Which month is the best to buy stocks

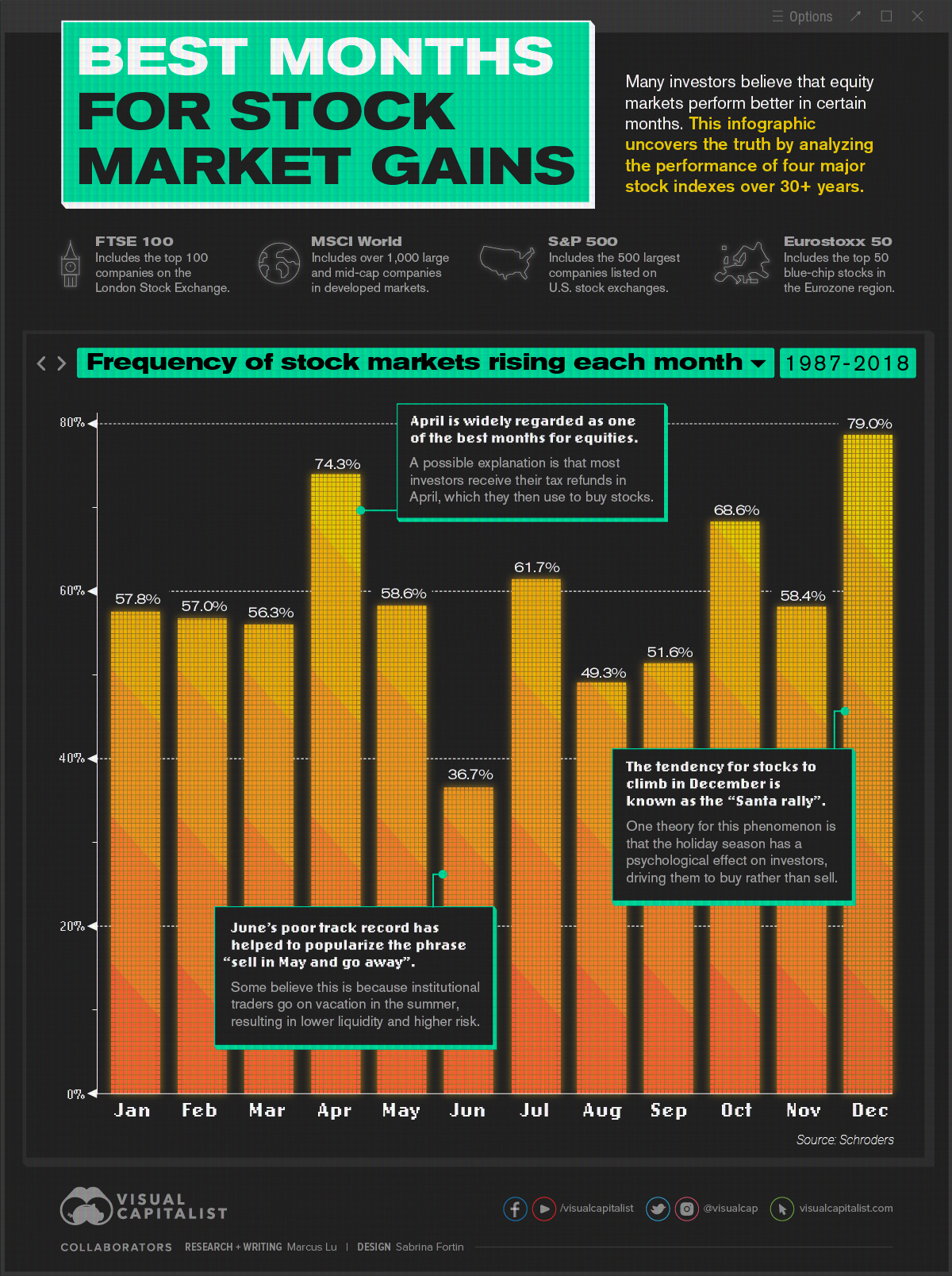

Best time of the year to buy stocks. With the turn of the year comes optimism and new cash infusions, making December and January months that have historically seen stocks rise. April also tends to be a strong month for stocks.

What is the weakest month in stock market

September

One of the historical realities of the stock market is that it typically has performed poorest during the month of September. The "Stock Trader's Almanac" reports that, on average, September is the month when the stock market's three leading indexes usually perform the poorest.

Is December a good month for stock market

How stocks historically perform in December. The last month of the year tends to be a good one for stock investors. “December is historically a strong month for stocks, with only April and November better going back to 1950," says Ryan Detrick, chief market strategist at Carson Group.

Do stocks Go Up in January

The January Effect is a purported market anomaly whereby stock prices regularly tend to rise in the first month of the year. Actual evidence of the January Effect is small, with many scholars arguing that it does not really exist.

What day is best to buy stocks

Monday

One of the most popular and long-believed theories is that the best time of the week to buy shares is on a Monday. The wisdom behind this is that the general momentum of the stock market will, come Monday morning, follow the trajectory it was on when the markets closed.

Why September is bad for stocks

Why The September Effect Could Exist. It is generally believed that investors return from summer vacation in September ready to lock in gains as well as tax losses before the end of the year. There is also a belief that individual investors liquidate stocks going into September to offset schooling costs for children.

Why is January a bad month for stocks

It's been said that tax planning is a major driver of the January Effect. According to this hypothesis, investors sell off underperforming stocks in December to lock in a capital loss for the year, thereby reducing their tax bill, which causes a temporary dip in prices.

Do stocks drop in December or January

According to this hypothesis, investors sell off underperforming stocks in December to lock in a capital loss for the year, thereby reducing their tax bill, which causes a temporary dip in prices. In January, prices recover when buying picks up again.

Do stocks usually rise or fall in December

In recent decades, the stock market has typically ended the year on the rise. Since 1950, the S&P 500 has generated average returns of more than 1.5% in December, LPL Financial said in a report on Monday.

Do stock prices fall in December

Analysts generally attribute this rally to an increase in buying, which follows the drop in price that typically happens in December when investors, engaging in tax-loss harvesting to offset realized capital gains, prompt a sell-off.

Do stocks go down in February

A recent analysis by Bespoke Investment Group shows that historically, the stock market tends to gain in the first half of the month of February and lose in the second half.

Does the stock market usually drop in January

January jump

Stock markets tend to perform well at the beginning of the year as this is when many investors have fresh capital to place into the market. They are therefore more likely to buy shares and push up prices. Historically, shares in 'small cap' companies benefit most from this effect.

What is the 3 day rule in stocks

Investors must settle their security transactions in three business days. This settlement cycle is known as "T+3" — shorthand for "trade date plus three days." This rule means that when you buy securities, the brokerage firm must receive your payment no later than three business days after the trade is executed.

Why is October a good month for stocks

According to research from LPL Financial, there are more 1% or larger swings in October in the S&P 500 than any other month in history dating back to 1950. Some of that can be attributed to the fact that October precedes elections in early November in the U.S. every other year.

Why is October the worst month for stocks

The October effect refers to the psychological anticipation that financial declines and stock market crashes are more likely to occur during this month than any other month. The Bank Panic of 1907, the Stock Market Crash of 1929, and Black Monday 1987 all happened during the month of October.

Do stocks rise or fall in January

The January Effect is a purported market anomaly whereby stock prices regularly tend to rise in the first month of the year. Actual evidence of the January Effect is small, with many scholars arguing that it does not really exist.

Do stocks always go up in January

What Is the January Effect in the Stock Market The January Effect is a purported market anomaly whereby stock prices regularly tend to rise in the first month of the year. Actual evidence of the January Effect is small, with many scholars arguing that it does not really exist.

Why do stocks go up in January

Another cause is the payment of year-end bonuses in January. Some of this bonus money is used to purchase stocks, driving up prices. The January effect does not always materialize; for example, small stocks underperformed large stocks in 1982, 1987, 1989 and 1990.

What time of year do stocks drop

share prices tend to fall over the summer months as big traders go on holiday and sell high-risk assets. … the end of a financial quarter or year can also see stock markets become quite volatile, with the share price of some companies reversing direction.

What is the 15 minute rule in stocks

Let the index/stock trade for the first fifteen minutes and then use the high and low of this “fifteen minute range” as support and resistance levels. A buy signal is given when price exceeds the high of the 15 minute range after an up gap.

What is No 1 rule of trading

If you ask the best traders around the world on how to become a profitable trader, a large number of them will talk about 'risk management'. One of the most popular risk management techniques is the 1% risk rule. This rule means that you must never risk more than 1% of your account value on a single trade.

Do stocks usually go down in October

What Is the October Effect The October effect is a perceived market anomaly that stocks tend to decline during the month of October. The October effect is considered to be more of a psychological expectation than an actual phenomenon, as most statistics go against the theory.

Do stocks go up in October

Experts say there isn't much fact behind the October effect. In fact, October tends to be a better month for the stock market than September, when the S&P 500 has seen positive returns just 44.7% of the time since 1928, according Bespoke Investment Group data from early last month.

Do stocks fall in October

The October effect is a perceived market anomaly that stocks tend to decline during the month of October. The October effect is considered to be more of a psychological expectation than an actual phenomenon, as most statistics go against the theory.

Why do stocks fall in January

The January Effect is theorized to occur when investors sell losers in December for tax-loss harvesting, only to re-buy new positions in January. Like other market anomalies and calendar effects, the January Effect is considered by some to be evidence against the efficient markets hypothesis.