Are leading indicators better than lagging indicators

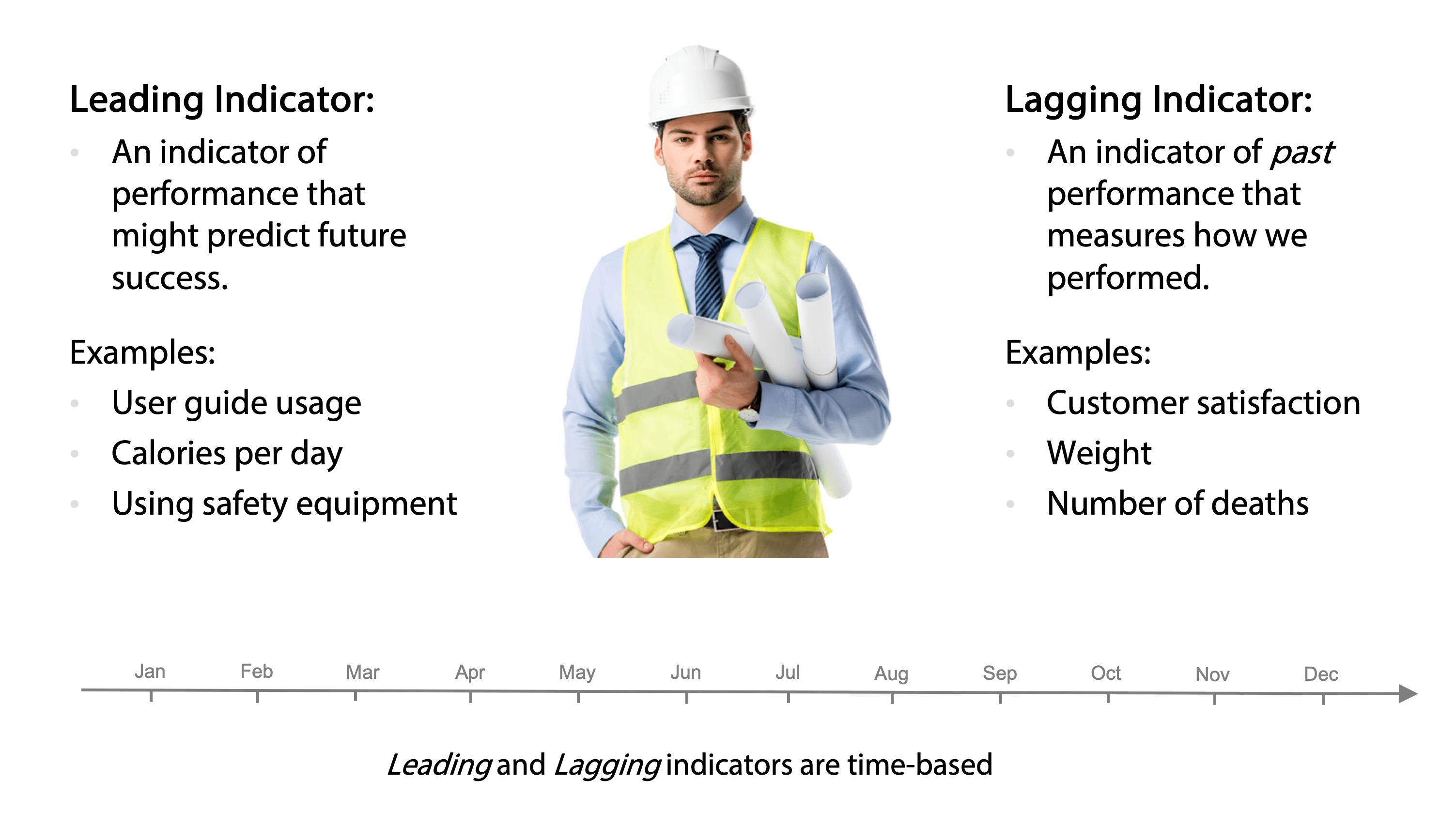

Leading indicators look ahead and attempt to predict future outcomes, whereas lagging indicators look at the past. Some people fixate on leading indicators, arguing that what happened in the past is useless. However, that's not true. Lagging indicators are very useful at confirming trends and changes in trends.

Are lagging indicators good

Lagging indicators confirm trends and changes in trends. Lagging indicators can be useful for gauging the trend of the general economy, as tools in business operations and strategy, or as signals to buy or sell assets in financial markets.

What is the primary advantage of lagging indicators over leading indicators

Lagging indicators are typically “output” oriented, easy to measure but hard to improve or influence, while leading indicators are typically input oriented, hard to measure and easier to influence.

Are leading indicators accurate

Accuracy of Leading Indicators and How to Use Them

Leading indicators are not always accurate. However, looking at several leading indicators in conjunction with other types of data may provide actionable information about the future health of an economy.

Do lagging indicators tend to be easier to measure than leading indicators

If a leading indicator informs business leaders of how to produce desired results, a lagging indicator measures current production and performance. While a leading indicator is dynamic but difficult to measure, a lagging indicator is easy to measure but hard to change.

What is the benefit of leading indicators

Employers may find that leading indicators can: Prevent workplace injuries and illnesses. Reduce costs associated with incidents. Improve productivity and overall organizational performance.

What indicators are best

List of the best technical indicatorsMoving Average Indicator (MA)Exponential Moving Average Indicator (EMA)Moving Average Convergence Divergence (MACD)Relative Strength Index (RSI)Percentage Price Oscillator indicator (PPO)Parabolic SAR indicator (PSAR)Average Directional Index (ADX)

What are the disadvantages of lagging indicators

Weaknesses of lagging indicatorsThey take time to measure: By definition, lagging indicators measure long-term trends, so they take weeks or months (or even longer) to change.You can't see why: Lagging indicators show an outcome, but it can be unclear what variables impacted that outcome.

What are the advantages of leads and lags

Project schedule managers sometimes use leads and lags as a technique to help schedule their activities within a project's timeline. Leads and lags can be useful tools for efficient scheduling, timeline optimization and as inputs to determine a project's critical path.

Which indicator has highest accuracy

Moving Average (M.A): Moving Average is the trend indicator and it is mostly used because it is very simple to use and it gives more effectiveness.Relative Strength Index.MACD (Moving Average Convergence/Divergence Oscillator)ADX (Average Directional Index)ATR (Average True Range)

Which indicator is accurate in trading

MACD Indicator is used by traders to evaluate the market trend within a time interval. Traders use this to understand the relationship between trends and the momentum of the stock prices. MACD is calculated by subtracting the 26-day exponential moving average (EMA) from the 12-day exponential moving average.

Are leading indicators easy to measure

Leading indicators are trickier to measure than lagging indicators. That's because they tend to be more abstract. As mentioned, a leading indicator is a measure of where your business is going.

Are lag indicators difficult to measure

A lagging indicator measures current production and performance, whereas a leading indicator advises company leaders on achieving desired objectives. In addition, a lagging indicator is simple to measure but difficult to change, in contrast to a leading indicator that is dynamic but difficult to measure.

What is the best leading indicator

Four popular leading indicatorsThe relative strength index (RSI)The stochastic oscillator.Williams %R.On-balance volume (OBV)

What is the most important leading indicator

Top Leading Indicators

The yield curve, durable goods orders, the stock market, manufacturing orders, and building permits are some of the best indicators to use when trying to determine where the economy is headed.

What is the most effective trend indicator

One of the most popular—and useful—trend confirmation tools is known as the moving average convergence divergence (MACD). This indicator first measures the difference between two exponentially smoothed moving averages. This difference is then smoothed and compared to a moving average of its own.

Is MACD leading or lagging

MACD is a lagging indicator. After all, all the data used in MACD is based on the historical price action of the stock. Because it is based on historical data, it must necessarily lag the price. However, some traders use MACD histograms to predict when a change in trend will occur.

What are the pros and cons of lead

In conclusion, using lead metal in construction has advantages and disadvantages that must be carefully weighed. While lead is durable, versatile and provides excellent thermal and sound insulation, it is also toxic, environmentally harmful, expensive, and difficult to install.

What are the advantages of lag strategy

Advantages. It's cost-effective. Paying employees slightly less than the market average saves the organization money on labor costs. This may be an important consideration if the company is experiencing financial difficulties.

What is the king of all indicators

In fact, the price action is the king of all indicators, and as a long-time technician I use it every single time when evaluating a chart. It is vital to follow price and not only the secondary indicators, because there will be times the price action is not in sync, and may lead you down the wrong path.

Is MACD a leading or lagging indicator

MACD is a lagging indicator. After all, all the data used in MACD is based on the historical price action of the stock. Because it is based on historical data, it must necessarily lag the price. However, some traders use MACD histograms to predict when a change in trend will occur.

What are the most reliable leading indicators

Top Leading Indicators

The yield curve, durable goods orders, the stock market, manufacturing orders, and building permits are some of the best indicators to use when trying to determine where the economy is headed.

Are Bollinger Bands leading or lagging

Bollinger bands are the lagging indicators used to measure volatility. Bollinger bands are created using a 20-day simple moving average. It gives bullish and bearish signals and indicates potential breakout.

What is the most accurate buy and sell indicator

Stochastics are a favored technical indicator because they are easy to understand and have a relatively high degree of accuracy. It falls into the class of technical indicators known as oscillators. The indicator provides buy and sell signals for traders to enter or exit positions based on momentum.

Which is the most commonly used indicator

Litmus is the most commonly used indicator in laboratories. Litmus indicator solution turns red in acidic solutions and blue in alkaline solutions. It turns purple in neutral solutions. Phenolphthalein is used in acid-base titrations.