What is a lagging indicator and examples

A lagging indicator is an observable or measurable factor that changes sometime after the economic, financial, or business variable with which it is correlated changes. Some general examples of lagging economic indicators include the unemployment rate, corporate profits, and labor cost per unit of output.

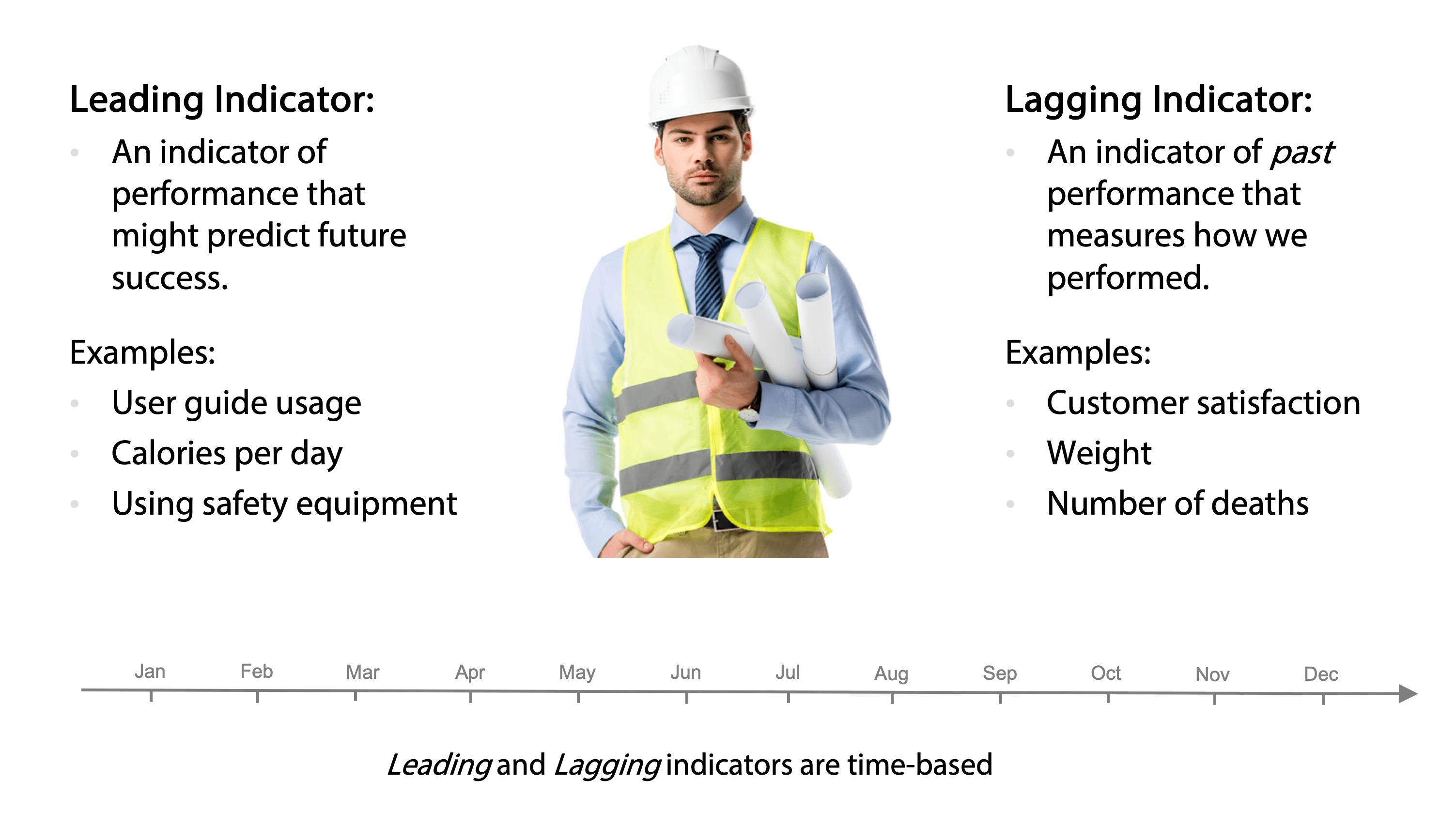

What is the difference leading and lagging indicators

Therein lies the main difference between the two: A leading indicator looks forward at future outcomes and events. A lagging indicator looks back at whether the intended result was achieved.

What is lagging vs non-lagging indicators

Lagging indicators are more accurate,while non-lagging indicators are more suitable for intraday trading. Fundamental traders should use lagging indicators because they are more reliable for long-term investing and they measure value based on historical data DTA $0.00003074 .

What are leading and lagging indicators examples

A leading indicator is a predictive measurement, for example; the percentage of people wearing hard hats on a building site is a leading safety indicator. A lagging indicator is an output measurement, for example; the number of accidents on a building site is a lagging safety indicator.

Is a KPI a lagging indicator

Lagging KPIs measure what has already happened, such as sales numbers and costs. These indicators provide valuable insight into your progress towards your goals and objectives.

What is the best lagging indicator

Three popular lagging indicatorsMoving averages.The MACD indicator.Bollinger bands.

What are leading and lagging indicators reliability

A leading indicator signals future events and includes metrics like Preventative Maintenance Compliance or Estimate vs. Actual Performance. Lagging indicators include maintenance metrics like Mean Time Between Failure (MTBF) and Mean Time to Repair (MTTR).

What types of indicators are lagging

Moving Averages, MACD, and Bollinger Bands are three types of lagging indicators. They cannot predict the future as the lagging indicators shift only upon major economic events.

Is KPI a leading or lagging indicator

These KPIs, such as the number of enquiries, help predict future sales and give you the ability to plan and make strategic decisions. The key difference between Leading and Lagging KPIs is that Leading KPIs indicate where you're likely to go, while Lagging KPIs only measure what you have already achieved.

What are leading and lagging indicators in KPI

Lagging indicators take a long time to change and show the later-stage results of efforts. Leading indicators, on the other hand, measure the activities you think will help you reach your goal, and can be tracked on a more ongoing basis.

What are indicators in KPI

Key performance indicators (KPIs) are targets that help you measure progress against your most strategic objectives. While organizations can have many types of metrics, KPIs are targets that are “key” to the success of your business.

Is RSI leading or lagging

Leading indicator: Relative Strength Index (RSI)

In its absolute sense, it is a lagging indicator, because the price has to move first for the indicator to start moving in that direction. It basically moves with the price, with a slight delay. That said, it can be a leading indicator.

Is GDP a lagging indicator

GDP: Gross Domestic Product (GDP) growth, used as a measure of economic health, is actually a lagging indicator of the economy, as the measure is always slightly behind the reality. While GDP growth provides valuable information about the economy, the measure doesn't point to the future but to the past.

Is inflation a lagging indicator

Is Inflation a Lagging Indicator Yes, inflation can be considered a lagging indicator. Inflation is defined as a period of rising prices, and when prices go up, people can't afford as much as they used to; therefore, inflation is also a period of declining purchasing power.

What are 5 types of indicators

In conclusion, there are various types of indicators used in monitoring and evaluation, including input, output, outcome, impact, efficiency, effectiveness, and sustainability indicators.

What are indicators examples

Indicators are weak acids or weak bases that show a change in colour as the concentration of Hydrogen ions in a solution changes or the pH of a solution changes. The indicators dissociate slightly in the water to form ions. Some examples of indicators are Litmus, turmeric, phenolphthalein, etc.

Is MACD leading or lagging

MACD is a lagging indicator. After all, all the data used in MACD is based on the historical price action of the stock. Because it is based on historical data, it must necessarily lag the price. However, some traders use MACD histograms to predict when a change in trend will occur.

Is EMA leading or lagging indicator

lagging indicator

Exponential Moving Average (EMA): The EMA is a lagging indicator that is a resultant from the SMA calculation; the only difference being that the EMA favours more recent price movements.

Is CPI a leading or lagging indicator

The consumer price index (CPI), which measures changes in the inflation rate, is another closely watched lagging indicator.

What are the 3 types of indicators

Indicators can be described as three types—outcome, process or structure – as first proposed by Avedis Donabedian (1966).

What are the 4 indicators

According to this typology, there are four types of indicators: input, output, outcome and impact.

How do you explain indicators

Indicators are statistics used to measure current conditions as well as to forecast financial or economic trends. In the world of investing, indicators typically refer to technical chart patterns deriving from the price, volume, or open interest of a given security.

Is ADX leading or lagging

A few limitations of using the ADX indicator are mentioned hereunder. This indicator is a lagging indicator and is used to identify trend changes.

Is GDP a lagging or leading indicator

GDP: Gross Domestic Product (GDP) growth, used as a measure of economic health, is actually a lagging indicator of the economy, as the measure is always slightly behind the reality. While GDP growth provides valuable information about the economy, the measure doesn't point to the future but to the past.

What are the 5 types of indicators

In conclusion, there are various types of indicators used in monitoring and evaluation, including input, output, outcome, impact, efficiency, effectiveness, and sustainability indicators.