What is an example of a lagging indicator

A lagging indicator is an observable or measurable factor that changes sometime after the economic, financial, or business variable with which it is correlated changes. Some general examples of lagging economic indicators include the unemployment rate, corporate profits, and labor cost per unit of output.

What are the examples of lagging and leading indicators

Leading indicators look forwards, through the windshield, at the road ahead. Lagging indicators look backwards, through the rear window, at the road you've already travelled. A financial indicator like revenue, for example, is a lagging indicator, in that it tells you about what has already happened.

What is the best lagging indicator

Three popular lagging indicatorsMoving averages.The MACD indicator.Bollinger bands.

What types of indicators are lagging

Moving Averages, MACD, and Bollinger Bands are three types of lagging indicators. They cannot predict the future as the lagging indicators shift only upon major economic events.

What are the two lagging indicators

Answer: The unemployment rate, corporate profit reports, and labor costs per unit of output are a few examples of lagging indicators. Another example is sales revenue, which reflects revenue generated after an event has already occurred and takes time to develop.

Is a KPI a lagging indicator

Lagging KPIs measure what has already happened, such as sales numbers and costs. These indicators provide valuable insight into your progress towards your goals and objectives.

Is inflation a lagging indicator

Is Inflation a Lagging Indicator Yes, inflation can be considered a lagging indicator. Inflation is defined as a period of rising prices, and when prices go up, people can't afford as much as they used to; therefore, inflation is also a period of declining purchasing power.

What are lagging and non-lagging indicators

Non-lagging indicators are also known as “Leading” indicators. Lagging indicators provide data after a trend is confirmed, while non-lagging indicators provide data in real-time as the trend occurs. Most technical indicators are lagging indicators.

Is RSI a leading or lagging indicator

The relative strength index (RSI) is a technical indicator that can act as both a leading and lagging indicator. In its absolute sense, it is a lagging indicator, because the price has to move first for the indicator to start moving in that direction. It basically moves with the price, with a slight delay.

Is price a lagging indicator

The consumer price index (CPI), which measures changes in the inflation rate, is another closely watched lagging indicator. There are few events that cause more economic ripple effects than price increases.

Is unemployment rate a lagging indicator

Unemployment: Unemployment is often used to indicate economic strength, but is also a lagging indicator. Low unemployment is the result of economic growth, not the precursor.

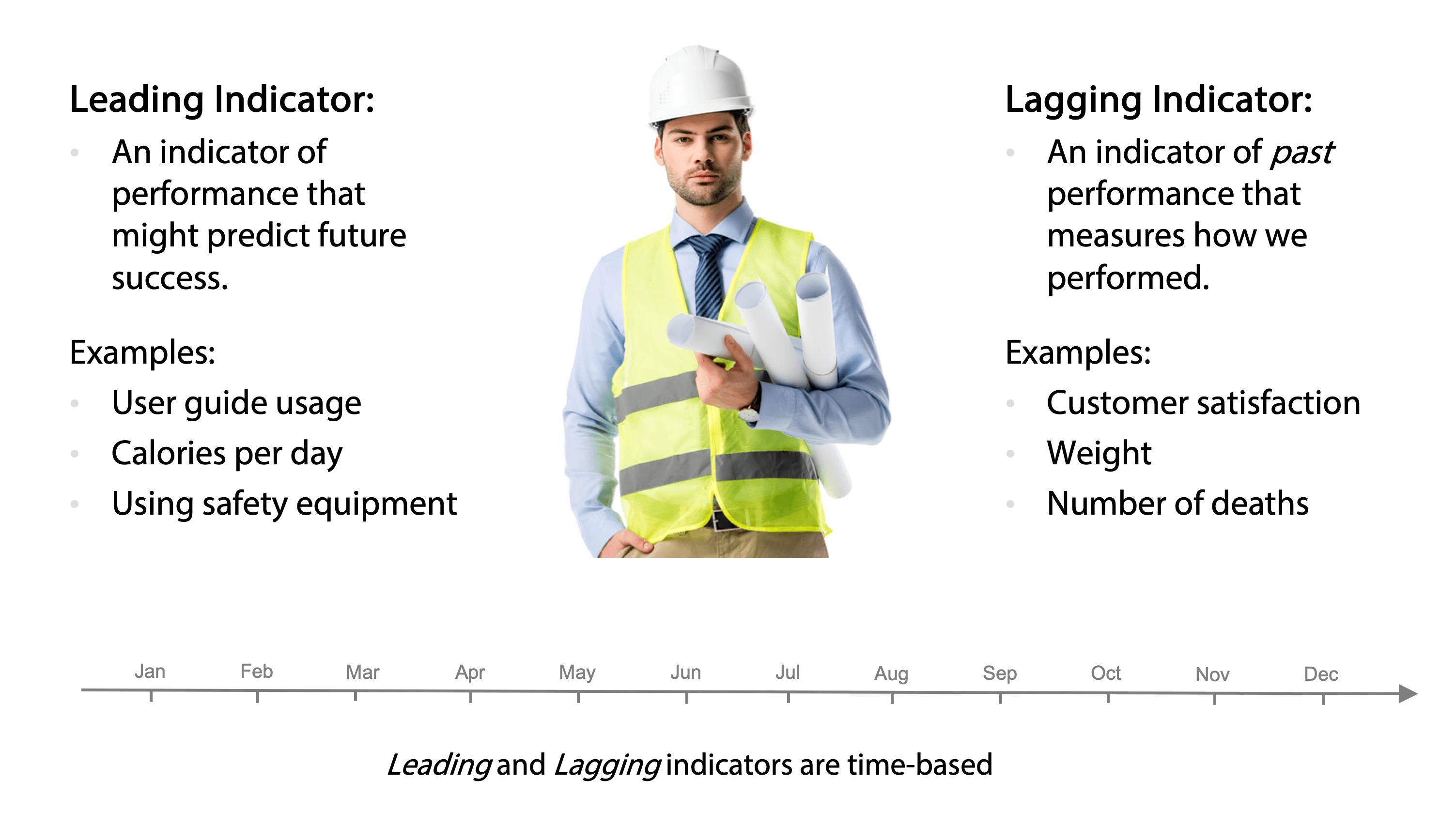

What is the difference between leading and lagging indicators

Lagging indicators take a long time to change, and show the later-stage results of your efforts. Leading indicators, on the other hand, measure the activities you think will help you reach your goal, and can be tracked on a more ongoing basis.

Is MACD leading or lagging

MACD is a lagging indicator. After all, all the data used in MACD is based on the historical price action of the stock. Because it is based on historical data, it must necessarily lag the price. However, some traders use MACD histograms to predict when a change in trend will occur.

Is EMA leading or lagging

Frequently used lagging indicators in the share market

1) Exponential moving average (EMA): It's a tool that gives more importance to the latest observations. That's how it is different from the simple moving average which gives equal importance to all data points. EMAs can be constructed for any length of time.

Are jobs a lagging indicator

The employment report is an example of a lagging indicator. Every month the Bureau of Labor Statistics publishes information on how many jobs the U.S. economy created and destroyed over the course of the previous month.

Is jobs a lagging indicator

The employment report is an example of a lagging indicator. Every month the Bureau of Labor Statistics publishes information on how many jobs the U.S. economy created and destroyed over the course of the previous month.

What is an example of a leading indicator

Leading indicator examples include the Consumer Confidence Index, Purchasing Managers' Index, initial jobless claims, and average hours worked.

Is RSI leading or lagging

Leading indicator: Relative Strength Index (RSI)

In its absolute sense, it is a lagging indicator, because the price has to move first for the indicator to start moving in that direction. It basically moves with the price, with a slight delay. That said, it can be a leading indicator.

Is ADX leading or lagging

A few limitations of using the ADX indicator are mentioned hereunder. This indicator is a lagging indicator and is used to identify trend changes.

Is Bollinger Band a lagging indicator

The Bollinger band tool is a lagging indicator, as it is based on a 20-day simple moving average (SMA) and two outer lines.

Are stocks a lagging indicator

Lagging indicators, however, reflect the economy's historical performance and changes to these are only identifiable after an economic trend or pattern has already been established. Though the stock market is not the most important indicator, it's the most well-known and widely followed leading indicator.

What are the 10 leading indicators

The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers' new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers' new orders for nondefense capital …

What are examples of leading and lagging indicators in healthcare

For example, medical call centers use lagging indicators such as the number of patients seen in a day, month, or year. They use leading indicators such as the number of new patients signing up for services daily.

Is EMA leading or lagging indicator

lagging indicator

Exponential Moving Average (EMA): The EMA is a lagging indicator that is a resultant from the SMA calculation; the only difference being that the EMA favours more recent price movements.

Is the S&P 500 a leading or lagging indicator

The S&P 500 is an element of the Index of Leading Economic Indicators, and we can see in the diagram below that they tend to move together (though the stock index experiences considerably more fluctuation than the leading indicators index).