What is the 50 year average stock market return

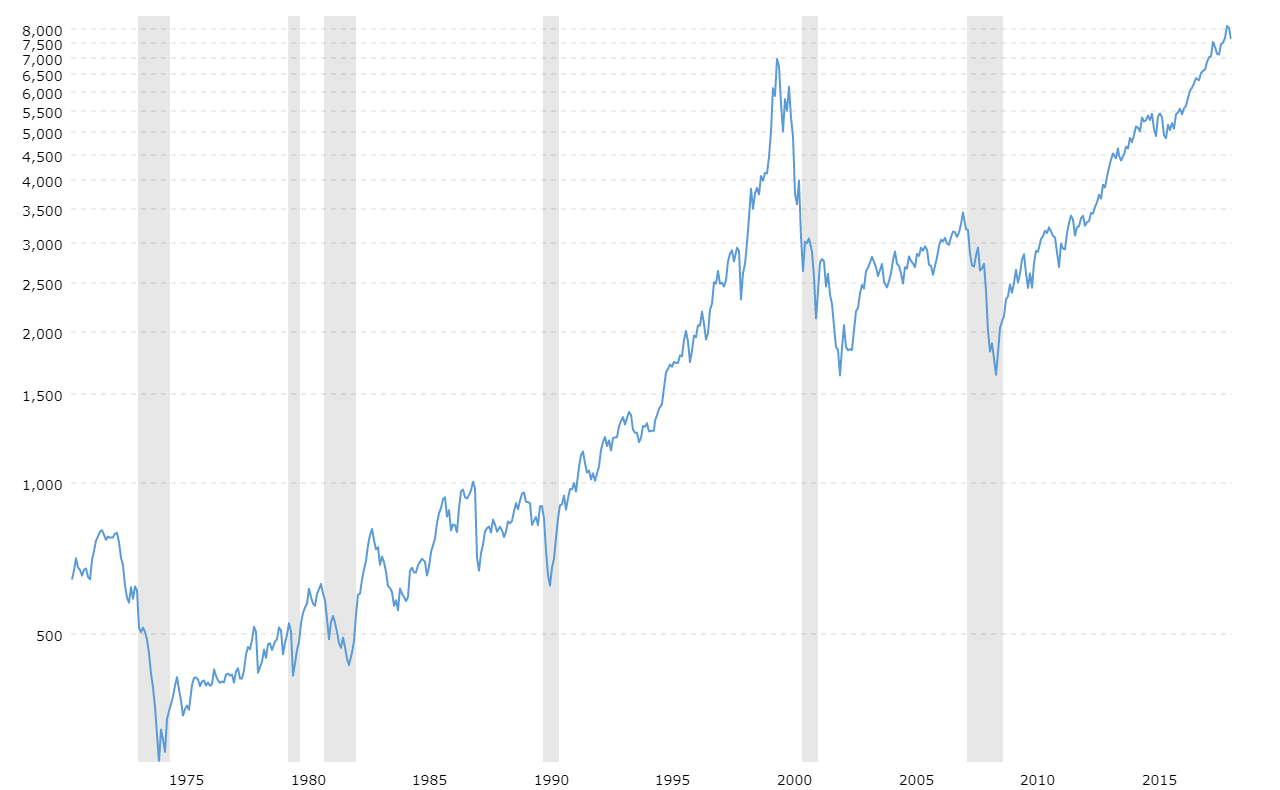

Stock Market Average Yearly Return for the Last 50 Years

The average yearly return of the S&P 500 is 10.749% over the last 50 years, as of the end of June 2023. This assumes dividends are reinvested. Adjusted for inflation, the 50-year average stock market return (including dividends) is 6.564%.

What is the average return of the Nasdaq over 20 years

Average Market Return for the Last 20 Years

The average stock market return for the last 20 years was 8.91% (6.40% when adjusted for inflation), which is lower than the average 10% return.

What is the average rate of return for the Nasdaq

The Nasdaq 100 index saw its lowest performance in 2008, with a return rate of -41.89 percent, while the largest returns were registered in 1999, at 101.95 percent. As of April 14, 2023, the rate of return of Nasdaq 100 Index stood at 19.56 percent.

What is the 50 year average return on the Dow Jones

The stock market has returned an average of 10% per year over the past 50 years.

What is the 30 year average stock market return

The S&P's annualized average return for the past 30 years is 7.9%. From the time it adopted 500 stocks into the index in 1957 through June 29, 2023 it has an average total return of 7.2% annualized, including reinvested dividends.

What is the 30 year average return on the Dow Jones

The Dow Jones average return is 8.70%, as measured by the SPDR Dow Jones Industrial ETF (DIA), from its January 1998 inception through March 2022. The Dow Jones, which consists of 30 stocks, was once the performance benchmark for the stock market.

What is the return of the Nasdaq 100 in 15 years

S&P 500 Index Versus Nasdaq 100 Performance

Over the past 15 years, Nasdaq 100 has delivered a CAGR of around 16%, while S&P 500 has returned about 8%.

What is the average market return over 30 years

The S&P's annualized average return for the past 30 years is 7.9%. From the time it adopted 500 stocks into the index in 1957 through June 29, 2023 it has an average total return of 7.2% annualized, including reinvested dividends.

What is the 10 year return of the Nasdaq 100

The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%. You could have earned a maximum 10-year CAGR return of 21% by investing in Nasdaq 100, while in the case of S&P 500, you could have earned a maximum return of 14% in the past 15 years.

What is the average market return 30 years

The S&P's annualized average return for the past 30 years is 7.9%. From the time it adopted 500 stocks into the index in 1957 through June 29, 2023 it has an average total return of 7.2% annualized, including reinvested dividends.

What is the average stock market return over 40 years

Here's a sample breakdown of stock market returns over time, assuming you invested $100 at the beginning of the time period listed: 40 Years (1982 – 2022): 11.6% annual return. 30 Years (1992 – 2022): 9.64% annual return. 20 Years (2002 – 2022): 8.14% annual return.

What is the average stock market return 20 years

5-year, 10-year, 20-year and 30-year S&P 500 returns

| Period (start-of-year to end-of-2022) | Average annual S&P 500 return |

|---|---|

| 5 years (2018-2022) | 7.51% |

| 10 years (2013-2022) | 10.41% |

| 20 years (2003-2022) | 7.64% |

| 30 years (1993-2022) | 7.52% |

30 thg 5, 2023

What is the 10 year return on the S&P 500

S&P 500 10 Year Return (I:SP50010Y)

S&P 500 10 Year Return is at 177.1%, compared to 156.3% last month and 177.9% last year. This is higher than the long term average of 112.9%.

What is the return of the S&P 500 after 10 years

S&P 500 10 Year Return is at 177.1%, compared to 156.3% last month and 177.9% last year.

What will S&P 500 be in 10 years

Where does the RA formula see the S&P 500 index 10 years hence The net 3.2% annual increase in share prices would mean the 500 hits 6000 in June of 2033, just 37% above its close of 4381 on June 22.

How much would $8000 invested in the S&P 500 in 1980 be worth today

To help put this inflation into perspective, if we had invested $8,000 in the S&P 500 index in 1980, our investment would be nominally worth approximately $951,129.45 in 2023. This is a return on investment of 11,789.12%, with an absolute return of $943,129.45 on top of the original $8,000.

What is the average stock market return over 20 years

5-year, 10-year, 20-year and 30-year S&P 500 returns

| Period (start-of-year to end-of-2022) | Average annual S&P 500 return |

|---|---|

| 5 years (2018-2022) | 7.51% |

| 10 years (2013-2022) | 10.41% |

| 20 years (2003-2022) | 7.64% |

| 30 years (1993-2022) | 7.52% |

30 thg 5, 2023

What is the return of the S&P 500 for 2 years

S&P 500 2 Year Return (I:SP5002YR)

S&P 500 2 Year Return is at 3.56%, compared to -0.58% last month and 22.10% last year. This is lower than the long term average of 14.39%.

What has the S&P 500 averaged over the last 30 years

5-year, 10-year, 20-year and 30-year S&P 500 returns

| Period (start-of-year to end-of-2022) | Average annual S&P 500 return |

|---|---|

| 5 years (2018-2022) | 7.51% |

| 10 years (2013-2022) | 10.41% |

| 20 years (2003-2022) | 7.64% |

| 30 years (1993-2022) | 7.52% |

30 thg 5, 2023

What is the Nasdaq forecast for 2030

Wallet Investor's five-year projection showed the index at 16,000, indicating a bullish Nasdaq 100 forecast for 2030 at new all-time highs. However, the long-term Nasdaq 100 price prediction from Long Forecast Agency was neutral, predicting that the index could close in 2023 at 14,993 with a maximum value of 15,950.

What if I invested $1000 in S&P 500 10 years ago

And if you had put $1,000 into the S&P 500 about a decade ago, the amount would have more than tripled to $3,217 as of April 20, according to CNBC's calculations.

What is the average 30 year market return

5, 10, 20, and 30-Year Return on the Stock Market

| Average Rate of Return | Inflation-Adjusted Return | |

|---|---|---|

| 5-Year (2017-2021) | 18.55% | 15.19% |

| 10-Year (2012-2021) | 16.58% | 14.15% |

| 20-Year (2002-2021) | 9.51% | 7.04% |

| 30-Year (1992-2021) | 10.66% | 8.10% |

2 thg 1, 2023

What is the lowest 30 year return on the S&P 500

The lowest annual return over any 30 year period going back to 1926 was 7.8%. That's what you got had you invested at the peak of the Roaring 20s boom in September 1929. You would have lost more than 80% of your investment in the ensuing crash and still made more than 850% in total over 30 years.

What is the S&P average over 40 years

The index acts as a benchmark of the performance of the U.S. stock market overall, dating back to the 1920s. The index has returned a historic annualized average return of around 11.88% since its 1957 inception through the end of 2021.

What was the S&P 500 rate of return last 50 years

This is a return on investment of 258,151.88%, or 11.28% per year.