Which state has lowest income tax in USA

Alaska

The Tax in the USA burden in Alaska is around 5.10%. It has no state income or any other sales tax. The state or local tax burden on Alaskans mainly includes property income sales and excise taxes, which is just around 5.10% of your income. It is the lowest tax of all 50 states.

What state is the most tax friendly

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax. Washington and South Dakota — which both received a B — also have no state income tax.

What state has the worst taxes

New York has the highest state income tax burden out of any other state. In 2020, the state collected income taxes that amounted to 4.7% of per capita personal income, or nearly $3,500 per person.

What are the best and worst states for taxes

The states with the highest sales tax burden are Hawaii (6.71%), Washington, (5.66%) and New Mexico (5.62%), while the states with the lowest sales tax burden are New Hampshire (1.07%), Delaware (1.09%) and Oregon (1.11%).

What states are tax free in the US

As of 2023, eight states — Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming — do not levy a state income tax. A ninth state, New Hampshire, does not tax earned income, but it does impose a 4% tax on dividends and interest. This is set to expire in 2027.

Which US city has the lowest taxes

Anchorage, Alaska. The crown of Lowest Taxes in America goes to the northernmost city in our study.Tampa, Florida.Jacksonville, Florida.Henderson, Nevada.Honolulu, Hawaii.Seattle, Washington.Colorado Springs, CO.Las Vegas, Nevada.

What are the top 3 most taxed states

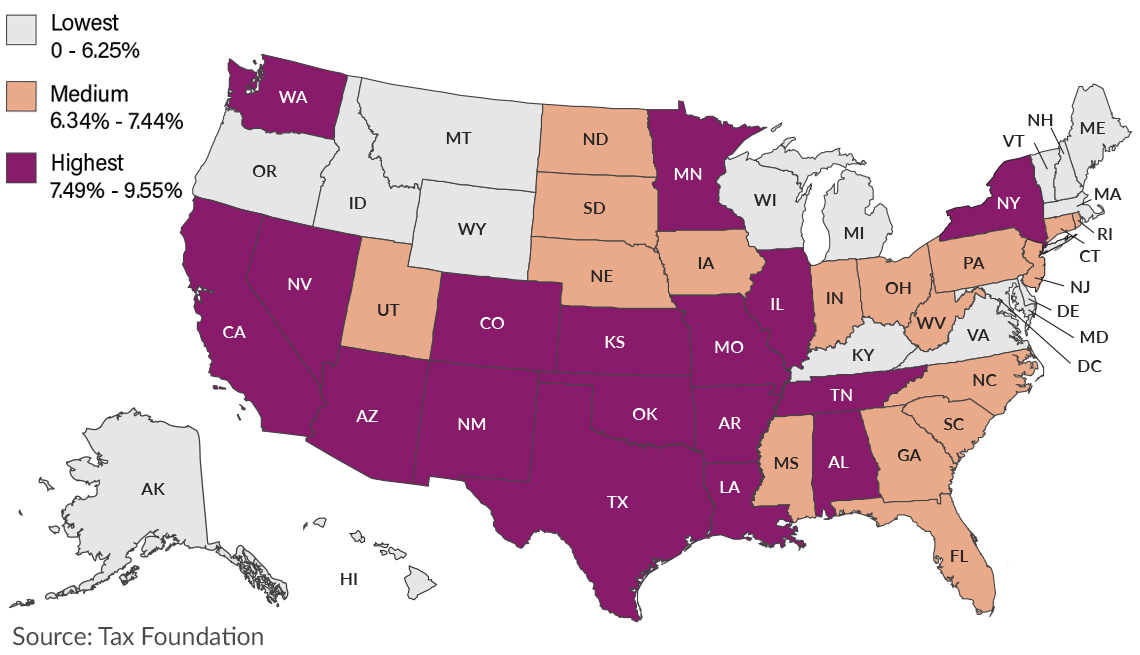

Here are the top 10 states with highest taxes:New York – 15.9%Connecticut – 15.4%Hawaii – 14.1%Vermont – 13.6%California – 13.5%New Jersey – 13.2%Illinois – 12.9%Virginia – 12.5%

What are the 10 least tax friendly states

The 10 States With the Highest Tax Burden

| State | Tax as % of Income | |

|---|---|---|

| 1. | Illinois | 16.9% |

| 2. | Connecticut | 15.3% |

| 3. | New Jersey | 14.8% |

| 4. | New Hampshire | 14.3% |

Who pays more taxes Texas or California

WalletHub estimates Sales & Excise Taxes of $4591 for the theoretical median household in Texas versus only $3292 in California. But sales tax rates are generally lower in Texas than in California. According to the Sales Tax Handbook, combined state and local sales taxes in California range from 7.25% to 10.75%.

How much is income tax in Texas

Texas has no state income tax, which means your salary is only subject to federal income taxes if you live and work in Texas. There are no cities in Texas that impose a local income tax. How many allowances should you claim Most people claim 0-5 allowances, check W-4 rules for details.

Does Texas pay more taxes than California

Though Texas has no state-level personal income tax, it does levy relatively high consumption and property taxes on residents to make up the difference. Ultimately, it has a higher effective state and local tax rate for a median U.S. household at 12.73% than California's 8.97%, according to a new report from WalletHub.

Which US city is tax free

Portland, Oregon, and Anchorage, Alaska have neither a state nor a local sales tax.

Is California tax free

Retail sales of tangible items in California are generally subject to sales tax. Examples include furniture, giftware, toys, antiques and clothing. Some labor services and associated costs are subject to sales tax if they are involved in the creation or manufacturing of new tangible personal property.

What are the top 10 lowest taxed states

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

Which city in USA has no sales tax

As of 2017, 5 states (Alaska, Delaware, Montana, New Hampshire and Oregon) do not levy a statewide sales tax. California has the highest base sales tax rate, 7.25%.

Why are taxes in California so high

California's taxes have risen in ranking partly because of voter-approved increases. In November 2012, the state passed a temporary hike in sales taxes of 0.25 percent and raised personal income taxes on the rich. Four years later, voters extended the income tax increasefor 12 more years.

What are the 7 tax free states in us

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

Does Texas have low taxes

Top ranked by Area Development, Texas' tax climate is a constant benefit for companies. With no corporate or personal income tax, Texas has one of the lowest tax burdens in the nation.

Is it cheaper to live in California or Florida

The bottom line is Florida is a far less expensive state to live in than California because it has less expensive homes, lower sales tax on things you buy, and lower income taxes on money you earn.

Is Texas or Florida better for taxes

Florida Total Tax Burden

Despite not having an individual income tax, Texas' total tax burden is much higher (8.22%) than Florida's.

Why Texas has no income tax

The Texas Constitution forbids personal income taxes. Instead of collecting income taxes, Texas relies on high sales and use taxes. When paired with local taxes, total sales taxes in some jurisdictions are as high as 8.25%. Property tax rates in Texas are also high.

Are taxes higher in California or Texas

But sales tax rates are generally lower in Texas than in California. According to the Sales Tax Handbook, combined state and local sales taxes in California range from 7.25% to 10.75%. In Texas, the range is from 6.25% to 8.25% Neither state levies sales taxes on groceries.

Are taxes higher in Florida or Texas

Florida does not have an individual income tax, so your total tax burden only includes the property tax burden (2.77%) and sales tax burden (3.87%). Despite not having an individual income tax, Texas' total tax burden is much higher (8.22%) than Florida's.

What are the 7 tax free states in the US

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

Which states in America are tax free

Nine states — Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming — have no income taxes. New Hampshire, however, taxes interest and dividends, according to the Tax Foundation.