Is there a difference between a personal and business bank account

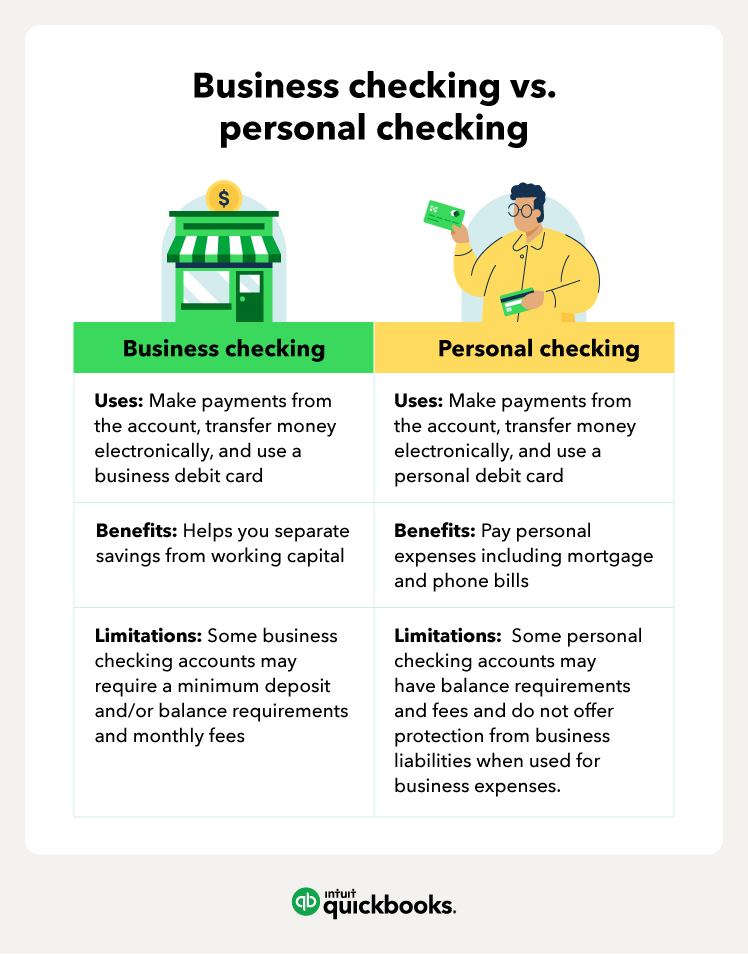

A business checking account helps business owners hold and manage money made within a company. Personal checking accounts help individuals hold and manage their personal funds.

Can I use my personal bank account for business

Legally, you can use your personal bank account for both business and non-business transactions, or you can set up a second personal bank account to use for your business. As a limited company is a separate legal entity, it needs to have its own business bank account.

Should I use a different bank for personal and business

If you have a sole proprietorship, to ensure FDIC coverage of all of your deposits, you should keep your personal and business checking accounts at different banks if the total sum of both accounts will exceed $250,000.

Why would you want a business account instead of just a personal account

Having a separate business account makes it easier to manage your business. You can collect receipts in the account, as well as write checks for expenses. That will be much easier to manage than if you're attempting to do it all through a personal account.

Is business account better than personal

Protecting Assets

According to the Small Business Administration, business checking accounts can offer limited liability protection to business owners. Additionally, enrolling in merchant services can offer purchase protections to your customers and keep their personal information secure.

Why should I use a business bank account

It makes your business more trustworthy

It's important that your customers and suppliers feel safe and secure using your business. By making payments to and from a business account instead of your personal one, they'll feel more comfortable straightaway.

What is the risk between a personal account and a business account

Using a personal bank account for business purposes can blur the lines between personal and business assets, making it difficult to protect your personal assets in case of a lawsuit or debt. If your business is sued, your personal assets can be at risk if they are not clearly separated from your business assets.

Can I use my savings account for business

Several small scale businesses use a savings account as their primary business account because their earnings and transactions may be limited. A savings account that can be managed online can even be managed on the go.

What are the risks between personal and business accounts

Using a personal bank account for business purposes can blur the lines between personal and business assets, making it difficult to protect your personal assets in case of a lawsuit or debt. If your business is sued, your personal assets can be at risk if they are not clearly separated from your business assets.

What are the disadvantages of a business bank account

Drawbacks of a Business Bank Account

Minimum balance or minimum opening deposit requirements: If your business is very small, you need to check to see if the business bank account you want has a minimum balance or minimum opening deposit requirement.

Is there an advantage to having a business account

Image is important in business, and having a separate business bank account can help to create a more professional image when dealing with suppliers and clients. It could help to build up your credibility and make you appear more trustworthy to clients, who may feel reluctant to send payments to a personal account.

Who should have a business bank account

If you run a limited company, a separate business bank account is not a legal requirement, but it is recommended. As a limited company is a separate legal entity, the money belongs to the business rather than you and it needs to be kept separate.

Is your money safe in a business bank account

How is my money protected FSCS protects you up to £85,000 in total across all accounts you hold within the bank/banking group. If you're a sole trader, your company is not treated as a separate entity. That means FSCS can protect up to £85,000 in total across all personal and business accounts you hold with the bank.

What is the purpose of a business account

Business accounts are used to track the cash balance, money owed to the business, money owed to creditors and payroll paid to employees. The number of accounts a business needs will vary, but business accounts are universal for all businesses.

What is the point of a business bank account

It can keep you legally compliant, provide some financial security and help you appear more professional to customers and vendors. Plus, having one account for the sole purpose of collecting from customers and paying your vendors makes it easier to log transactions and manage your business.

Do you need to have a business bank account

Do you need a business bank account If you are a sole trader, you are not legally required to have a separate business account and you can usually use your personal bank account to manage your business and non-business finances.

What is the purpose of a business bank account

It can keep you legally compliant, provide some financial security and help you appear more professional to customers and vendors. Plus, having one account for the sole purpose of collecting from customers and paying your vendors makes it easier to log transactions and manage your business.

What is the advantage of a business account

Separate business accounts help you track business expenses, present a more professional business image, and take advantage of tax deductions and credits available to small business owners while avoiding tax and accounting problems.

Can I just open a business bank account

You can open a business bank account once you've gotten your federal EIN. Most business bank accounts offer perks that don't come with a standard personal bank account. Protection. Business banking offers limited personal liability protection by keeping your business funds separate from your personal funds.

What are the features of a business bank account

Business Bank Accounts Offer More Services

You can also set limits on business debit card use. Depending on your account tier, you may also receive benefits such as unlimited transactions, earning interest on your cash reserves, and lower-cost cash and change processing.

What are the disadvantages of opening a business bank account

Drawbacks of a Business Bank Account

Minimum balance or minimum opening deposit requirements: If your business is very small, you need to check to see if the business bank account you want has a minimum balance or minimum opening deposit requirement.

Do I need a new bank account for my business

Why do you need a separate bank account for your company Opening a business bank account is an important first step to establishing your small business. If your company is incorporated, then you should handle all of its financial transactions through your business, especially those related to taxes.

What is the benefit of a business bank account

With a business checking account, you can accept not just credit card payments, but mobile payment options like Cash App and Square, ACH transfers, wire transfers, and more. This makes it easier to accept payments for invoices, services, and physical products, particularly if you conduct most of your business online.