What is considered an accounting firm

An accounting firm is a group of accounting professionals that provides clients with financial management services. These services could include auditing, tax preparation and planning, payroll processing, bookkeeping, and advisory services.

What is the difference between an accounting firm and a CPA firm

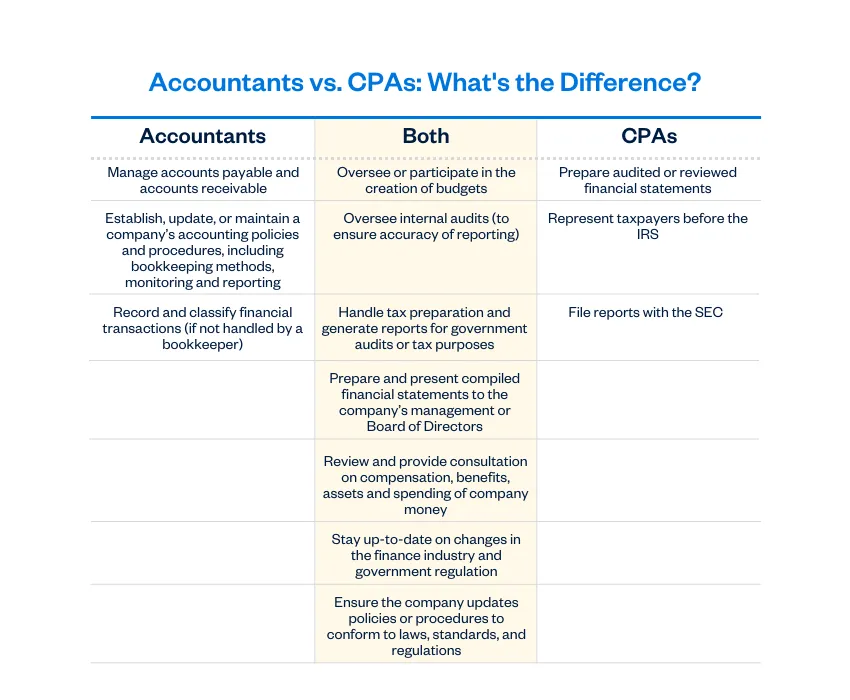

First, it should be noted that CPAs are permitted to represent taxpayers before the IRS. Accountants, on the other hand, do not have standing with the IRS and can thus, not represent clients before the Internal Revenue Service. CPAs can also sign tax returns and represent clients during tax audits. Accountants cannot.

What is the difference between accountant and accounting

In broad terms, accountancy covers the principles that guide the creation and use of financial records, while accounting refers to the process of maintaining those records.

Is an accounting firm a business

Starting an accounting firm is like starting any small business – it requires a lot of work. However, industry and consulting firms list accounting firms as one of the single most profitable small businesses a person can start right now.

Is PwC an accounting firm

It is the second-largest professional services network in the world and is considered one of the Big Four accounting firms, along with Deloitte, EY and KPMG. PwC firms are in 157 countries, across 742 locations, with 328,000 people.

What does an accountant do in a firm

An Accountant helps businesses make critical financial decisions by collecting, tracking, and correcting the company's finances. They are responsible for financial audits, reconciling bank statements, and ensuring financial records are accurate throughout the year.

Is PwC an accountancy firm

PricewaterhouseCoopers International Limited is a British multinational professional services brand of firms, operating as partnerships under the PwC brand. It is the second-largest professional services network in the world and is considered one of the Big Four accounting firms, along with Deloitte, EY and KPMG.

Is a CPA better than an accountant

A CPA is better qualified than an accountant to perform some accounting duties, and recognized by the government as someone who is credible and an expert in the field. Individuals who have received a CPA designation are trained in generally accepted accounting principles and best practices (including online tools).

Who is higher than an accountant

A controller, or comptroller, oversees the accounting operations of a firm, including managing staff. Because controllers' duties and responsibilities expand beyond that of an accountant, they typically command larger salaries.

Is there a difference between firm and business

Conclusion. A business that sells goods and services for a profit, often professional services, is referred to as a firm. On the other hand, a company is a business that engages in any activity that generates money via the sale of products and services, which covers all commercial trades and structures.

Is Big 4 an accounting firm

What is the Big 4 The Big 4 are the four largest international accounting and professional services firms. They are Deloitte, EY, KPMG and PwC. Each provides audit, tax, consulting and financial advisory services to major corporations.

Is Deloitte an accounting firm or consulting firm

Deloitte is a leading global provider of audit and assurance, consulting, financial advisory, risk advisory, tax, and related services.

Is an accounting firm a good business

Running an accounting business requires a different set of skills and experience than working as an employee. As with any small business, establishing an accounting practice entails a great deal of work, but as Thomson Reuters notes, accounting firms are currently among the most profitable of all small businesses.

Why work for a CPA firm

Variety and Responsibility: In a local firm, you're very likely to be involved with all aspects of a client project, gaining valuable on-the-job experience; it is common for staff members to obtain a significant overview and understanding of numerous industries and the accounting activities that affect a business.

Why CPA is better than ACCA

Key Differences ACCA vs CPA

CPA works for the Regulator of a business, whereas ACCA is the Advance module of Finance. The work experience required for ACCA is 1-2 years, whereas CPA requires 3 years. Both ACCA vs CPA degrees requires a minimum qualification of graduation.

What is a lower position than an accountant

The accounting pyramid organizes accounting-related job titles into a hierarchy that ranks them by responsibilities and deliverables, with bookkeepers at the bottom, accountants in the middle, and the Chief Financial Officer (CFO) at the top.

What is the lowest level of accountant

Junior Accountant

An entry-level accounting position, usually reporting to any of the higher level accounting positions, or in smaller companies, to the controller. They may or may not have a bachelor's degree, and their main responsibilities will usually include reconciling accounts and preparing preliminary reports.

Why is a company called a firm

According to the Online Etymology Dictionary, in 1744, the term first emerged in the English language with the meaning of 'business house'. It is believed to have come from the German Firma meaning 'a business, name of a business,' which came from the Italian word Firma, meaning 'signature' and Firmare 'to sign'.

Which is better firm or company

Once registered, a company becomes a separate legal entity and can sue and can be sued under its name. A firm is not a separate legal entity and cannot contract with third parties under its name. For a registered company, the minimum capital requirement is 1 lakh in a private company and 5 lakh in a public limited.

Is PwC a big accounting firm

These Big 4 are the four largest public accounting firms in the world: Deloitte. PricewaterhouseCoopers (PwC) Ernst & Young.

What is the advantage of accounting firm

Save Money on Business Costs

You will know exactly where your money goes in terms of costs such as rents, insurance, interest rates, staff salaries etc. Targeting challenging areas will help liquidity and solvency of your business and give you a peace of mind at the same time.

Why small accounting firms are better

HEALTHY WORK-LIFE BALANCE

The larger a company gets, the more obstacles get in the way of prioritizing people over profit. Small accounting firms are more likely to provide employees with fluid, flexible, and realistic job schedules and a less pressure-laden work environment.

What is a small accounting firm

Small accounting firms are local and regional firms with a few employees.

What makes a good accounting firm

Diversifying Services

The most successful accounting firms don't just offer a single service; they have a diversified list of services available for their clients. Why does this make them so much more successful If you offer a diversified package of services, you'll appeal to a more diverse client base.

Is ACCA higher than CPA

It is typically lower than CPA. Time: On average, it takes a candidate 3 – 4 years to get the ACCA certificate if they clear the examination on the first attempt and then gain three years of practical experience.