What is the purpose and advantages of a non profit organization

Most nonprofits are formed to provide a benefit to the public, as opposed to clubs, cooperatives, etc. that are formed to benefit their members. They include companies formed for charitable, educational, scientific, religious and literary purposes. These charitable companies are also referred to as Sec.

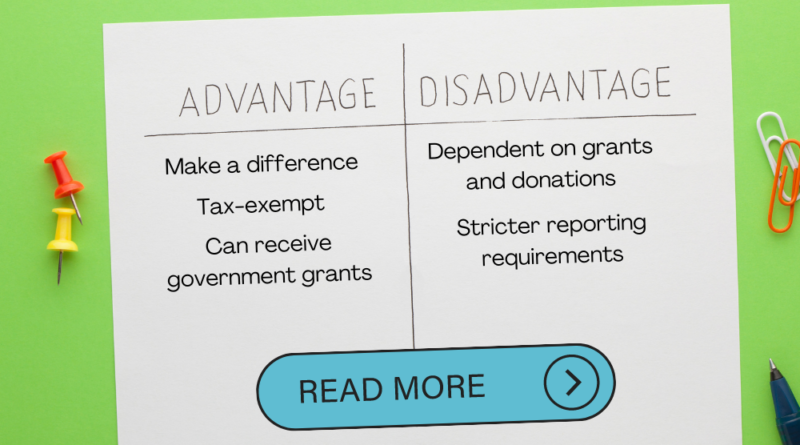

What are the advantages and disadvantages of creating a non profit organization

Despite the challenges, nonprofits survive through generous donations of money and in-kind donations from benefactors and supporters.Advantage: Employee Commitment.Disadvantage: Limited Funding.Advantage: Intrinsic Rewards.Disadvantage: Social Pressure.Advantage: Financial Benefits.Disadvantage: Public Scrutiny.

What is a disadvantage of a non profit company

Cost: Creating a nonprofit organization takes time, effort, and money. Fees are required to apply for incorporation and tax exemption. The use of an attorney, accountant, or other consultant may also be necessary.

What are the benefits of starting a nonprofit organization in Canada

You are exempt from paying income tax. You are eligible to receive gifts from registered charities. You gain increased credibility in the community. Many goods and services you provide are exempt from goods and services tax/harmonized sales tax (GST/HST).

What are the advantages of a profit Organisation

The establishment of a for-profit business has some clear advantages: self-employment and financial rewards proportional to success. It is not without disadvantages, however, such as financial liability and obligation to investors and creditors.

What are the advantages of organizations

A well-established organization provides for the training and development of employees at all levels. It provides opportunities for leadership and helps in ensuring the stability of the enterprise through executive development. It makes for cooperation and harmony of actions.

What are the advantages and disadvantages of organization

Organizing a company in this way has inherent advantages and disadvantages.Advantage: Specialization.Advantage: Operational Speed.Advantage: Operational Clarity.Disadvantage: Segregation.Disadvantage: Weakening of Common Bonds.Disadvantage: Lack of Coordination.Disadvantage: Territorial Disputes.

What are the advantages and disadvantages of business organizations

The advantages are: shared costs, knowledge and expenses. The disadvantages are: profit sharing and personal liability. The next type of business organization is a corporation, which is defined as a legal entity owned by shareholder(s).

What are the advantages and disadvantages of a for-profit organization

The establishment of a for-profit business has some clear advantages: self-employment and financial rewards proportional to success. It is not without disadvantages, however, such as financial liability and obligation to investors and creditors.

What are the disadvantages of business Organisation

Disadvantages include:Unlimited liability: You are personally responsible for all business debts and company actions under this business structure.Lack of structure: Since you are not required to keep financial statements, there is a risk of becoming too relaxed when managing your money.

What is the importance for nonprofits to invest in PR

Credibility of a nonprofit is vital in securing both people & funds to help the organisation fulfill its mission on a daily basis. A nonprofit organisation can increase awareness of their credibility with PR by delivering messages showing how they do what they set out to do.

What is the advantage and disadvantage of profit planning

The advantages of profit sharing plans are tax deferrals and the fact that they can be used as incentives for better performance. The disadvantage of profit sharing plans is that they are discretionary, meaning employer contributions are not mandatory or guaranteed.

What is 5 one advantage of the corporate form of organization

The corporate form of organization offers several advantages, including limited liability for shareholders, greater access to financial resources, specialized management, and continuity.

What are the benefits advantages of having an organization

7 Advantages of a Good OrganisationHelps in Optimum Utilisation of Technological Innovations:Helps in Administration:Promotes Growth and Diversification:Easy Co-ordination:Training and Development of Personnel:Encourages Initiative:Better Human Relations:

Which are advantages and disadvantages

As nouns, the difference between disadvantage and advantage is that disadvantage is a weakness or undesirable characteristic; a con while the advantage is any condition, circumstance, opportunity, or means, particularly favorable to success, or any desired end.

What are 3 advantages and 3 disadvantages of owning your own business

At the same time, consider the advantages as well as the disadvantages of owning your own company.Advantage: Financial Rewards.Advantage: Lifestyle Independence.Advantage: Personal Satisfaction and Growth.Disadvantage: Financial Risk.Disadvantage: Stress and Health Issues.Disadvantage: Time Commitment.Try a Side Hustle.

What are advantages of business organization

There are several advantages to becoming a corporation, including the limited personal liability, easy transfer of ownership, business continuity, better access to capital and (depending on the corporation structure) occasional tax benefits.

What are the advantages and disadvantages of company Organisation

The pros and cons of a company business structure

| Pros | Cons |

|---|---|

| Tax rate capped at 25% | Greater regulatory compliance |

| Well-defined governance agreements | Requires a higher level of business understanding and responsibility |

| Limited liability and increased personal asset protection | Limited tax concessions |

| Unlimited lifespan | – |

What are the benefits of public relations to an organization

Further, PR can add value through increasing visibility of your products and services, personalise your brand, raise your profile, build strong relationships, manage your reputation, assist with your sales process and add value to your own clients through case studies. Overall, it is a win-win scenario.

Why is it important for business to invest in a community

In recent years, community investment has become increasingly important. Not only does investing in the local community benefit the company by fostering a positive reputation and customer loyalty, but it also has a positive impact on the community by creating jobs and supporting local businesses.

What is the disadvantage of a for-profit company

DISADVANTAGES. Limited Ability to Receive Grants, and No Tax Deduction to Donors. One big drawback of for-profit companies is that they are not generally eligible to receive foundation and government grants (with some exceptions).

What are the advantages of having profit

Profit equals a company's revenues minus expenses. Earning a profit is important to a business because profitability impacts whether a company can secure financing from a bank, attract investors to fund its operations and grow its business. Companies cannot remain in business without turning a profit.

What are the advantages of an organization

7 Advantages of a Good OrganisationHelps in Optimum Utilisation of Technological Innovations:Helps in Administration:Promotes Growth and Diversification:Easy Co-ordination:Training and Development of Personnel:Encourages Initiative:Better Human Relations:

What are the advantages of corporate Organisation

Incorporating offers several advantages over sole proprietorships.Owners benefit from limited liability.Ownership interests are easier to transfer.The life of the corporation can extend beyond that of the founders.Credibility is boosted in the eyes of partners.Financing and grants are easier to access.

What are 3 benefits of organizational structure

Organizational structures are important because they improve efficiency, reduce confusion and miscommunication, and help employees gain clarity on their roles and responsibilities.