How much is wealth tax in France

French real estate wealth tax : Calculation of the tax

| Fraction of the net taxable value of the assets | Applicable rate |

|---|---|

| Between €1,300,001 and €2,570,000 | 0,70% |

| Between €2,570,001 and €5,000,000 | 1% |

| Between €5,000,001 and €10,000,000 | 1,25% |

| More than € 10,000,000 | 1.50% |

What is the wealth tax in the United States

To initiate wealth taxation, Biden proposes a “minimum billionaires tax,” under which wealthy Americans will pay at least 20% of their “total income”—including unrealized capital gains—in federal income taxes. 1 A sizable majority (59%) of diverse Americans2 also favored a wealth tax in 2022.

Does wealth tax exist in India

Note: Wealth tax was abolished in the 2015 budget (that was effective FY 2015-16), since the cost incurred for tax recovery was higher than the benefit emanated. The finance minister introduced a surcharge in place of wealth tax. The surcharge is levied from 2% to 12% for the highly-rich section of people.

What is a wealth tax UK

The UK does not have a wealth tax as such, but some assets and property are subject to tax laws. Buying property may be subject to stamp duty land tax, selling expensive items may be subject to capital gains tax, and the value of someone's estate when they die may be liable to inheritance tax.

Is there wealth tax in Germany

Currently, there is no direct wealth tax levied in Germany. However, property taxes are levied, for example, on real property (land tax).

Does Netherlands have a wealth tax

In the Netherlands, your savings and investments are taxed in box 3. The wealth tax (or: box 3 taxation) works differently than the taxation on income from work (box 1). As soon as your assets exceed the tax-free capital threshold, you have to pay wealth tax in box 3.

What is the wealth tax in Germany

Currently, there is no direct wealth tax levied in Germany. However, property taxes are levied, for example, on real property (land tax).

Does America tax the rich more

According to a 2021 White House study, the wealthiest 400 billionaire families in the US paid an average federal individual tax rate of just 8.2 percent. For comparison, the average American taxpayer in the same year paid 13 percent.

How much tax do billionaires pay in India

"A one-time tax of 5 per cent on the 10 richest billionaires in the country (Rs 1.37 lakh crore) is more than 1.5 times the funds estimated by the Health and Family Welfare Ministry (Rs 86,200 crore) and the Ministry of Ayush (Rs 3,050 crore) for the year 2022-23," it added.

How do millionaires avoid taxes in India

Considerable wealth is acquired in inheritance, which in many countries is by levy of estate duty. India has no estate duty to tax the inherited wealth. India also has no wealth tax to tax the wealth — whether financial or real estate.

Does England have wealth tax

Britain has wealth taxes. But they don't work very well. Inheritance tax is avoided to such an extent that the effective average tax rate drops from a peak of 20% on estates worth £2m to 10% for estates worth more than £10m. In 2020, the Wealth Tax Commission costed a one-off wealth tax.

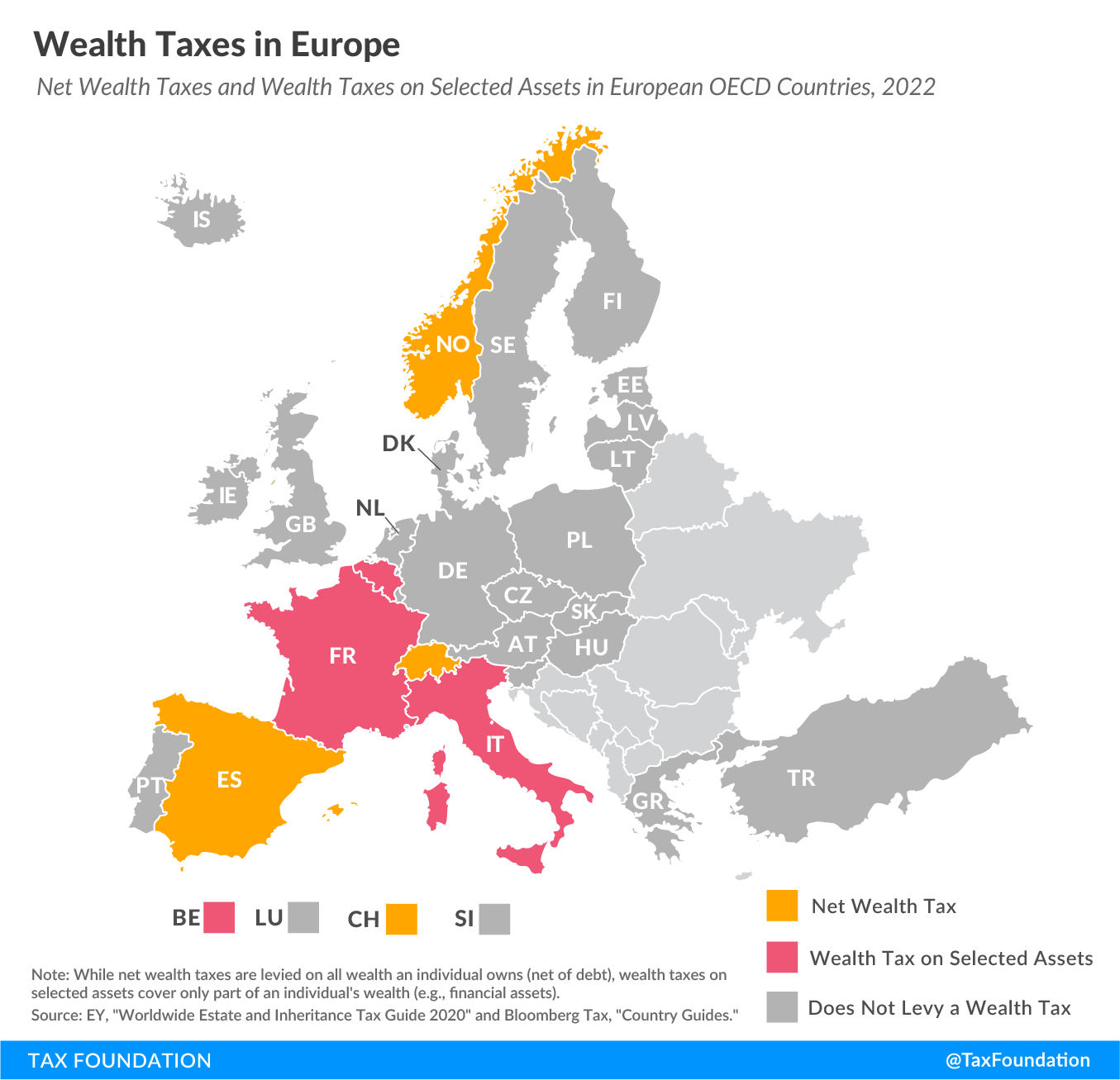

Is there a wealth tax in Denmark

From 1997, the wealth tax has been abolished. However, individuals must still fill out asset declarations as to foreign pension schemes and certain investments.

Do rich pay more taxes in Germany

High earners pay higher taxes

All German residents that earn more than basic tax-free allowance (Grundfreibetrag) in a given year are required to pay taxes. The amount of taxes due vary based on the amount that one has earned.

Why is the Netherlands a tax haven

Effectively, the Netherlands is a conduit country that helps to funnel profits from high-tax countries to tax havens. Particularly the Dutch Special Purpose Entities attract income, often as interest and royalty payments, and pass it on, effectively untaxed, to tax havens.

Is it tax free in Switzerland

Because of low rates, strong privacy, favorable tax treaties, stable politics, and easily accessible financial experts, Switzerland has become notorious for being a place to avoid taxes. However, the country has recently taken steps to walk back some of the benefits taxpayers have long enjoyed.

What is the wealth tax in Switzerland

In Switzerland, the wealth tax is levied by the cantons and counties. There is no federal wealth tax. This means you are entirely dependent on your canton for how much wealth you will pay. The wealth tax is usually much lower than the income tax.

Who pays the most taxes rich or poor

The highest-earning Americans pay the most in combined federal, state and local taxes, the Tax Foundation noted.

Are the rich taxed more than the poor in the US

Federal taxes are progressive, but state and local taxes are regressive. According to the Institute on Taxation and Economic Policy, state and local tax rates are highest for the poor and lowest for the rich.

Do rich pay less taxes in India

The ultra-wealthy individuals on the Forbes list report the lowest income — about 0.5 per cent of their wealth. "The super-wealthy Indians on the Forbes list pay a tax that is less than 0.2 per cent of their wealth — much smaller than the tax liability for individuals at middle wealth levels," observed the study.

What is the richest 1 percent in India

For India, the entry point is $1,75,000 or Rs 1.45 crore. In Asia, Singapore has the highest threshold with $3.5 million required to be in the top 1%, ahead of Hong Kong's $3.4 million. For the Middle East, the highest entry point is at UAE, estimated at $1.6 million.

How much tax do Indian billionaires pay

"A one-time tax of 5 per cent on the 10 richest billionaires in the country (Rs 1.37 lakh crore) is more than 1.5 times the funds estimated by the Health and Family Welfare Ministry (Rs 86,200 crore) and the Ministry of Ayush (Rs 3,050 crore) for the year 2022-23," it added.

How do rich people avoid tax Australia

Private trusts, along with super, negative gearing, and loopholes in Capital Gains Tax, are popular ways for people with higher incomes – and their well-paid financial advisers – to avoid paying tax. Tax avoidance through trusts means the rest of us must contribute more in order to fund essential services.

Why don t billionaires pay taxes in UK

Some of the richest people in the UK do not pay taxes because they don't declare everything correctly or because they have been ill-informed. Either way, the truth is that there is a large sum of unpaid taxes that the revenue are trying to recover.

Who pays wealth tax in USA

Taxpayers subject to the wealth tax: those whose net assets (i.e., assets minus debt) are valued at over $50 million, based on their 2022 valuation. Tax rate: 2% on net assets valued over $50 million and up to $1 billion; 3% on net assets in excess of $1 billion.

Why are Denmark’s taxes so high

Danish taxes are put towards an extensive social security network so that every resident is well-provided for at all times of life. Services from education right through to retirement are subsidized.