What are lagging measures

A lagging indicator is an observable or measurable factor that changes sometime after the economic, financial, or business variable with which it is correlated changes. Some general examples of lagging economic indicators include the unemployment rate, corporate profits, and labor cost per unit of output.

What is an example of a lagging measure

A lagging indicator is an output measurement, for example; the number of accidents on a building site is a lagging safety indicator. The difference between the two is a leading indicator can influence change and a lagging indicator can only record what has happened.

What is a lagging measure in English

a measure of economic activity that relates to events or developments in the past, not to changes that have taken place since those events or developments: Profit is a lagging indicator since it reflects business activity that was completed in the past.

What are leading and lagging performance measures

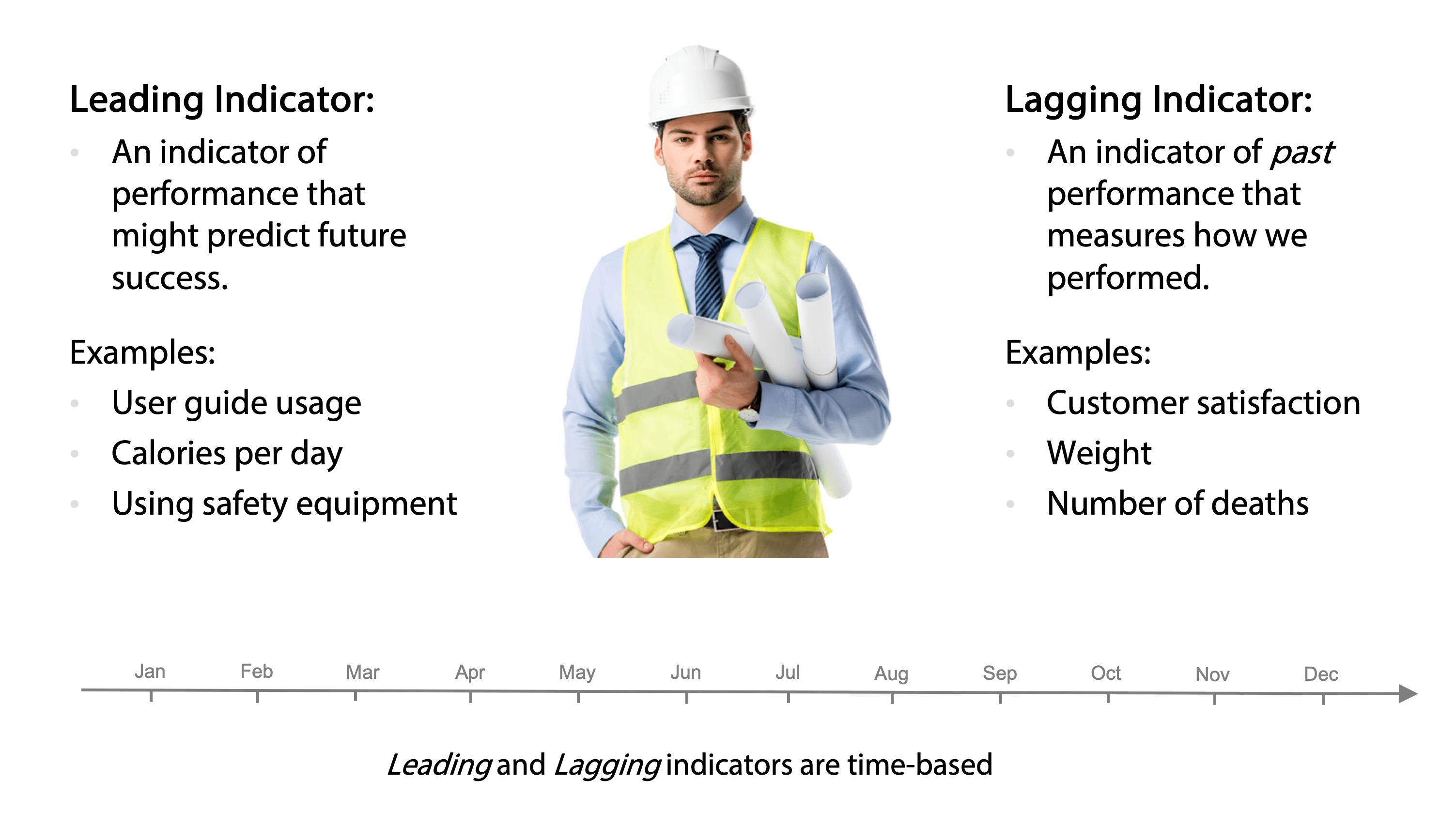

A leading indicator looks forward at future outcomes and events. A lagging indicator looks back at whether the intended result was achieved.

What is an example of a lagging KPI

The following are few examples: Lagging KPIs for a marketing campaign indicate whether sales have been generated and if so, how much Lagging KPIs can represent product revenue and hence product growth. Product ROI in terms of revenue can be used as a lagging KPI for product optimization.

What is lagging vs indicators

Leading indicators look ahead and attempt to predict future outcomes, whereas lagging indicators look at the past. Some people fixate on leading indicators, arguing that what happened in the past is useless. However, that's not true. Lagging indicators are very useful at confirming trends and changes in trends.

Is a KPI a lagging indicator

Lagging KPIs measure what has already happened, such as sales numbers and costs. These indicators provide valuable insight into your progress towards your goals and objectives.

What is lagging vs non lagging indicators

Lagging indicators are more accurate,while non-lagging indicators are more suitable for intraday trading. Fundamental traders should use lagging indicators because they are more reliable for long-term investing and they measure value based on historical data DTA $0.00003074 .

What is leading vs lagging examples

Leading indicators look forward, through the windshield, at the road ahead. Lagging indicators look backwards, through the rear window, at the road you've already traveled. A financial indicator like revenue, for example, is a lagging indicator. It tells you what has already happened.

What is leading or lagging strategy

A lead strategy is aggressive and involves increasing capacity in mere anticipation of an increase in demand. It may result in costly excess capacity. A lag strategy is conservative and involves increasing capacity only when there is an actual increase in demand.

What is an example of leading vs lagging KPI

Burn rate is a lagging indicator as it describes how much money is spent (or lost) for any period of time. The runway is a leading indicator as it predicts how long cash would last with a specific burn rate. A great example of the impact of leading and lagging KPIs is when a company does an Earnings Conference Call.

What are lagging and non-lagging indicators

Non-lagging indicators are also known as “Leading” indicators. Lagging indicators provide data after a trend is confirmed, while non-lagging indicators provide data in real-time as the trend occurs. Most technical indicators are lagging indicators.

What is lagging vs non-lagging indicators

Lagging indicators are more accurate,while non-lagging indicators are more suitable for intraday trading. Fundamental traders should use lagging indicators because they are more reliable for long-term investing and they measure value based on historical data DTA $0.00003074 .

What is the difference between lag and lead measures

Lead Measures vs Lag Measures. While Lag Measures such as reviewing revenues and reports may influence the chance of success in achieving goals, Lead Measures are the highest leveraged actions or activities that will get you moving forward to accomplish your goals with maximum outcomes and medium efforts.

What is leading and lagging KPI examples

Leading KPIs are used to predict changes in the company, but they are not always accurate.Leading indicators examples: % Growth in Sales Pipeline.Lagging indicators include the following: Annual Sales.Pop Quiz:Lagging indicators example:Current Ratio:AR Turnover:Runway and Burn Rate:

What is lead and lag strategy example

Example of Timing a Foreign Payment

it will accelerate the transaction (lead) before the price of the asset increases in U.S. dollar terms. If the company believes the Canadian dollar will weaken, it will hold off payment (lag) in the hope that the bill becomes cheaper in U.S. dollar terms.

What are lagging and leading OKRs

Lagging and leading indicators can be used together with the objective and key results (OKR), to determine the outcome of a business organization. Objectives and key results (OKRs) refers to the framework used to define and track objectives and the outcome, over a specific amount of time.

What are leading vs lagging indicators examples

Leading indicators give us real-time coaching opportunities — for example, looking at rep activities or call connects. Lagging indicators, such as revenue or quota attainment, tell us what's already happened. These measures give us the ability to review and strategize.

What is lead KPI vs lag KPI

These KPIs, such as the number of enquiries, help predict future sales and give you the ability to plan and make strategic decisions. The key difference between Leading and Lagging KPIs is that Leading KPIs indicate where you're likely to go, while Lagging KPIs only measure what you have already achieved.

What are lead and lag measures in project management

Lead indicators are after-the-event estimation fundamental to progress. It's an output measure that helps project managers record events and estimate results. Examples of lag indicators are counting the number of accidents on a worksite, employee turnover, or calculating how much sales you make in a month.

What is lag vs lead KPI

Lagging indicators take a long time to change and show the later-stage results of efforts. Leading indicators, on the other hand, measure the activities you think will help you reach your goal, and can be tracked on a more ongoing basis.

What is leading and lagging concept

Definition. For a given load, if the load current lags behind the voltage, then the power factor of the load is called lagging power factor. For a given load, if the load current leads or advances in phase the voltage, then the load power factor is called leading power factor.

What types of indicators are lagging

Moving Averages, MACD, and Bollinger Bands are three types of lagging indicators. They cannot predict the future as the lagging indicators shift only upon major economic events.

What is the difference between a lead and a lag

Leads are the predicted measurement of how long it will take to do something while lags measure how far behind a task or project phase is after it has started. A lead can include many lags but lags do not account for leads.

What is lagging in project management

In project management, lag can happen when two or more tasks that are dependent on each other are slowed down by an error along the way. When one is halted, the others have to wait until the issue is fixed in order to move on.