Which city has lowest tax in us

Anchorage, Alaska

Neither Anchorage nor Alaska levy an income tax, and Anchorage residents don't pay sales tax. Auto taxes are another bright spot, being among the lowest of any city. The result is an approximate 3.4% total tax burden.

What city in the US has the highest taxes

1. Bridgeport, Connecticut. It's no real surprise that one of the wealthiest cities in the U.S. also imposes some of the highest taxes. In Bridgeport, as of 2022, approximately 20% of families that live here report income of $200,000 or more.

How much are you taxed in NYC

What is New York City's tax rate Residents of New York City are subject to additional taxes atop of what they owe to New York state. For the 2022 tax year (taxes filed in 2023), NYC tax rates are 3.078%, 3.762%, 3.819% and 3.876%. New York State Department of Taxation and Finance.

What cities in the US have the highest sales tax

Among cities with populations of 200,000 or more, the following 10 have the highest sales taxes, according to the Tax Foundation:Tacoma, Washington (10.3%)Chicago, Illinois (10.25%)Fremont, California (10.25%)Long Beach, California (10.25%Oakland, California (10.25%)Seattle, Washington (10.25%)

Does Las Vegas have low taxes

Although Nevada has a below-average tax burden, it is not typically ranked as one of the lowest among states. Nevada does not levy an individual or corporate income tax — a point in its favor as one of nine states with such an exemption. The state also has a low property tax burden.

Where in the US has the lowest property tax

Hawaii

Hawaii has the lowest property tax rate in the U.S. at 0.27%.

What state has the lowest sales tax

States with the lowest sales taxNew York: 4% sales tax rate.Wyoming: 4% sales tax rate.Colorado: 2.9% sales tax rate.Alaska: no sales tax.Delaware: no sales tax.Montana: no sales taxes.New Hampshire: no sales tax.Oregon: no sales tax.

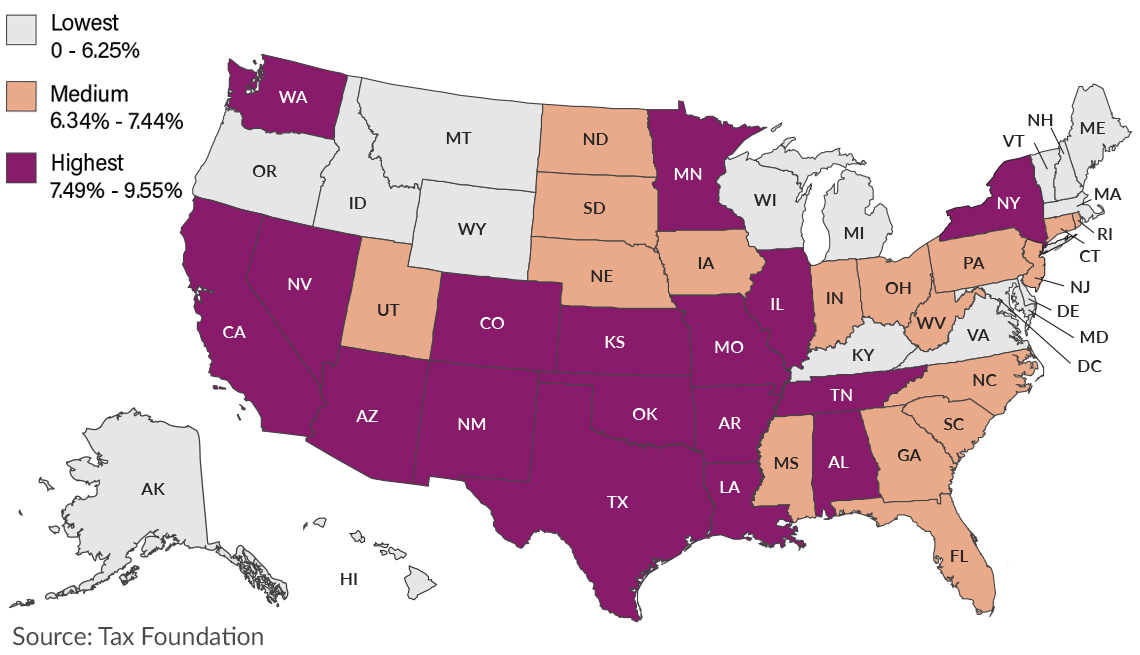

Which US states have the highest lowest tax rates

The states with the highest sales tax burden are Hawaii (6.71%), Washington, (5.66%) and New Mexico (5.62%), while the states with the lowest sales tax burden are New Hampshire (1.07%), Delaware (1.09%) and Oregon (1.11%).

How much taxes do I pay in Florida

Florida has no state income tax, which makes it a popular state for retirees and tax-averse workers. If you're moving to Florida from a state that levies an income tax, you'll get a pleasant surprise when you see your first paycheck. Additionally, no Florida cities charge a local income tax.

What is the tax rate in California

Tax Districts

The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

Which cities have the lowest property taxes

The cities with the lowest tax rates are:Honolulu, HI, with a .27% effective tax rate;Montogmery, AL, with a .35% effective tax rate;Birmingham, AL, with a .37% effective tax rate;Cheyenne, WY, with a .54% effective tax rate; and.Denver, CO, with a . 55% effective tax rate.

Do you pay sales tax in Florida

Florida's general state sales tax rate is 6%. Additionally, most Florida counties also have a local option discretionary sales surtax.

Is tax cheaper in Vegas than California

Sales Tax California vs Nevada

Nevada's sales tax is much smaller by comparison. The state sales tax in Nevada is 4.6%, which is 2.65% lower than its neighbor to the west. Like in California, different cities and municipalities often add in local sales taxes.

How much is tax in California

7.25%

The statewide tax rate is 7.25%. In most areas of California, local jurisdictions have added district taxes that increase the tax owed by a seller. Those district tax rates range from 0.10% to 1.00%. Some areas may have more than one district tax in effect.

What state has the cheapest taxes

These are the states with the lowest tax burdens, according to USAFacts:Alaska (5.36%)Tennessee (6.33%)New Hampshire (6.37%)Wyoming (6.63%)Florida (6.73%)Delaware (6.77%)South Dakota (7.03%)Montana (7.33%)

Which state is property tax free in USA

Unfortunately, there are no states without a property tax. Property taxes remain a significant contributor to overall state income. Tax funds are used to operate and maintain essential government services like law enforcement, infrastructure, education, transportation, parks, water and sewer service improvements.

What state is most tax friendly

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax. Washington and South Dakota — which both received a B — also have no state income tax.

Are taxes lower in California than Texas

But sales tax rates are generally lower in Texas than in California. According to the Sales Tax Handbook, combined state and local sales taxes in California range from 7.25% to 10.75%. In Texas, the range is from 6.25% to 8.25% Neither state levies sales taxes on groceries.

Are California taxes high

California is a high-tax state, with some of the steepest sales tax, gas tax, personal income tax and corporate tax rates in the United States.

What state has the lowest taxes

These are the states with the lowest tax burdens, according to USAFacts:Alaska (5.36%)Tennessee (6.33%)New Hampshire (6.37%)Wyoming (6.63%)Florida (6.73%)Delaware (6.77%)South Dakota (7.03%)Montana (7.33%)

How much is the tax in Los Angeles

9.5%

What is the sales tax rate in Los Angeles, California The minimum combined 2023 sales tax rate for Los Angeles, California is 9.5%. This is the total of state, county and city sales tax rates.

Where is the best place to live in the US for taxes

Alaska had the lowest tax burden in the U.S. in 2021, though it was also one of the least affordable states to live in.

Is there sales tax in NY

Sales and use tax rates in New York State reflect a combined statewide rate of 4%, plus the local rate in effect in the jurisdiction (city, county, or school district) where the sale or other transaction or use occurs.

Are taxes lower in California or Texas

But sales tax rates are generally lower in Texas than in California. According to the Sales Tax Handbook, combined state and local sales taxes in California range from 7.25% to 10.75%. In Texas, the range is from 6.25% to 8.25% Neither state levies sales taxes on groceries.

Is Vegas or LA cheaper

Even when you do stay home, prices are generally higher in Los Angeles. Groceries in Los Angeles cost about 17-percent more than they do in Las Vegas. Sure, you'll probably save money eating at home in either city, but your overall bill will still probably be lower if you do your grocery shopping in Las Vegas.