What is the meaning of price change

Price change refers to the difference between a security's closing price on a trading day and its closing price on the previous trading day. A security's price likely is the most visible barometer of an issuer's financial health. Predicting price changes is one of the most critical parts of an analyst's job.

What causes price changes

By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.

How does stock price change

The demand and supply factor

If an increased number of people start investing in a particular share, its demand is high, so its prices start to soar. Conversely, if many people want to sell a particular stock simultaneously, its supply will increase, so its prices will fall.

What is the meaning of stock price movement

Stock prices are driven by a variety of factors, but ultimately the price at any given moment is due to the supply and demand at that point in time in the market. Fundamental factors drive stock prices based on a company's earnings and profitability from producing and selling goods and services.

How do you measure price change

The Consumer Price Index (CPI) is a measure of the average change overtime in the prices paid by urban consumers for a market basket of consumer goods and services.

What happens when prices change

Increased prices typically result in lower demand, and demand increases generally lead to increased supply. However, the supply of different products responds to demand differently, with some products' demand being less sensitive to prices than others.

What affects price changes

Supply and demand issues impact prices. Prices that people think are too high, known as price gouging, or a sudden increase in price are not illegal. Businesses must not mislead consumers about what they'll be charged or why. Businesses must set prices independently of their competitors.

What are the four basic cause of a price change

Now that the market is stable, we can start to figure out why prices and quantities change. There are only 4 things that can change a price: Demand increases, Demand decreases, Supply increases or Supply decreases.

What are 3 reasons why stock prices change

There are four main factors that can affect stock prices:Company news and performance.Industry performance.Investor sentiment.Economic factors.

What happens when stock prices rise

A steadily rising share price signals that a company's top brass is steering operations toward profitability. If shareholders are pleased, and the company is tilting towards success, as indicated by a rising share price, C-level executives are likely to retain their positions with the company.

How do you analyze price movement

Many traders use candlestick charts since they help better visualize price movements by displaying the open, high, low and close values in the context of up or down sessions. Candlestick patterns such as the Harami cross, engulfing pattern and three white soldiers are all examples of visually interpreted price action.

How do you analyze stock price movement

Key Takeaways

One popular form of stock analysis is fundamental analysis, the practice of using financial activity to forecast stock prices. Another popular form of stock analysis is technical analysis, the reliance of historical stock price activity to predict future price activity.

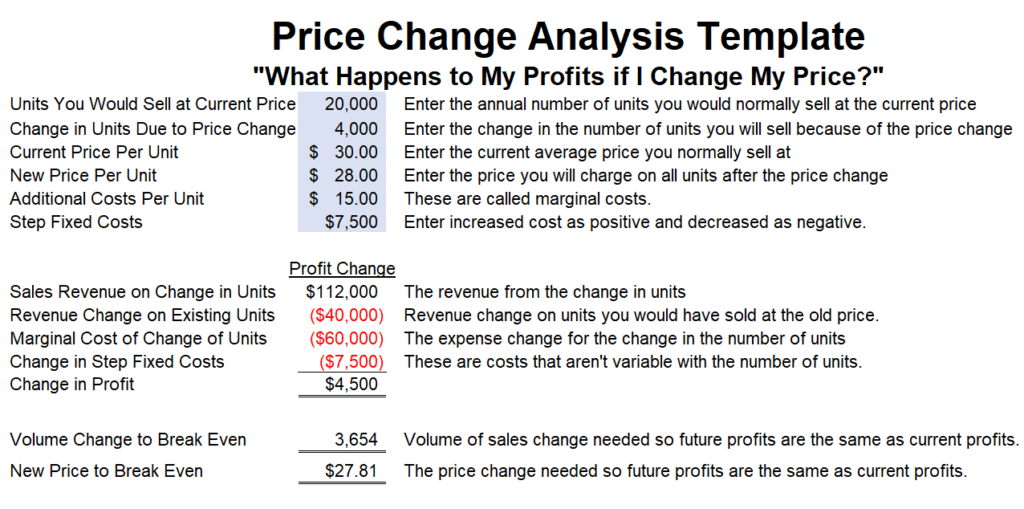

How do you calculate price change impact

Price Impact = Target Volume * (Actual Price – Target Price)

How do you measure change

These are some of the common ways in which change is often measured in projects:Change readiness surveys.Training evaluation surveys.Communications metrics.Employee sentiments/culture surveys.Change heatmaps.

What happens when prices rise

In an inflationary environment, unevenly rising prices inevitably reduce the purchasing power of some consumers, and this erosion of real income is the single biggest cost of inflation. Inflation can also distort purchasing power over time for recipients and payers of fixed interest rates.

What happens if the price increases

The Law of Demand

In other words, the higher the price, the lower the level of demand. Because buyers have finite resources, their spending on a given product or commodity is limited as well, so higher prices reduce the quantity demanded. Conversely, demand rises as the product becomes more affordable.

What are the 4 factors that affect price

Four Major Market Factors That Affect PriceCosts and Expenses.Supply and Demand.Consumer Perceptions.Competition.

What are the 5 factors that affect price

The main determinants that affect the price are:Product Cost.The Utility and Demand.The extent of Competition in the market.Government and Legal Regulations.Pricing Objectives.Marketing Methods used.

What are the three 3 factors affect pricing

Three important factors are whether the buyers perceive the product offers value, how many buyers there are, and how sensitive they are to changes in price.

What are 4 factors that affect stock prices

Many different forces can affect stock prices, including company news and performance, industry performance, investor sentiment, and economic factors.

What factors can change a stock market share price

Let's look at some of the most common drivers of stock prices over the short term.Economic factors. One area that has a big influence on stock prices is data related to the overall economy.Political news.Technical reasons.Earnings growth.Dividends.Change in valuation.

Do stock prices rise with inflation

Does inflation boost stock prices Though higher inflation isn't necessarily bad for stock prices, the hike in interest rates that tends to follow could be. Historically speaking, stock prices tend to go up when consumer prices do.

How do you predict stock price will go up or down

This method of predicting future price of a stock is based on a basic formula. The formula is shown above (P/E x EPS = Price). According to this formula, if we can accurately predict a stock's future P/E and EPS, we will know its accurate future price.

What is price analysis used for

A “price analysis” is an evaluation of the offeror's price relative to the prices being offered by other vendors and being paid by the general public for the same or similar items.

What is a price analysis a good analysis for

A price analysis is helpful when you're trying to price a tangible commercial product. This analysis is primarily based on how much vendors and consumers are willing to pay based on similar market items. The objective of conducting a price analysis is to determine if the price of goods is fair and reasonable.