets, liabilities, net assets/equity, revenues and expenses. It is noted in Study 1 that moving along the spectrum from cash to accrual accounting does not mean a loss of the cash based information which can still be generated from an accrual accounting system.

What is as 5 accounting standard

Accounting Standard 5 (AS 5) deals with the classification and disclosure of specific items in the Statement of Profit and Loss. The purpose of AS 5 is to suggest such a classification and disclosure in order to bring uniformity in the preparation and presentation of statement of net profit or loss across enterprises.

What are the 4 components of accounting

Components of Basic AccountingRecording. The primary function of accounting is to make records of all transactions that the firm enters into.Summarising. Recording of transactions creates raw data.Reporting. Management is answerable to the investors about the company's state of affairs.Analyzing.

What are the 10 components of accounting

This chapter defines 10 elements of financial statements: assets, liabilities, equity (net assets), revenues, expenses, gains, losses, investments by owners, distributions to owners, and comprehensive income.

What are the five 5 financial statements prepared in accounting

5 Types of Financial StatementsBalance Sheet. The first type of financial report is the balance sheet.Income Statement. The second type of financial report is the income statement.Cash Flow Statement.Statement of Changes in Capital.Notes to Financial Statements.

What are the 4 components of financial statements

Financial statements can be divided into four categories: balance sheets, income statements, cash flow statements, and equity statements.

What is IFRS 5 in accounting

IFRS 5 Non-current Assets Held for Sale and Discontinued Operations outlines how to account for non-current assets held for sale (or for distribution to owners).

What are the as 6 accounting standards

AS-6 deals with depreciation of the tangible asset. Hence, only the historical cost, accumulated depreciation on the asset and total depreciation for the period for each class of asset will be recorded.

What are the 6 parts of accounting

6 Important Steps in Full Accounting CycleStep 1: Identify the Transaction. The accounting cycle begins with: transactions.Step 2: Record Transactions in a Journal.Step 3: Post to the General Ledger.Step 4: Create a Trial Balance.Step 5: Create Financial Statements.Step 6: Closing the Books.

What are the 8 parts of accounting

What Are the 8 Steps of the Accounting CycleIdentify and analyze transactions.Record transactions in a journal.Post transactions to a general ledger.Determine the unadjusted trial balance.Analyze the worksheet.Adjust journal entries and fix any errors.Create financial statements.Close the books.

What are the 8 accounting concepts

: Business Entity, Money Measurement, Going Concern, Accounting Period, Cost Concept, Duality Aspect concept, Realisation Concept, Accrual Concept and Matching Concept.

What are the 5 types of statements

The usual order of financial statements is as follows:Income statement.Cash flow statement.Statement of changes in equity.Balance sheet.Note to financial statements.

What is accounting standard 5 explain in detail

Accounting Standard 5 (AS 5) deals with the classification and disclosure of specific items in the Statement of Profit and Loss. The purpose of AS 5 is to suggest such a classification and disclosure in order to bring uniformity in the preparation and presentation of statement of net profit or loss across enterprises.

What are the 3 components of financial statement

The income statement, balance sheet, and statement of cash flows are required financial statements. These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value.

What are the components of final accounts

The components of final accounts are :Trading account.Profit and loss account.Profit and loss appropriation account.

What are the 5 components of an IFRS financial statements in accordance with IFRS

According to IFRS, there are 5, namely Income Statement which aims to determine the profit or loss of a company, Statement of change in Equity which aims to determine changes in the capital of a company within a certain period, Statement of Financial Position which aims to show the financial position of a company in a …

What is the as 7 accounting standard

Accounting Standard 7 (AS 7) relates with accounting of construction contracts. The very purpose of this accounting standard is to specify the accounting treatment of revenue and costs associated with construction contracts.

What are the 10 part of accounting

The ten steps are analyzing transactions, journalizing transactions, post transactions, preparing an unadjusted trial balance, preparing adjusting entries, preparing the adjusted trial balance, preparing financial statements, preparing closing entries, posting a closing trial balance, and recording reversing entries.

What are the 12 types of accounting

In this article, we'll cover:Financial Accounting.Cost Accounting.Auditing.Managerial Accounting.Accounting Information Systems.Tax Accounting.Forensic Accounting.Fiduciary Accounting.

What are the 9 accounting concepts

: Business Entity, Money Measurement, Going Concern, Accounting Period, Cost Concept, Duality Aspect concept, Realisation Concept, Accrual Concept and Matching Concept.

What are the 6 basic financial statements

The usual order of financial statements is as follows:Income statement.Cash flow statement.Statement of changes in equity.Balance sheet.Note to financial statements.

What are the 4 main financial statements

ContentsBalance sheet.Income statement.Cash flow statement.Statement of owner's equity.

What is accounting standard 6

AS-6 deals with depreciation of the tangible asset. Hence, only the historical cost, accumulated depreciation on the asset and total depreciation for the period for each class of asset will be recorded.