What are leading and lagging indicators

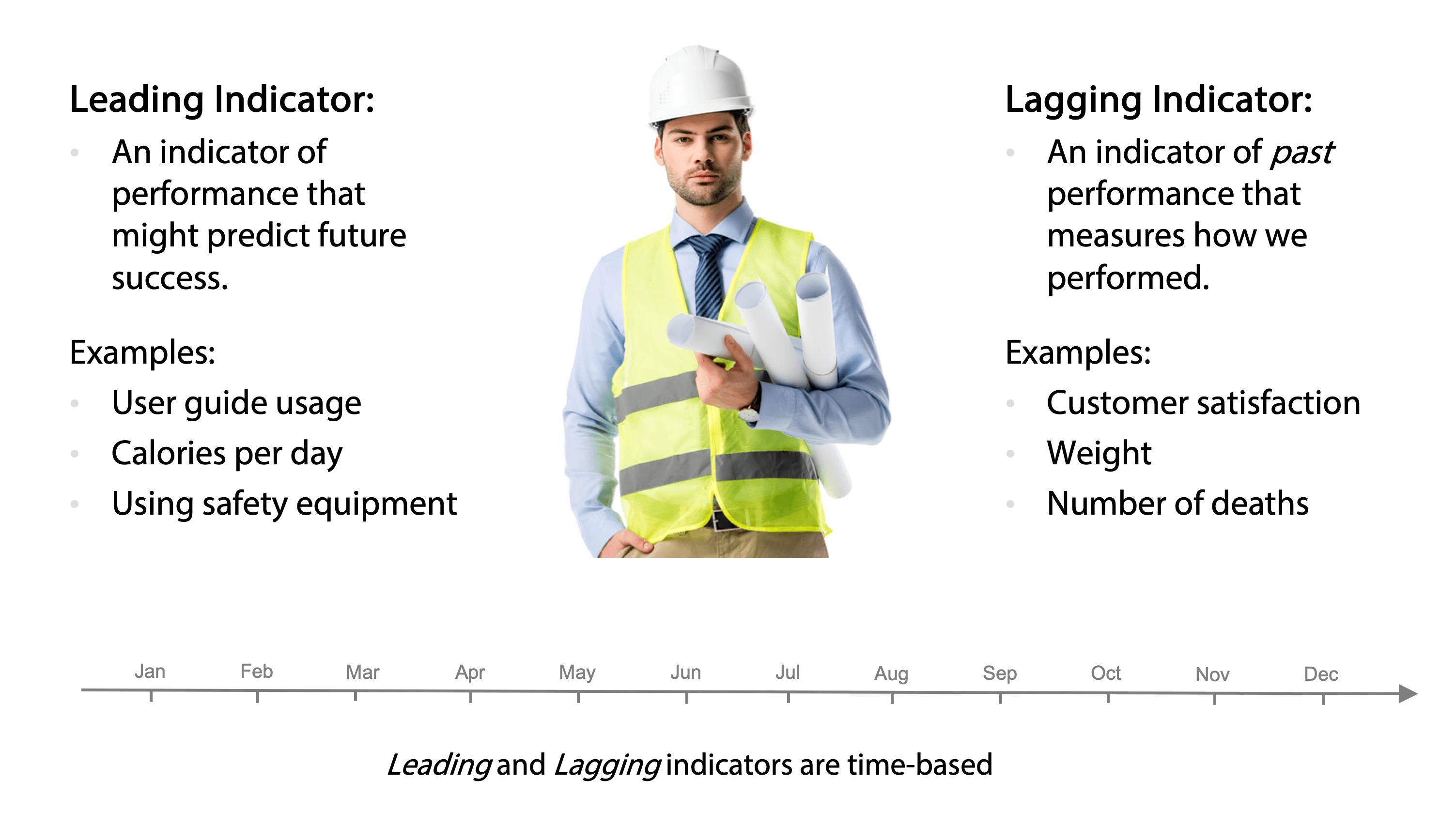

Leading indicators look ahead and attempt to predict future outcomes, whereas lagging indicators look at the past. Some people fixate on leading indicators, arguing that what happened in the past is useless. However, that's not true. Lagging indicators are very useful at confirming trends and changes in trends.

What is an example of a leading indicator

Leading indicator examples include the Consumer Confidence Index, Purchasing Managers' Index, initial jobless claims, and average hours worked.

What is the difference between leading and lagging indicators in trading

These indicators are generally of two types – lagging indicators and leading indicators. Lagging indicators are those which tell us about an event after it has happened whereas leading indicators are predictive in nature — they signal what is likely to happen.

What is a leading indicator

Leading indicators are proactive and preventive measures that can shed light about the effectiveness of safety and health activities and reveal potential problems in a safety and health program. Many employers are familiar with lagging indicators.

What is a lagging indicator example

A lagging indicator is an observable or measurable factor that changes sometime after the economic, financial, or business variable with which it is correlated changes. Some general examples of lagging economic indicators include the unemployment rate, corporate profits, and labor cost per unit of output.

What are leading and lagging indicators reliability

A leading indicator signals future events and includes metrics like Preventative Maintenance Compliance or Estimate vs. Actual Performance. Lagging indicators include maintenance metrics like Mean Time Between Failure (MTBF) and Mean Time to Repair (MTTR).

What is an example of a lagging indicator

A lagging indicator is an observable or measurable factor that changes sometime after the economic, financial, or business variable with which it is correlated changes. Some general examples of lagging economic indicators include the unemployment rate, corporate profits, and labor cost per unit of output.

What is an example of a lagging KPI

Burn rate is a lagging indicator as it describes how much money is spent (or lost) for any period of time. The runway is a leading indicator as it predicts how long cash would last with a specific burn rate. A great example of the impact of leading and lagging KPIs is when a company does an Earnings Conference Call.

What is leading KPI and lagging KPI

These KPIs, such as the number of enquiries, help predict future sales and give you the ability to plan and make strategic decisions. The key difference between Leading and Lagging KPIs is that Leading KPIs indicate where you're likely to go, while Lagging KPIs only measure what you have already achieved.

What is a lagging indicator

A lagging indicator is an observable or measurable factor that changes sometime after the economic, financial, or business variable with which it is correlated changes. Some general examples of lagging economic indicators include the unemployment rate, corporate profits, and labor cost per unit of output.

What are the 10 leading indicators

The ten components of The Conference Board Leading Economic Index® for the U.S. include: Average weekly hours in manufacturing; Average weekly initial claims for unemployment insurance; Manufacturers' new orders for consumer goods and materials; ISM® Index of New Orders; Manufacturers' new orders for nondefense capital …

What is an example of a leading lagging KPI

The following are few examples of leading KPIs: User adoption/retention rate: An increasing user adoption and retention rate can indicate that the product growth is in the right direction and product monetization goals (lagging KPIs) can be achieved.

What is the best lagging indicator

Three popular lagging indicatorsMoving averages.The MACD indicator.Bollinger bands.

What are leading and lagging indicators in data analytics

A leading indicator can be defined simply as a performance measurement that occurs before a process begins to follow a particular trend. A lagging indicator is the opposite: it is a measurement that indicates results after the process is complete.

What is lagging vs non-lagging indicators

Lagging indicators are more accurate,while non-lagging indicators are more suitable for intraday trading. Fundamental traders should use lagging indicators because they are more reliable for long-term investing and they measure value based on historical data DTA $0.00003074 .

What are 3 examples of lagging indicators

Some general examples of lagging indicators include the unemployment rate, corporate profits, and labor cost per unit of output. Interest rates can also be good lagging indicators since rates change as a reaction to severe movements in the market.

What is an example of leading vs lagging KPI

Burn rate is a lagging indicator as it describes how much money is spent (or lost) for any period of time. The runway is a leading indicator as it predicts how long cash would last with a specific burn rate. A great example of the impact of leading and lagging KPIs is when a company does an Earnings Conference Call.

What is an example of a lead and lag indicator in HR

For example, productivity is a leading KPI for labor cost. A lagging indicator refers to past developments and effects. This reflects the past outcomes of KPIs. If productivity is a leading HR KPI for labor cost, sickness rate would be a lagging KPI.

What is a lagging indicator and examples

Lagging indicators are variables, such as interest rates, profits, etc., that help analyze the market after the occurrence of a significant economic or financial event. For example, the increasing interest rates can indicate that the economy is in inflation.

Is KPI a leading indicator

A leading KPI indicator is a measurable factor that changes before the company starts to follow a particular pattern or trend. Leading KPIs are used to predict changes in the company, but they are not always accurate.

What is the best leading indicator

Four popular leading indicatorsThe relative strength index (RSI)The stochastic oscillator.Williams %R.On-balance volume (OBV)

What types of indicators are lagging

Moving Averages, MACD, and Bollinger Bands are three types of lagging indicators. They cannot predict the future as the lagging indicators shift only upon major economic events.

What is a lagging indicator in HR

Lagging HR indicators measure the performance of the HR function in a given period. They measure outcomes or end results that have already taken place. Below are some examples: Average cost per training man-day, cost of labor as % of total operating cost or total revenue, % of internal vs.

Are KPIs leading or lagging

These KPIs, such as the number of enquiries, help predict future sales and give you the ability to plan and make strategic decisions. The key difference between Leading and Lagging KPIs is that Leading KPIs indicate where you're likely to go, while Lagging KPIs only measure what you have already achieved.

Which are lagging indicators

A lagging indicator is an observable or measurable factor that changes sometime after the economic, financial, or business variable with which it is correlated changes. Some general examples of lagging economic indicators include the unemployment rate, corporate profits, and labor cost per unit of output.