What is the 5 3 1 rule in trading

The number 5 stands for choosing 5 currency pairs that a trader would like to trade. The number 3 stands for developing 3 strategies with multiple combinations of trading styles, technical indicators and risk management measures. The number 1 guides traders to choose the most suitable time for trading.

What is a 3 to 1 risk reward ratio

Usually, the ratio quantifies the relationship between the potential dollars lost should the investment or action fail versus the dollars realized if all goes as planned (reward). A risk-reward ratio of 1-to-3, for example, would signify that for every dollar risked, there's a $3 potential profit or reward.

What is the rule for 3 trades a day

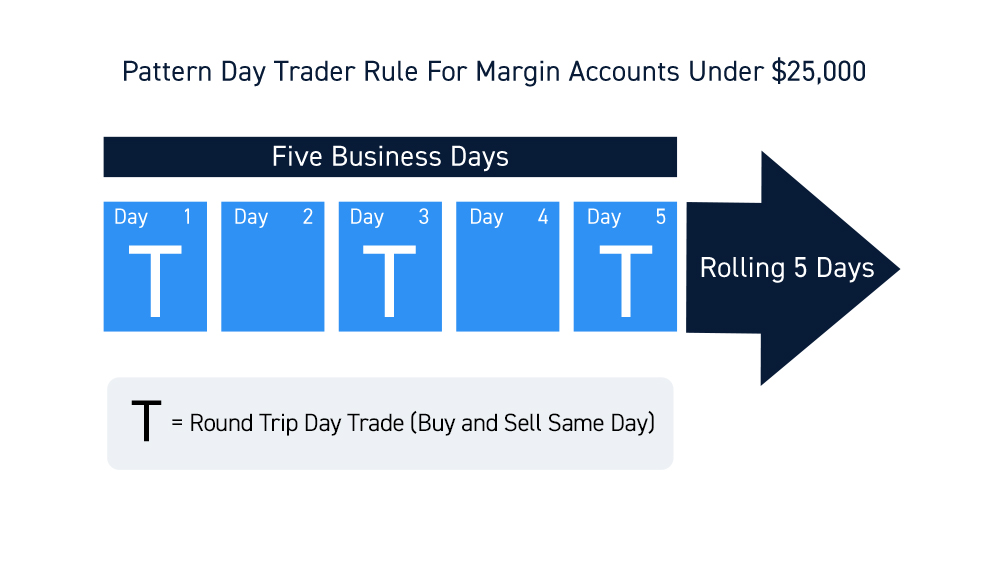

Essentially, if you have a $5,000 account, you can only make three-day trades in any rolling five-day period. Once your account value is above $25,000, the restriction no longer applies to you. You usually don't have to worry about violating this rule by mistake because your broker will notify you.

What is the 3 5 7 rule in trading

The strategy is very simple: count how many days, hours, or bars a run-up or a sell-off has transpired. Then on the third, fifth, or seventh bar, look for a bounce in the opposite direction. Too easy

What is 123 rule in trading

123 pattern is a common pattern that usually appears at the beginning of many price reversals. Sometimes, it might give a signal about trend continuation as well. To get higher quality signals it is better to use the 123 pattern in a tandem with an oscillator (for example RSI).

What is 80% trading rule

The 80/20 Rule – Coincidental Yet Consistent

If you're not already familiar with this notion, it's called the 80/20 Rule, or the Pareto Principle. To recap, it says that 80% of the effects (in our case, one's trading success rate) come from 20% of the causes.

What is a 3 1 profit to loss ratio

For example, if a system had a winning average of $750 per trade and an average loss over the same time of $250 per trade, then the profit/loss ratio would be 3:1. A consistently solid profit/loss ratio can encourage a trader to leverage bets on the same strategy in an attempt to generate greater absolute profits.

What is a 2 to 1 reward ratio

Experienced traders consider the risks involved in a trade and how they relate to the potential profit, which is what the risk-to-reward ratio is about. For example, a ratio of 1:2 means that the potential reward for a trade is double the risk taken.

How do you avoid the 3 day trade rule

The simplest way to avoid being labeled a PDT is to refrain from making more than three day trades within five rolling business days. Additionally, keep the following in mind: Individual options contracts aren't necessarily considered day trades if they're part of a spread or larger order.

What happens if I do more than 3 day trades

If you execute four or more round trips within five business days, you will be flagged as a pattern day trader. Here's where you might be dinged: If you're flagged as a pattern day trader and you have less than $25,000 in your account, you could be restricted from opening new positions.

What is the 80 20 rule in trading

Based on the application of famed economist Vilfredo Pareto's 80-20 rule, here are a few examples: 80% of your stock market portfolio's profits might come from 20% of your holdings. 80% of a company's revenues may derive from 20% of its clients. 20% of the world's population accounts for 80% of its wealth.

What is the 80 20 rule in day trading

If you discover that 80% of your outcomes, profits or losses, were generated by 20% of your trades (or something close to it), then you've just seen, with your own eyes, the Pareto Principle at work. The Pareto Principle is all about “uneven distribution” of outcomes to causes.

What is the 4 trade rule

Understanding the rule

Your account will be flagged for pattern day trading if you make 4 or more day trades within 5 trading days, and the number of day trades represents more than 6% of your total trades in that same 5 trading day period. This rule only applies to margin accounts and IRA limited margin accounts.

What is the 30 trading rule

Under the wash-sale rules, a wash sale happens when you sell a stock or security for a loss and either buy it back within 30 days after the loss-sale date or "pre-rebuy" shares within 30 days before selling your longer-held shares.

What is a 2 1 profit ratio

The higher the number, the better the system is at predicting future price movements. Many investing books suggest a minimum of a 2:1 profit/loss ratio. As an example, a system with a win average of $800 and a loss average of 400$ over a defined time period would have a profit/loss ratio of 2:1.

What is a 2 1 profit loss ratio

For example, if a trader takes a trade with a P/L ratio of 2:1, they only need to win 33% of their trades to break even. This is because the potential profit is twice as large as the potential loss, so even if they lose more trades than they win, they can still make a profit overall.

What is 3 2 1 ratio examples

In this example, the ratio of gravel to sand to cement is still 3 : 2 : 1, so the total number of parts into which the concrete is divided is still 3+2+1=6.

What is a 5 1 risk-reward ratio

If you have a risk-reward ratio of 1:5, it means you're risking $1 to potentially make $5.

What happens if you exceed 3 day trades

If you execute four or more round trips within five business days, you will be flagged as a pattern day trader. Here's where you might be dinged: If you're flagged as a pattern day trader and you have less than $25,000 in your account, you could be restricted from opening new positions. So, what now

What happens if I trade more than 3 times in a week

If you make four or more day trades over the course of any five business days, and those trades account for more than 6% of your account activity over the period, your margin account will be flagged as a pattern day trader account.

Can I day trade 3 times a day

You could inform your broker (saying “yes, I'm a day trader”) or day trade more than three times in five days and get flagged as a pattern day trader. This allows you to day trade as long as you hold a minimum account value of $25,000—just keep your balance above that minimum at all times.

What is the 40 60 rule in trading

In its simplest form, the 60/40 rule means having 60% of your portfolio invested in potentially higher risk, historically higher return, assets such as stocks and the other 40% invested in lower risk, but also traditionally lower return, assets such government bonds.

What is the 5% trading rule

It dates back to 1943 and states that commissions, markups, and markdowns of more than 5% are prohibited on standard trades, including over-the-counter and stock exchange listings, cash sales, and riskless transactions. Financial Industry Regulatory Authority (FINRA).

What is the 6% rule for day trading

Who Is a Pattern Day Trader According to FINRA rules, you're considered a pattern day trader if you execute four or more "day trades" within five business days—provided that the number of day trades represents more than 6 percent of your total trades in the margin account for that same five business day period.

What is the 5 rule in trading

The Bottom Line

It dates back to 1943 and states that commissions, markups, and markdowns of more than 5% are prohibited on standard trades, including over-the-counter and stock exchange listings, cash sales, and riskless transactions. Financial Industry Regulatory Authority (FINRA).