What is the format of VAT no in Spain

Vat No. Spain ESX9999999X 9 characters (The first and last characters may be alpha or numeric; but they may not both be ES Número de Identificación Fiscal (formerly named Código de Identificación Fiscal) NIF (CIF) Sweden SE999999999999 12 digits SE VAT-nummer or momsnummer or momsregistreringsnumm er Momsnr.

What is the format of VAT registration number

In England, Scotland, and Wales, a VAT number consists of the letters 'GB' followed by nine numbers. An example of a VRN that follows the UK VAT number format could be 'GB123456789'. If your business is located in Northern Ireland and you trade to the EU, you will use the prefix “XI” instead of GB.

What is the VAT ID number

Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT.

What is the intra EU VAT number

What's an Intra-community VAT number An Intra-Community VAT number individually identifies the companies liable for VAT in each EU Member State, whether they are established in that country or not. It may also be referred to as a “Tax Identification Number” (TIN) or “VAT registration number“.

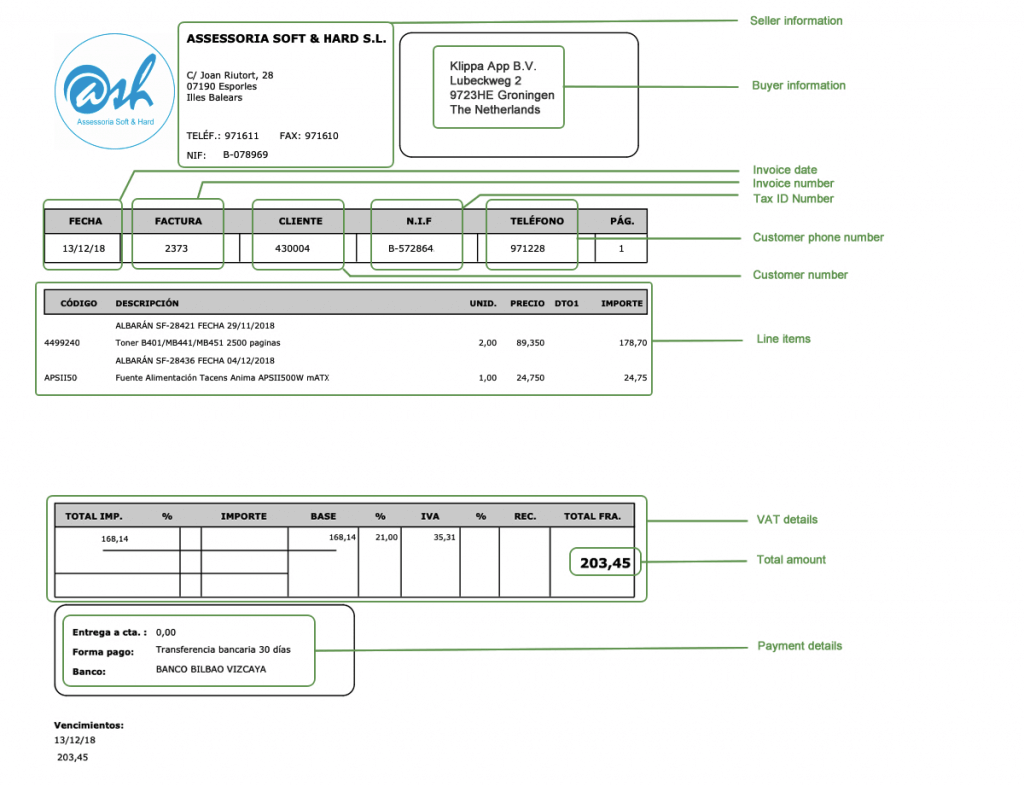

Is NIF in Spain same as VAT

What is a VAT number The VAT number identifies traders and non-trading legal entities, and is necessary to carry out certain intra-community transactions. It is the same as the tax identification number (NIF) with the prefix ES (denoting Spain) assigned to any relationship involving tax or with fiscal implications.

What is the difference between NIF and NIE in Spain

The Spanish Tax Identification Number (NIF) is necessary for dealing with the Tax Agency when the interested party does not have a Spanish National ID (DNI) or Foreigner Identification Number (NIE).

What is a VAT ID in Spain

VAT number (Número IVA): This is 'ES' followed by the CIF (example: ES B12345678). If you applied for intracommunitary VAT exemption and your company has been approved, then this number will be listed in the EU VAT registry.

How many digits is a VAT number

What is a VAT number A UK VAT number is nine (9) digits long, with two letters at the front indicating the country code of the registered business.

What is the difference between a VAT number and VAT ID

A tax ID number is generally assigned to every taxable person. A VAT registration number, in turn, is only assigned to companies that have EU wide transactions.

What is the format of VAT number in Germany

DE 123456789

German VAT number format

The general format of a German VAT number is: DE 123456789. The tax office splits VAT number into two: one for reporting VAT filings and general correspondence; the second for identification for companies undertaking EU cross border transactions (intra-community supplies).

What is an invalid EU VAT number

If the system returns an invalid status it means that the VAT number you are trying to validate is not registered in the relevant national database. This is due to one of the following reasons: the VAT number does not exist. the VAT number has not been activated for intra-EU transactions.

Is VAT the same in the EU

The EU has standard rules on VAT, but these rules may be applied differently in each EU country. In most cases, you have to pay VAT on all goods and services at all stages of the supply chain including the sale to the final consumer.

Does Spain use NIE or NIF

The NIF is equal to your Spanish ID number, which can have two different forms: If you are a Spanish national, it is called DNI. Then it will made up of 8 letters and a number. But if you are a foreigner, your NIF will be the same as your NIE, made up of 8 numbers and a letter (which can only be X,Y, or Z).

What is NIF number in Spanish

The Spanish Tax Identification Number (NIF) is necessary for dealing with the Tax Agency when the interested party does not have a Spanish National ID (DNI) or Foreigner Identification Number (NIE).

Is NIF the same as VAT in Spain

What is a VAT number The VAT number identifies traders and non-trading legal entities, and is necessary to carry out certain intra-community transactions. It is the same as the tax identification number (NIF) with the prefix ES (denoting Spain) assigned to any relationship involving tax or with fiscal implications.

Is A VAT ID the same as a tax ID

When you register for VAT in a single country, you receive this identifier for their system. We'll cover what exactly it's used for in a section below. Important note: This is not the same as a local tax number or tax ID. A VAT number is exclusively for the Value-Added Tax scheme.

What is a 9 digit VAT number

A VAT number is a unique identification number given to VAT-registered businesses. In England, Scotland and Wales, a VAT number is a nine-digit code with the prefix 'GB'. VAT numbers are issued by HMRC. In Northern Ireland, VAT registered businesses use the prefix XI to trade under the Northern Ireland Protocol.

How long is the VAT identification number

The VAT registration number differs depending on the country and is structured differently in each case. It consists of four to 15 characters, of which the two at the beginning represent the country code (e.g. DE for Germany).

What are the different VAT codes

Outside the scope — No VAT

| VAT Code | VAT Rate | Code used on purchase form |

|---|---|---|

| Exempt | Exempt VAT rate | No VAT Net Purchase to Box 7 |

| 5.0% R | Reduced rate VAT | VAT at 5% to Box 4 Net Purchase to Box 7 |

| 0.00% Z | Zero-rate VAT | VAT at 0% to Box 4 Net Purchase to Box 7 |

| No VAT | Outside the scope of VAT | N/A |

How many digits are in a VAT number

What is a VAT number A UK VAT number is nine (9) digits long, with two letters at the front indicating the country code of the registered business.

What is the 11 digit VAT number in Germany

The tax number (Steuernummer)

It's a 10 or 11 digit number, and has the format “12/345/67890”. It's sometimes written as “3012034567890” (the first two digits are the number of your Bundesland 4). It's also called Steuer-Identnummer or St-Nr.

How do I know if my VAT number is correct

Checking a VAT number is valid

Be sure to check that the number is nine digits long, as this is the valid format for a VAT registration number. There are a couple of ways to check a UK VAT registration number. HMRC have a VAT number checker, or you can call their VAT helpline on 0300 200 3700.

How do I know if my VAT number is valid

The VIES system allows businesses and individuals to check the VAT number of their customers, suppliers or partners before conducting a transaction, ensuring that the VAT number is valid and up-to-date.

Where can I find my EU VAT number

How do I check an EU VAT number To check your own VAT number or the VAT number of another business, you can use VIES. VIES is a tool developed by the European Commission to confirm the validity of VAT numbers across the EU.

What is Europe standard VAT

VAT rates. EU law only requires that the standard VAT rate must be at least 15% and the reduced rate at least 5% (only for supplies of goods and services referred to in an exhaustive list). Actual rates applied vary between EU countries and between certain types of products.