What is the 100 age rule for investments

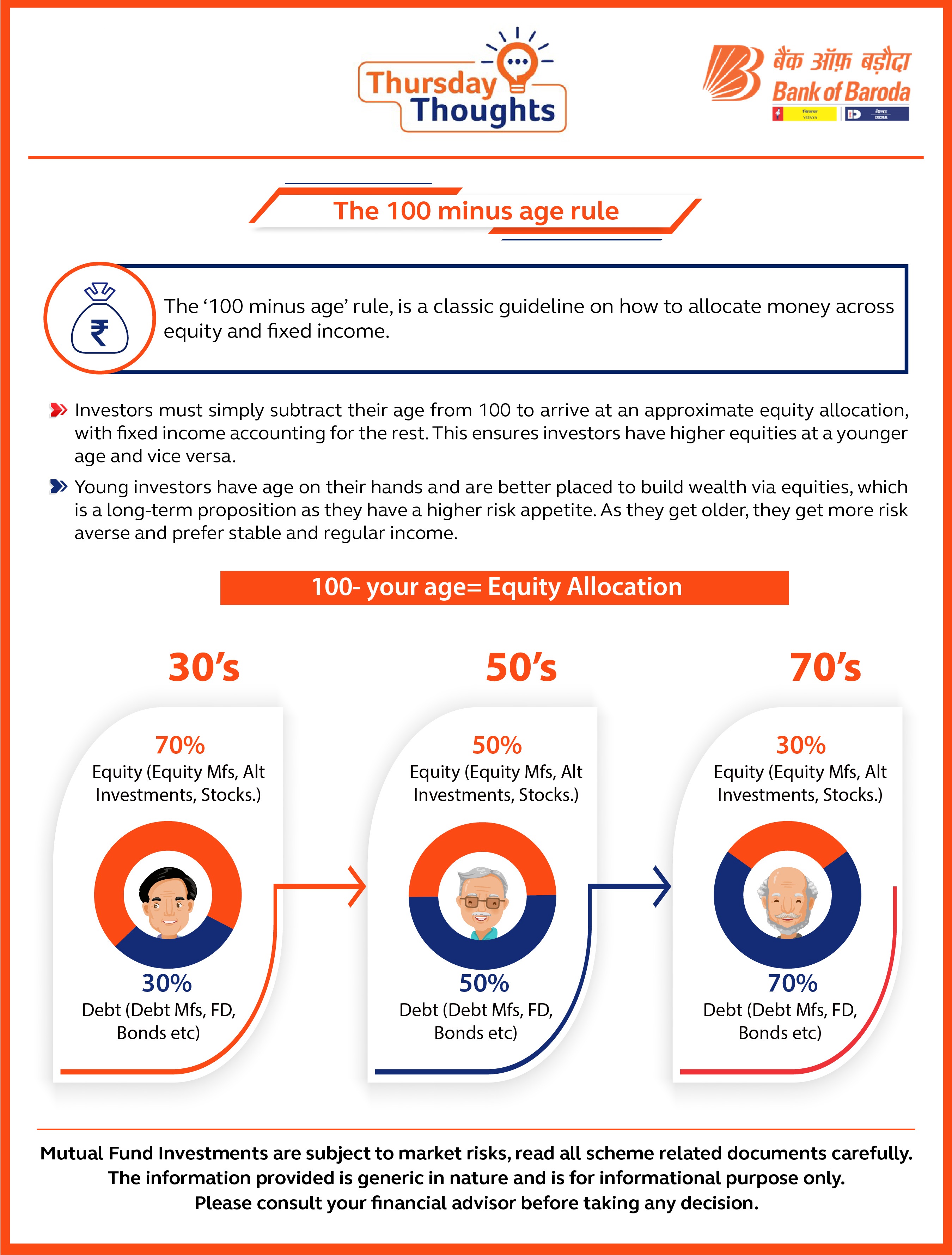

According to the '100 minus age' rule, an investor's portfolio should comprise 100 minus their age percentage of their surplus funds in equities and the remainder in debt.

What is the 100 minus your age rule

The '100 minus age' rule, is a classic guideline on how to allocate money across equity and fixed income. Investors must simply subtract their age from 100 to arrive at an approximate equity allocation, with fixed income accounting for the rest.

What is the 10 5 3 rule

In this regard, as one of the basic rules of financial planning, the asset allocation or 10-5-3 rule states that long-term annual average returns on stocks is likely to be 10%, the return rate of bonds is 5% and cash, as well as liquid cash-like investments, is 3%.

What is the 10 year rule on investing

This means any gain attributable to depreciation recapture or ordinary income assets might go away—as long as the investor holds that asset for 10 years or longer.

Is 25 too late to invest

No matter how old you are, the best time to start investing was a while ago. But it's never too late to do something. Just make sure the decisions you make are the right ones for your age—your investment approach should age with you.

What is the 120 rule in stocks

The 120-age investment rule states that a healthy investing approach means subtracting your age from 120 and using the result as the percentage of your investment dollars in stocks and other equity investments.

What is the 120 your age rule

What Is the 120-Age Investment Rule The 120-age investment rule states that a healthy investing approach means subtracting your age from 120 and using the result as the percentage of your investment dollars in stocks and other equity investments.

What is the 120 minus age rule

The Rule of 120 (previously known as the Rule of 100) says that subtracting your age from 120 will give you an idea of the weight percentage for equities in your portfolio. The remaining percentage should be in more conservative, fixed-income products like bonds.

What is the 70 10 10 10 strategy

His 70/10/10/10 rule is widely respected and well known. In a nutshell Mr Rohn argues to achieve financial success we should allocate 70% of our income for living expenses, 10% for savings, 10% for investment and 10% for personal development.

What is 10 10 10 investment rule

Focus on 10 stocks for the period of 10 months and keep a target of a maximum 10 per cent of your stock portfolio allocation per stock if you are an investor. If you are a trader target not more than 10% loss per month out of your fixed allocated trading capital.

What is the 120 rule in investing

The Rule of 120 (previously known as the Rule of 100) says that subtracting your age from 120 will give you an idea of the weight percentage for equities in your portfolio. The remaining percentage should be in more conservative, fixed-income products like bonds.

What is the rule of 100

The age-old rule of 100 is a concept that places every saver into a generic one-size-fits-all approach to 'retirement planning. ' The rule states: Beginning with 100, subtract your age – this number gives you the percentage of your money that should be invested in stocks (equities) within your portfolio.

Should I invest at age 20 or 30

For example, as we saw above, if your goal is to have $1 million at age 65 and you save just under $4,500 each year starting at age 20, there's a good chance you'd meet your goal. If you start at age 30 instead, you'll have to save about $9,000 each year for the same chance at reaching your goal.

Is 21 too late to invest

No matter how old you are, the best time to start investing was a while ago. But it's never too late to do something. Just make sure the decisions you make are the right ones for your age—your investment approach should age with you.

What is the 90 100 rule stocks

In applying the "90 to 100" approach, there is a list of some factors that investors should consider:Start by looking for stocks priced between $90 – $93 per share.The stock must have a positive overall trend.The stock needs to be a relative strength buy compared to its benchmark index.

What is the 80-20 rule in trading

Based on the application of famed economist Vilfredo Pareto's 80-20 rule, here are a few examples: 80% of your stock market portfolio's profits might come from 20% of your holdings. 80% of a company's revenues may derive from 20% of its clients. 20% of the world's population accounts for 80% of its wealth.

What is the 110 minus your age rule

It is a simple way to figure out what percentage of your portfolio should be kept in stocks. To determine this number, you simply take 110 minus your age. So, if you are 40, then the rule states that 70% of your portfolio should be kept in stocks.

What is the 120 minus your age heuristic

The “120 minus your age” Rule

This rule calculates a percentage to be dedicated to equity holdings in any investor's portfolio by the equation 120 – Investor age. For example, a 30-year-old investor would allocate 120-30 = 90, or 90% of their portfolio to stocks.

What is the 120 age formula

The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to 100 minus your age. So if you're 40, you should hold 60% of your portfolio in stocks. Since life expectancy is growing, changing that rule to 110 minus your age or 120 minus your age may be more appropriate.

What is 120 age asset allocation

For example, if you're 30 years old, subtracting your age from 120 gives you 90. Therefore, you would invest 90% of your retirement money in stocks and 10% into more consistent financial instruments. This rule creates a portfolio that gradually carries less risk.

What is 60 30 10 strategy

According to this rule, 60% of an employee's income should be saved or invested. 30% should be allocated to necessities such as housing, food, and transportation. And the remaining 10% should be allocated to personal expenses such as entertainment, clothing, and hobbies.

What is the 10-10-10 rule explained

A great way to prioritize and make decisions is to apply the 10/10/10 rule – which helps analyze the short-term and long-term consequences of your work-life balance decisions. This decision framework was created by writer and author Suzy Welch, and her original model uses 10 minutes, 10 months, and 10 years.

What is the 70 20 10 rule investing

The 70-20-10 rule holds that: 70 percent of your after-tax income should go toward basic monthly expenses like housing, utilities, food, transportation, and personal living expenses; 20 percent should be saved or put into investments, leaving 10 percent for debt repayment.

What is the 80 20 rule investments

Pareto's principle, better known as the 80/20 rule, asserts that 80% of the results can be achieved with 20% of the effort. When applied to investing, many folks may come to the same conclusion that 80% of their returns are generated from only 20% of their asset allocations.

What is the 80-20 20 rule investing

In investing, the 80-20 rule generally holds that 20% of the holdings in a portfolio are responsible for 80% of the portfolio's growth. On the flip side, 20% of a portfolio's holdings could be responsible for 80% of its losses.