What is the golden rule of wealth

Golden Rule #1: Save more, spend less

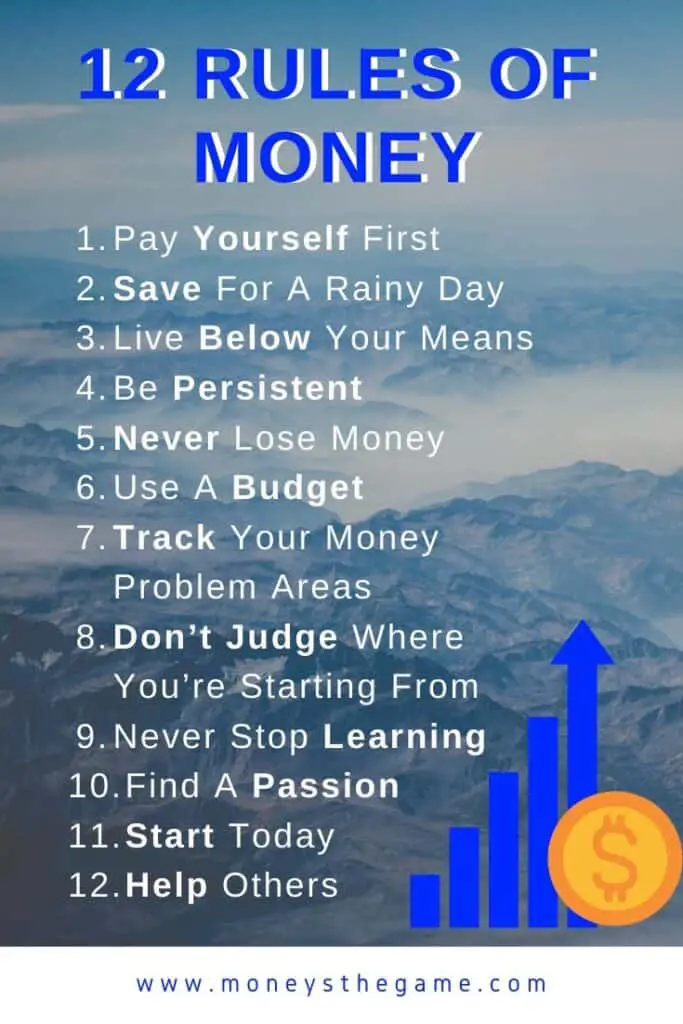

One of his most famous pieces of advice on managing your money is “Don't save what is left after spending, spend what is left after saving." In other words, save before you spend – pay yourself first.

What is the golden rule rule

The golden rule is a moral principle which denotes that you should treat others the way you want to be treated yourself. For example, the golden rule means that if you want people to treat you with respect, then you should treat them with respect too.

What are the three golden rules for saving money

Three rules of money that can ensure a healthy savings account balance are: Save before you spend. Save a specific percentage of your income. Save for the unexpected.

What is the gold or golden rule

Calling something "golden" means it has great quality and value. For example, the “golden rule” is possibly the world's most widespread moral rule. It says people should treat others the way they themselves would like to be treated.

What is the first rule of money

Warren Buffett once said, “The first rule of an investment is don't lose [money]. And the second rule of an investment is don't forget the first rule. And that's all the rules there are.”

What is the first rule of wealth

Rule #1 – You Have To Earn It (Your Money, Your Wealth) If you want to get rich and grow wealth, you have to earn it. There's no way you're going to get to what you want and where you want to be if you're not trying to get there.

Why is it called golden rule

The Golden Rule is a moral which says treat others how you would want to be treated. This moral in various forms has been used as a basis for society in many cultures and civilizations. It is called the 'golden' rule because there is value in having this kind of respect and caring attitude for one another.

Why is the golden rule good

It helps you establish a standard of behavior and influence others to adhere to that standard in all situations and circumstances. This makes decisions about how to treat people in different situations easier. When you always practice the Golden Rule, you always leave the customer feeling heard and validated.

What is the 5 rule in money

In investment, the five percent rule is a philosophy that says an investor should not allocate more than five percent of their portfolio funds into one security or investment. The rule also referred to as FINRA 5% policy, applies to transactions like riskless transactions and proceed sales.

What is the best money rule

One of the most common types of percentage-based budgets is the 50/30/20 rule. The idea is to divide your income into three categories, spending 50% on needs, 30% on wants, and 20% on savings.

Why is the Golden Rule good

It helps you establish a standard of behavior and influence others to adhere to that standard in all situations and circumstances. This makes decisions about how to treat people in different situations easier. When you always practice the Golden Rule, you always leave the customer feeling heard and validated.

What are the 4 rules of money

The Four Fundamental Rules of Personal Finance

Spend less than you make. Spend way less than you make, and save the rest. Earn more money. Make your money earn more money.

What are the 3 parts of the Golden Rule

The Three C's that Make the Golden RuleCivility – What you say and how you say it does matter.Common good – It cannot be all about “you.”Curiosity – There are so many good ideas out there.

Why is it called the Golden Rule

The Golden Rule is a moral which says treat others how you would want to be treated. This moral in various forms has been used as a basis for society in many cultures and civilizations. It is called the 'golden' rule because there is value in having this kind of respect and caring attitude for one another.

What is the 15 5 5 rule

50 – Consider allocating no more than 50 percent of take-home pay to essential expenses. 15 – Try to save 15 percent of pretax income (including employer contributions) for retirement. 5 – Save for the unexpected by keeping 5 percent of take-home pay in short-term savings for unplanned expenses.

What is rule number 1 of money

Warren Buffett once said, “The first rule of an investment is don't lose [money]. And the second rule of an investment is don't forget the first rule. And that's all the rules there are.”

What are the 5 principles of money

1.2Five Core Principles of Money and BankingTime has value. Time is a very important factor that affects the value of all financial instruments.Risk requires compensation.Information is the basis for decisions.Markets determine prices and allocate resources.Stability improves welfare.

What is Diamond rule

In the "diamond rule", you treat others as they wish YOU to treat them. The "you" in this case is the individual "you".

What is the 10 5 3 rule in finance

Although there are no guaranteed returns on an annual basis, this rule of thumb indicates that one should expect 10% returns from equities, 5% returns from bonds and 3% is the average rate of return that one usually gets from term deposits with banks or money market instruments such as Treasury bills.

Does 50 30 20 work

Is the 50/30/20 budget rule right for you The 50/30/20 Rule can be a good budgeting method for some, but whether the system is right for you will be determined by your unique monthly expenses. Depending on your income and where you live, earmarking 50% of your income toward your needs may not be enough.

What are the 4 fundamentals of money

It is important to be prepared for what to expect when it comes to the four principles of finance: income, savings, spending and investment. "Following these core principles of personal finance can help you maintain your finances at a healthy level".

What is the platinum rule

The “Platinum Rule” is a common business buzzword. The Platinum Rule states that instead of treating people the way you want to be treated, you should invest time in discovering how they want to be treated.

Is there a platinum rule

As opposed to "do unto others as you would have them do unto you," as the golden rule states, the platinum rule asks you to "do unto others, wherever possible, as they would want to be done to them." This rule helps to deal with one of the biggest problems posed by the golden rule.

What is the 70 20 10 rule finance

The biggest chunk, 70%, goes towards living expenses while 20% goes towards repaying any debt, or to savings if all your debt is covered. The remaining 10% is your 'fun bucket', money set aside for the things you want after your essentials, debt and savings goals are taken care of.

What is the 75 15 10 rule finance

so for every dollar you make, you can spend 75 cents. then 15 cents is the minimum that you can invest, and 10 cents is the minimum that you save. this allows you to allocate 25 of your income. towards wealth building activities.