Which city has lowest tax in us

Anchorage, Alaska

Neither Anchorage nor Alaska levy an income tax, and Anchorage residents don't pay sales tax. Auto taxes are another bright spot, being among the lowest of any city. The result is an approximate 3.4% total tax burden.

Where in USA pays the least taxes

There are seven states — Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming — without income taxes. Conversely, New York and Maryland collected income taxes that amounted to more than 4% of personal income in 2020. One way states offset low or no income taxes is with property taxes.

Which city has the lowest property tax

It's Honolulu. The Hawaiian capital had an effective tax rate of 0.28% in 2022, according to a report Thursday from property data provider ATTOM that ranked the U.S. cities with the highest and lowest rates.

What is the best tax free state in USA

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

Which city in USA has no sales tax

As of 2017, 5 states (Alaska, Delaware, Montana, New Hampshire and Oregon) do not levy a statewide sales tax. California has the highest base sales tax rate, 7.25%.

What state is most tax friendly

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax. Washington and South Dakota — which both received a B — also have no state income tax.

What city is best to live tax free

Anchorage, Alaska. The crown of Lowest Taxes in America goes to the northernmost city in our study.Tampa, Florida.Jacksonville, Florida.Henderson, Nevada.Honolulu, Hawaii.Seattle, Washington.Colorado Springs, CO.Las Vegas, Nevada.

Is there anywhere in the US without property tax

Unfortunately, there are no states without a property tax. Property taxes remain a significant contributor to overall state income. Tax funds are used to operate and maintain essential government services like law enforcement, infrastructure, education, transportation, parks, water and sewer service improvements.

Which cities are tax free in USA

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax. Note that Washington does levy a state capital gains tax on certain high earners.

What are the 10 least tax friendly states

The 10 States With the Highest Tax Burden

| State | Tax as % of Income | |

|---|---|---|

| 1. | Illinois | 16.9% |

| 2. | Connecticut | 15.3% |

| 3. | New Jersey | 14.8% |

| 4. | New Hampshire | 14.3% |

What state is the most tax friendly

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax. Washington and South Dakota — which both received a B — also have no state income tax.

Do you pay sales tax in Florida

Florida's general state sales tax rate is 6%. Additionally, most Florida counties also have a local option discretionary sales surtax.

What are the top 5 tax friendly states

MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. States that received a grade of A all share something in common: no state income tax.

What is the best tax haven in the US

In the past decade, hundreds of billions of dollars have poured out of traditional offshore jurisdictions such as Switzerland and Jersey, and into a small number of American states: Delaware, Nevada, Wyoming – and, above all, South Dakota.

Do foreigners pay property taxes in USA

Do foreigners pay property taxes in the USA Yes, foreigners need to pay property taxes. It's the same procedure even for a foreign national.

Which state in USA has no sales tax

What states have no sales tax There are five states with no general statewide sales tax: Alaska, Delaware, Montana, New Hampshire, and Oregon. These are sometimes referred to as the NOMAD states (“N” for New Hampshire, “O” for Oregon, and so forth).

What are the 7 tax free states in us

Which Are the Tax-Free States As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not levy a state income tax.

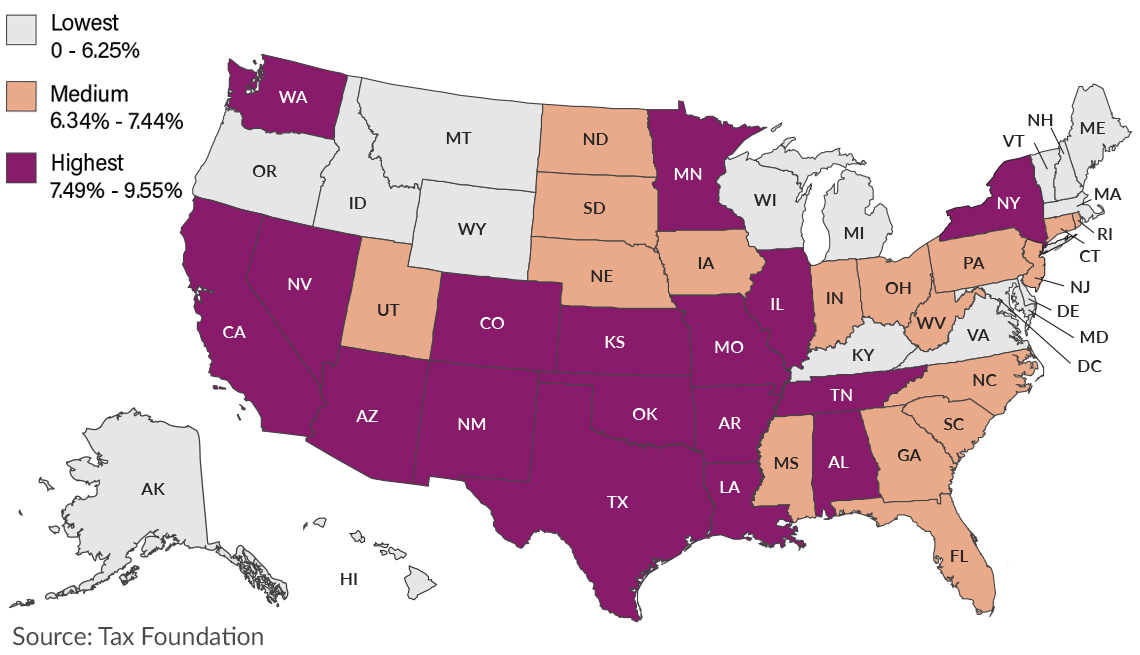

What state has the worst tax rate

States with the highest tax burdensNew York (12.75%)Hawaii (12.70%)Maine (11.42%)Vermont (11.13%)Minnesota (10.20%)New Jersey (10.11%)Connecticut (10.06%)Rhode Island (9.91%)

What are the top 3 most taxed states

Here are the top 10 states with highest taxes:New York – 15.9%Connecticut – 15.4%Hawaii – 14.1%Vermont – 13.6%California – 13.5%New Jersey – 13.2%Illinois – 12.9%Virginia – 12.5%

What state has the lowest sales tax

States with the lowest sales taxNew York: 4% sales tax rate.Wyoming: 4% sales tax rate.Colorado: 2.9% sales tax rate.Alaska: no sales tax.Delaware: no sales tax.Montana: no sales taxes.New Hampshire: no sales tax.Oregon: no sales tax.

Why does Florida have no income tax

In 1968, the Florida Constitution was ratified to prevent the state from collecting an income tax. And the state constitution protects taxpayers from having the state impose new taxes or raise them.

What state has the worst taxes

New York has the highest state income tax burden out of any other state. In 2020, the state collected income taxes that amounted to 4.7% of per capita personal income, or nearly $3,500 per person.

Is USA a tax haven country

In some cases, even Germany and the USA are considered tax havens. It is not only countries that levy particularly low taxes on certain types of income that are regarded as tax havens. A popular form of tax evasion is, for example, the "parking" of funds in countries to hide them from the local tax authorities.

Where is the best place for low tax

Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance.

Is US tax free for foreigners

FDAP income that is non-effectively connected income is taxed at a flat 30% rate on the gross income unless a tax treaty specifies a lower rate. Nonresident aliens must file and pay any tax due using Form 1040-NR, U.S. Nonresident Alien Income Tax Return.