Which state in US has lowest tax

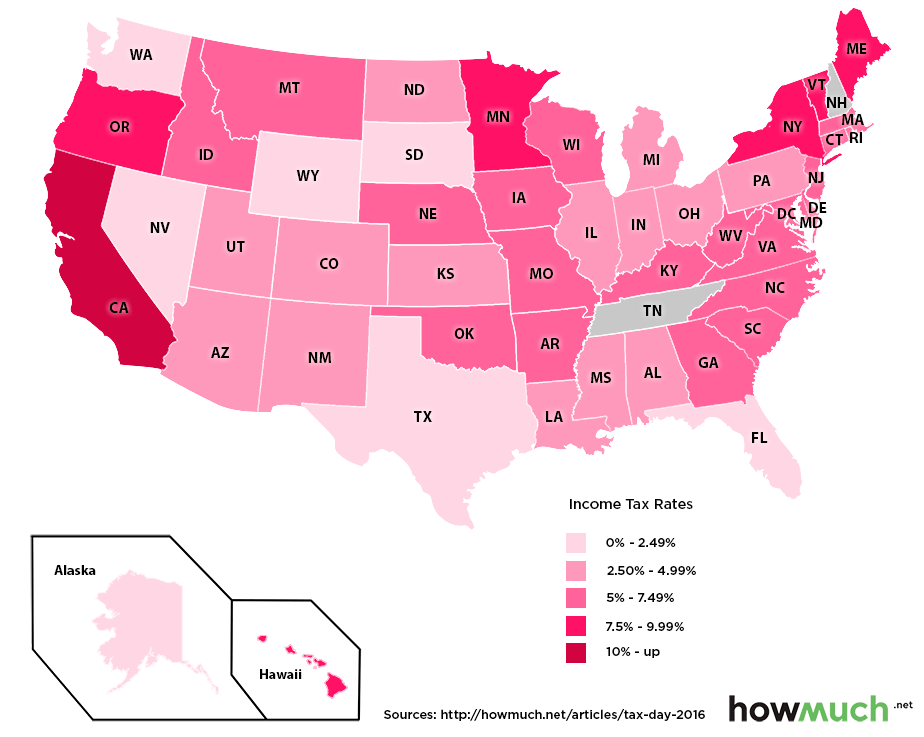

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

What are the best and worst states for taxes

The states with the highest sales tax burden are Hawaii (6.71%), Washington, (5.66%) and New Mexico (5.62%), while the states with the lowest sales tax burden are New Hampshire (1.07%), Delaware (1.09%) and Oregon (1.11%).

Where is the best place to live for taxes

1. Cheyenne, Wyoming. While not an obvious candidate, Cheyenne, Wyoming tops the list of U.S. cities with the lowest tax rates. Cheyenne tax rates are low across the board, with an average 9.7% rate for lower-income families.

What are the best tax states ranked

States with a perfect score on the individual income tax component (Alaska, Florida, South Dakota, and Wyoming) have no individual income tax and no payroll taxes besides the unemployment insurance tax. The next highest-scoring states are Nevada, Tennessee, Texas, Washington, and New Hampshire.

What state is most tax friendly

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax. Washington and South Dakota — which both received a B — also have no state income tax.

What are the 10 least tax friendly states

The 10 States With the Highest Tax Burden

| State | Tax as % of Income | |

|---|---|---|

| 1. | Illinois | 16.9% |

| 2. | Connecticut | 15.3% |

| 3. | New Jersey | 14.8% |

| 4. | New Hampshire | 14.3% |

What are the top 3 most taxed states

Here are the top 10 states with highest taxes:New York – 15.9%Connecticut – 15.4%Hawaii – 14.1%Vermont – 13.6%California – 13.5%New Jersey – 13.2%Illinois – 12.9%Virginia – 12.5%

What state is the most tax friendly

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax. Washington and South Dakota — which both received a B — also have no state income tax.

What city has the lowest taxes

Portland, Oregon, and Anchorage, Alaska, have no state or local sales taxes. Richmond, Virginia has 5.3 percent state sales tax. Honolulu, Hawaii, has a low sales tax rate of 4.5 percent, but the tax applies broadly to goods and services when compared with sales tax from other locations.

What states have the worst taxes

According to the foundation, the top five states with the highest state and local tax combinations are:New York 12.7%Connecticut 12.6%New Jersey 12.2%Illinois 11.0%California and Wisconsin 11.0%

What state has worst income tax

But in case you're wondering, California eventually has the highest state tax rate in the country, with 13.30% charged on any income over $1 million.

What is the best state to live in financially

North Dakota

North Dakota takes the cake as the best state in the U.S. to save money in. With the third lowest debt-to-income ratio in the country for Q3 2022—and the second lowest percentage of income spent on housing costs and rent—North Dakotans are able to keep more money in their pockets.

What state has the worst taxes

New York has the highest state income tax burden out of any other state. In 2020, the state collected income taxes that amounted to 4.7% of per capita personal income, or nearly $3,500 per person.

Which US city has no tax

Las Vegas, Nevada

Residents of Sin City pay no income taxes, a sales tax rate of 8.1% and effective property taxes of about 1% of a home's value.

What is the highest taxed city in the US

Bridgeport, Connecticut

1. Bridgeport, Connecticut. It's no real surprise that one of the wealthiest cities in the U.S. also imposes some of the highest taxes. In Bridgeport, as of 2022, approximately 20% of families that live here report income of $200,000 or more.

Who pays the most taxes in the US

The highest-earning Americans pay the most in combined federal, state and local taxes, the Tax Foundation noted. As a group, the top quintile — those earning $130,001 or more annually — paid $3.23 trillion in taxes, compared with $142 billion for the bottom quintile, or those earning less than $25,000.

How much is 75k after taxes in California

If you make $75,000 a year living in the region of California, USA, you will be taxed $19,714. That means that your net pay will be $55,286 per year, or $4,607 per month.

What state has to lowest cost of living

Mississippi

The cheapest states to live in are Mississippi, Oklahoma, Kansas, Alabama, Georgia, Missouri, Iowa, Indiana, West Virginia, and Tennessee. Mississippi is the cheapest state to live in in the US, with a cost of living index of 85. The second cheapest state to live in is Oklahoma, with a cost of living index of 85.8.

What is the most unaffordable state to live in

Hawaii

According to several studies on cost of living, Hawaii is the most expensive U.S. state to live in. Prices are typically double in Hawaii compared to those on the mainland, and the continued rise in inflation is making costs ranging from housing to health care much more expensive.

Who pays more taxes Texas or California

WalletHub estimates Sales & Excise Taxes of $4591 for the theoretical median household in Texas versus only $3292 in California. But sales tax rates are generally lower in Texas than in California. According to the Sales Tax Handbook, combined state and local sales taxes in California range from 7.25% to 10.75%.

How much is income tax in Texas

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax. How many allowances should you claim Most people claim 0-5 allowances, check W-4 rules for details.

What states are tax free in the US

As of 2023, eight states — Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming — do not levy a state income tax. A ninth state, New Hampshire, does not tax earned income, but it does impose a 4% tax on dividends and interest. This is set to expire in 2027.

Which US city has the lowest taxes

Anchorage, Alaska. The crown of Lowest Taxes in America goes to the northernmost city in our study.Tampa, Florida.Jacksonville, Florida.Henderson, Nevada.Honolulu, Hawaii.Seattle, Washington.Colorado Springs, CO.Las Vegas, Nevada.

Which city has less tax in USA

Portland, Oregon, and Anchorage, Alaska, have no state or local sales taxes. Richmond, Virginia has 5.3 percent state sales tax. Honolulu, Hawaii, has a low sales tax rate of 4.5 percent, but the tax applies broadly to goods and services when compared with sales tax from other locations.

Who pays the most tax in the world

While both its sales and corporate tax regimes may be considerably lower than those of other countries globally, at 60%, Côte d'Ivoire's income tax rates are markedly higher compared to developed countries.